pibbles

@0xpibs

research & dune wiz at (redacted) capital

ID: 1531800573489860609

https://pibbles-website.vercel.app/dune 01-06-2022 00:51:38

373 Tweet

460 Followers

301 Following

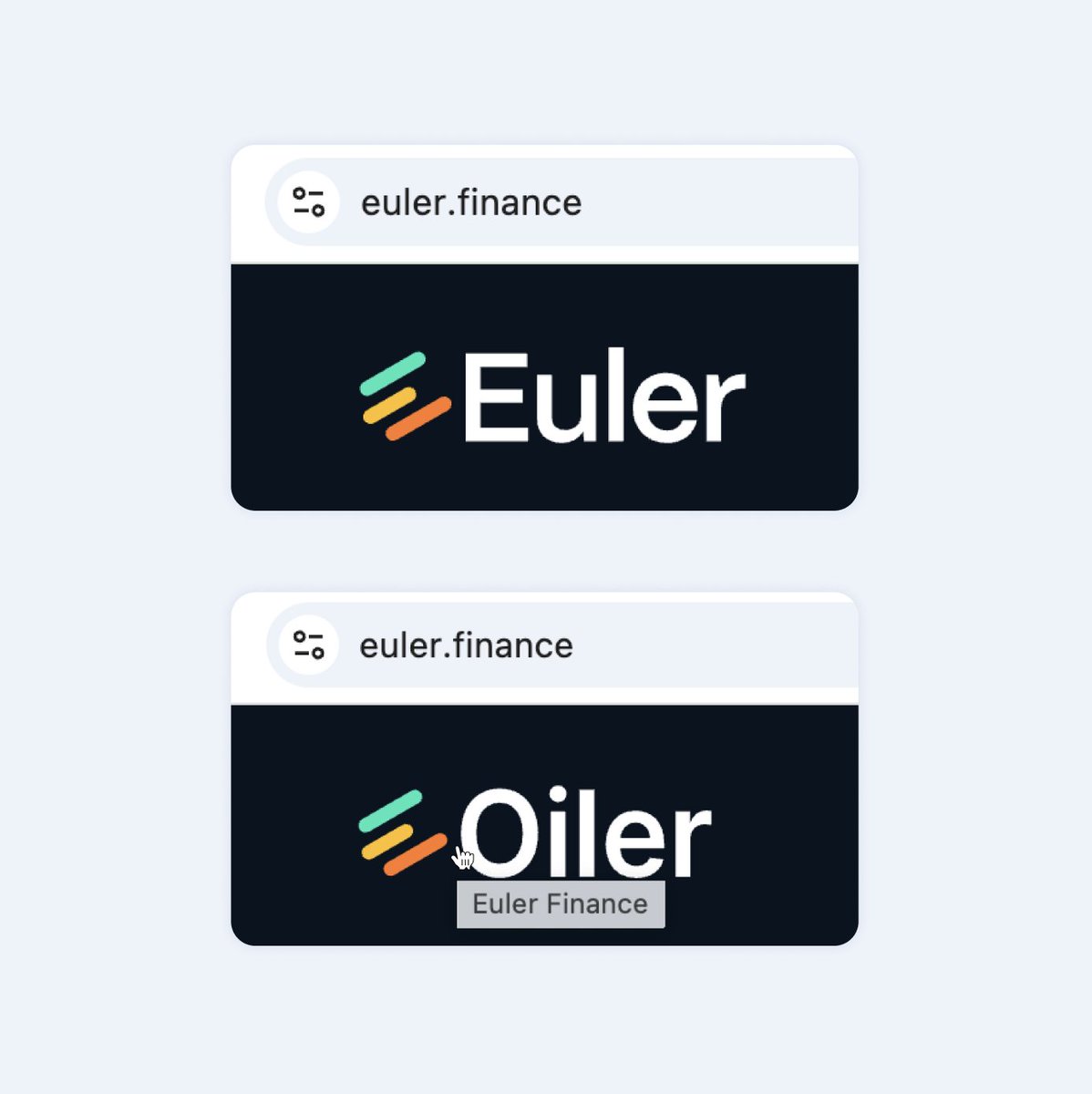

this hover state on the Euler Labs website may be one of the most self-aware and brilliant easter eggs ever

Just 10% away from $2bn - and that’s without an Arbitrum deployment. If only there was an incentive program on Arbitrum to onboard Euler Labs to get us there… Could you cook something up Entropy Advisors? 👀

Noticed something cool playing with Farside Investors data today: ETH ETFs have now tied the previous record of 19 consecutive days without outflows (prev. streak was between 22nd Nov 2024 to 18th Dec 2024 inclusive). Today also marks the first time in 2025 that ETH ETF inflows

What's great about DRIP is that it also rewards innovation and new protocols - ones I'm particularly excited about are: - GammaSwap 👽: perp options with IL hedge - Euler Labs: potentially deploying on Arb? - GU: launchpad built by Camelot team with a token