Andrew

@ap_abacus

Founder x 3: Finance, Bitcoin 🟠🟠🟠

ID: 939131942775218176

http://archpublic.com 08-12-2017 13:57:58

14,14K Tweet

52,52K Followers

1,1K Following

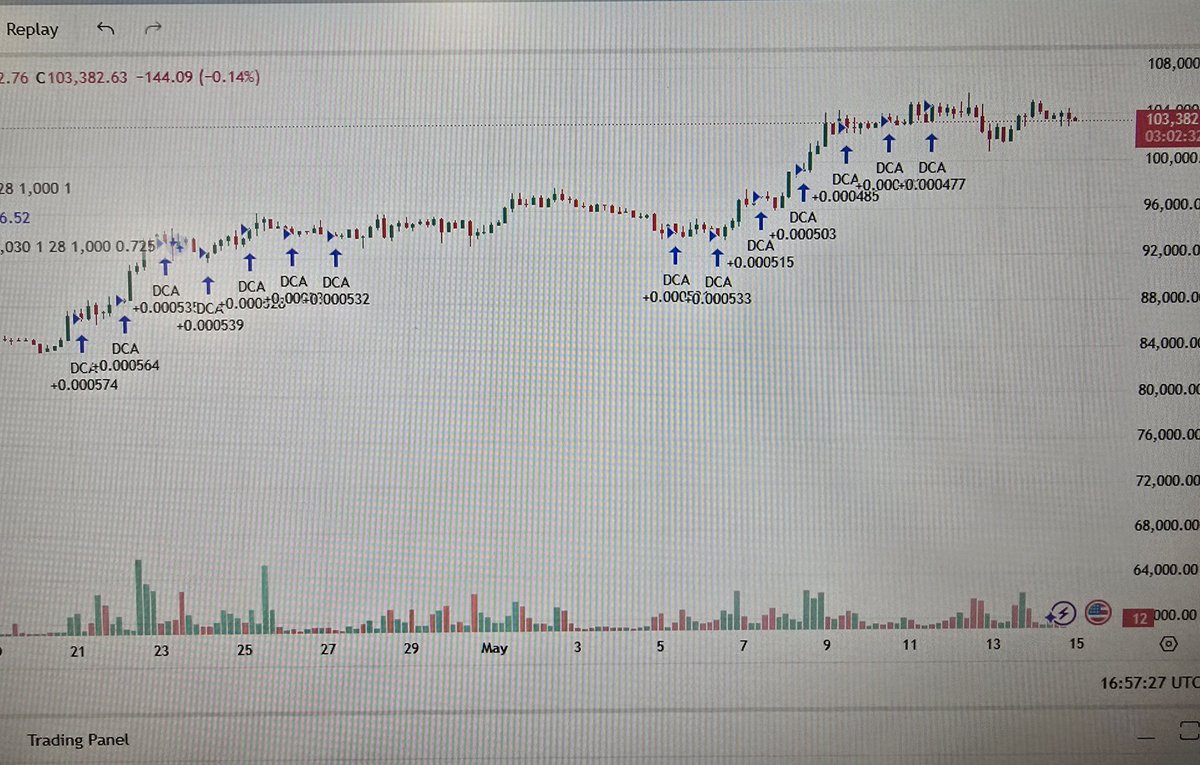

Finally getting my Arch Public algos set up! No more missed opportunities while sleeping or working Andrew. S/O to The Wolf Of All Streets for having Arch on the show so often

As I continue to be a public guinea pig regarding the Arch Public algos, this morning, 2 more sells executed on the XRP algos. I’m not vouching for anything or anyone and I haven’t been paid to make this post. I’m curious to find out if this is the future of retail investing

Mastercard. MoonPay. Stable coins. In two years the banking landscape will be turned upside down. • Exhibit A: Custodia Bank ™ tokenized deposits • instant settlement, no delays. • international instant settlement. • $BTC base layer for lending products.

UPDATE: two sources Goldman Sachs say the firm is exploring market interest in Bitcoin bonds. • impetus is appetite for $MSTR debt • as well as institutional $IBIT appetite • potential Q3 rollout of ‘Bit-Bond” • Source: “interest for $BTC product remains strong.” • Source:

Amanda Fischer just the magick of the X algo