Alex Elkrief

@aelkrief

Co-founder @upshift_fi and @august_digital

ID: 1076750252

10-01-2013 14:29:02

224 Tweet

550 Followers

978 Following

I've known Alex and Aya Kantorovich since the early days of helping launch crypto at Goldentree and I continue to be extremely impressed with their vision and execution bridging the needs of institutions coming into crypto and a heavy retail user base. Bringing August's infra to

Tune in with Aya Kantorovich, Shiliang Tang, and Rob Hadick >|<. Who will Stripe acquire next? x.com/i/spaces/1mnxe…

Institutions aren’t just dipping their toes—they’re diving in. DeFi access was complex. Now Aya Kantorovich of August is unlocking institutional access to multiple DeFi protocols. Lydia Chiu of Blizzard the Avalanche Fund & Breevie🔺️🎈 go live to unpack how it’s being unlocked, here

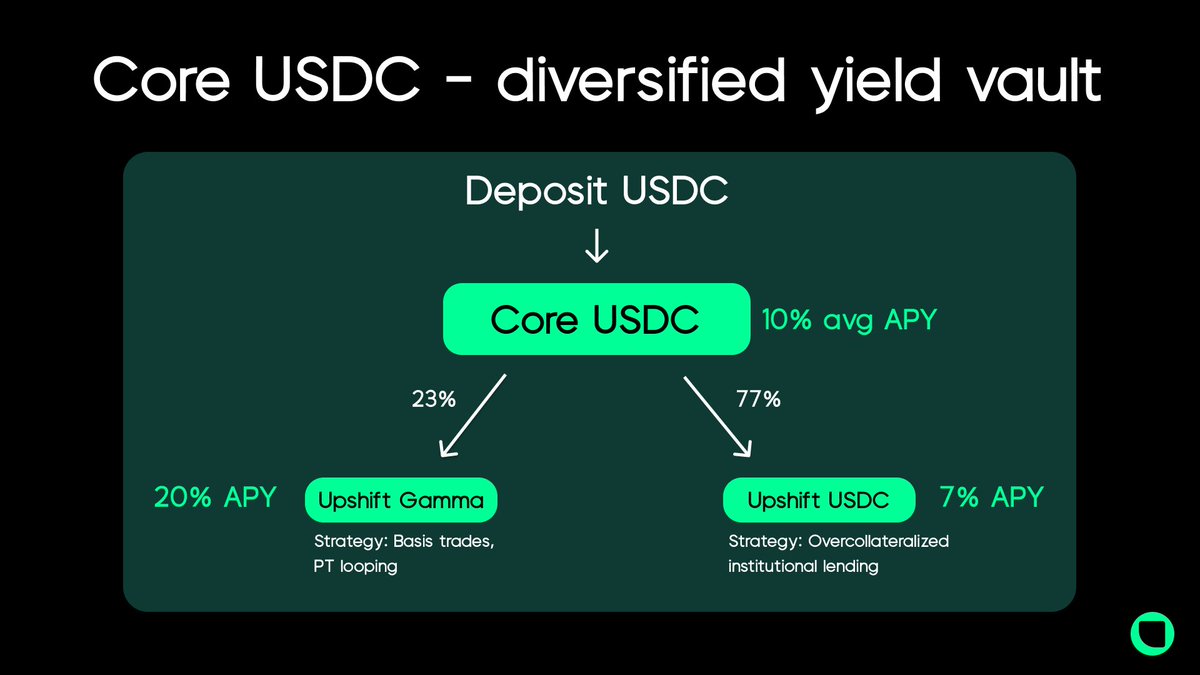

today on defi/acc, we'll be joined by Nick van Eck from Agora and Alex Elkrief from Upshift to talk about stablecoins on monad we'll also be talking about an exciting new product that will be bring a lot of yield to the monad eco 👀 join us: x.com/i/spaces/1nAKE…