Anastasia Amoroso

@aamoroso_1

Chief Investment Strategist at @icapitalnetwork. Global markets & trade ideas. Alternative investments & disruptive technologies. Views and opinions are my own.

ID: 886728468

https://www.icapitalnetwork.com 17-10-2012 12:37:29

517 Tweet

27,27K Followers

705 Following

Thanks CNBCOvertime Scott Wapner for the important conversation yesterday about why inflation might be peaking and odds of a soft landing might be rising. And ... it's great to be back on set!

Crypto conferences are better with friends, great to see you LizThomasStrat Katie Stockton, CMT at @consensus2022 !

Great to join Danny & Dan on On The Tape Podcast this week, enjoyed the timely conversation on all things markets, Fed and (of course) AI.

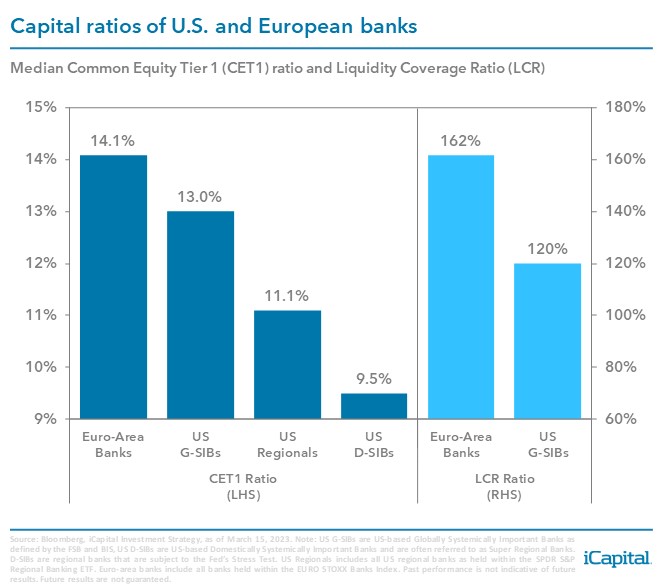

Great to join CNBC Halftime Report yesterday. What I like about one segment of the Financials - if capital markets activity picks up in H2 '23, big banks and alternative asset managers should benefit.