Aaron Hector, R.F.P., CFP, TEP

@aaronhectorcfp

Passion for personal finance, innovative ideas & the well being of my clients. Opinions/posts are my own. Private Wealth Advisor @ CWB Wealth, President @ IAFP

ID: 262003045

07-03-2011 04:10:14

7,7K Tweet

7,7K Followers

428 Following

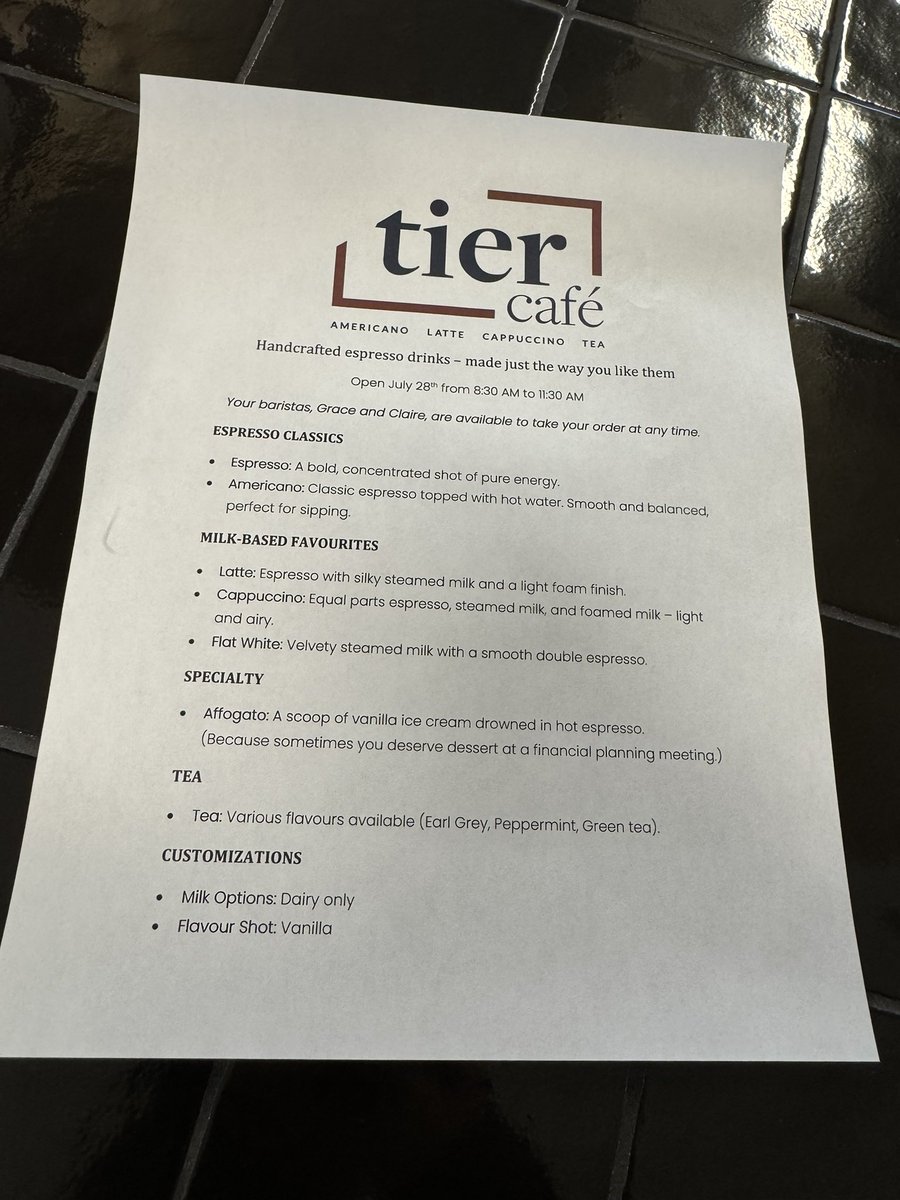

We had a wonderful start to the week at TIER Wealth today, with a few extra super cute hands on deck to get everyone caffeinated to start the week!