Akhil Patel

@akhilgpatel

Director, Property Sharemarket Economics (@PropertyShareM1). Speaker. Author: The Secret Wealth Advantage - Linktr.ee/akhilgpatel

ID: 244433425

https://propertysharemarketeconomics.com 29-01-2011 08:53:44

2,2K Tweet

5,5K Followers

1,1K Following

The housing market’s heating up again, but where are we in the cycle? Akhil Patel (Akhil Patel) returns with a timely update on what’s next in the 18.6-year cycle, and how to prepare before momentum shifts. Listen here: shepheardwalwyn.com/booms-busts-an…

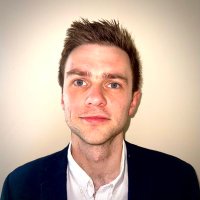

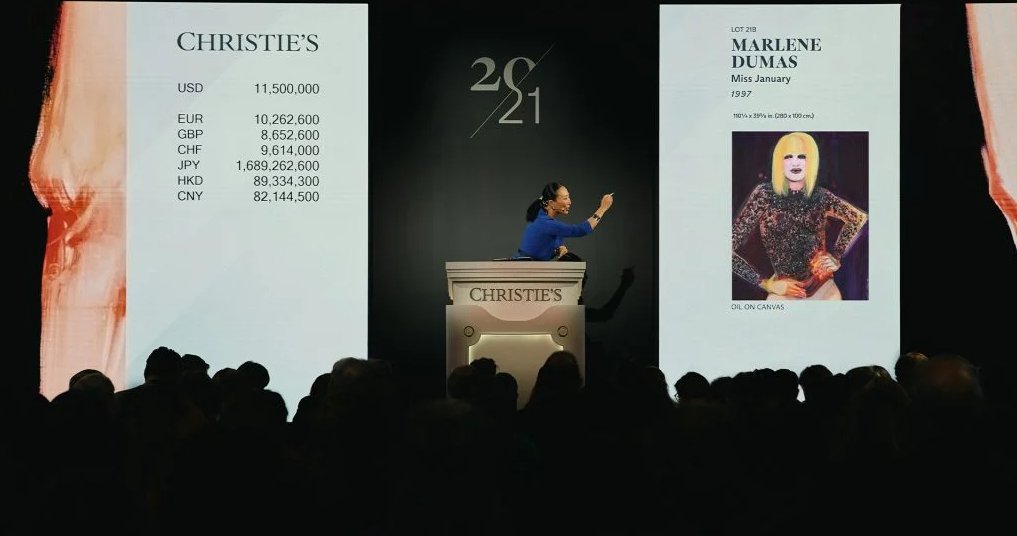

Markets are fragile but climbing ‘the wall of worry’, copper is breaking out, and early red flags have started to flash. What does it all mean for investors in 2025? In this Q2 update, Tim Moffatt returns with Akhil Patel to break down another turbulent quarter—and how the 18.6