Sudipan | Chainrisk 🛡️

@0xriskyvision

Intelligence @afiprotocol_ai | CEO @chain_risk | Mentor @ETHGlobal | Cost of Corruption^Profits 🔜 1 | @thielfellowship Finalist | MTech Math & Computing IIT

ID: 1512360929899745281

08-04-2022 09:26:01

3,3K Tweet

10,10K Followers

1,1K Following

AFI isn’t another DeFi dashboard. It thinks and executes for you. • 24/7 AI agents • Yields without spreadsheets • No custody, no bullshit • Built for serious capital Welcome to Autonomous Finance. Artificial Financial Intelligence

AFI isn’t another DeFi dashboard. It thinks and executes for you. • 24/7 AI agents • Yields without spreadsheets • No custody, no bullshit • Built for serious capital Welcome to Autonomous Finance. Artificial Financial Intelligence

. Sonic Labs isn’t “fast” like other chains claim. It’s verified fast, with numbers that break the L1 vs L2 narrative. - In tests vs Ethereum L2s: Finality: Sonic hits ~0.9s. (Arbitrum? 10–15s. Optimism? 2 blocks + sequencer delays.) Native assets: No bridging needed. USDC is

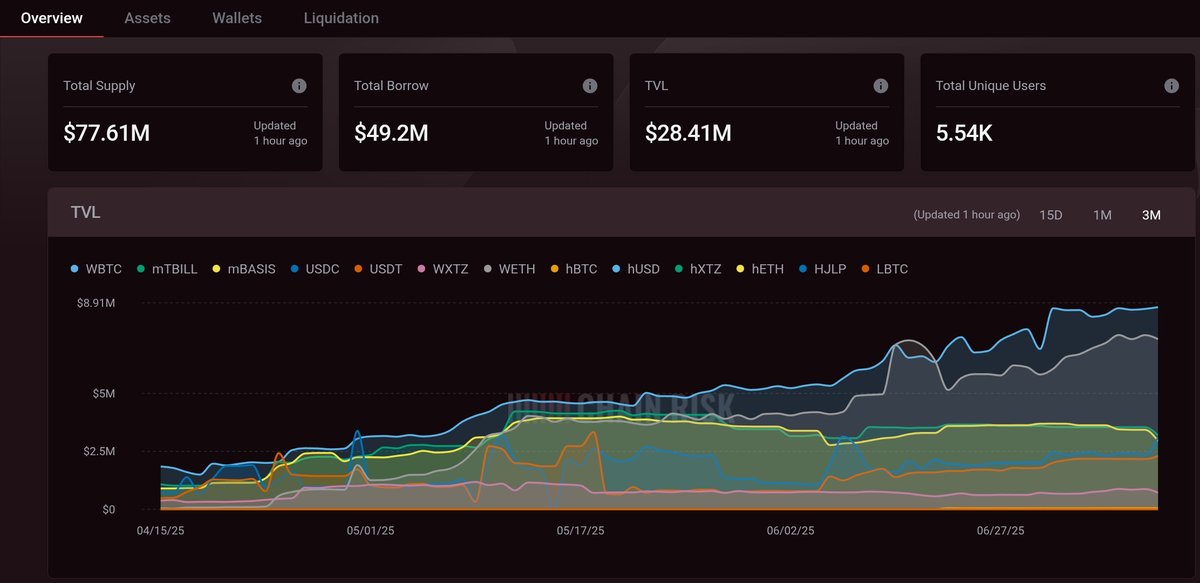

Some are worried about the 2% price drop. Some of us are modeling the 40% liquidation cascade it could trigger across three protocols. We are not the same. See the whole board with Artificial Financial Intelligence.

The old excuses for building a weak protocol are now obsolete. The infrastructure from platforms like Sonic Labs is here to solve them: Your excuse: "My application is too slow." → The solution: Sub-second finality. Your excuse: "My protocol isn't profitable." → The