Albert Queralto

@albert_queralto

Ph.D. Economics, NYU — views are my own

ID: 274837118

http://www.albertqueralto.com 31-03-2011 03:35:19

56 Tweet

260 Followers

712 Following

In today's post we analyse the trade-offs that policymakers face in setting interest rates building on R**, the financial (in)stability interest rate concept. libertystreeteconomics.newyorkfed.org/2023/05/financ… #interestrates #monetarypolicy #financialstability Ozge Akinci Marco Del Negro (he, him) Albert Queralto

What is the relationship between interest rates, financial stability, and the macroeconomy? In a three post series with Ozge Akinci Gianluca Benigno Ethan Nourbash and Albert Queralto we look into this arguably timely question #interestrates #monetarypolicy #financialstability

Podcast with David Beckworth on the Basics and Policy Functionality of R** and the Dollar’s Imperial Circle | Mercatus Center #financialstability #dollar #SupplyChain Jon Turek Ozge Akinci Marco Del Negro (he, him) Albert Queralto mercatus.org/macro-musings/…

Delighted to have Gianluca Benigno on the show to discuss financial stability R**, liquidity in a NK model, the exorbitant duty of the U.S. financial system, the dollar's imperial circle, the global supply chain pressures index, and more! (1/5) directory.libsyn.com/episode/index/…

Gianluca Benigno (Gianluca Benigno) on the basics of r** and its policy functionality: mercatus.org/macro-musings/…

🚨Please check out our recent work with Albert Queralto and M. Bodenstein, where we quantify the macroeconomic effects of global risk episodes and highlight the significance of differentiated demand for safe assets as a transmission mechanism in open economies. Comments welcome!

I am looking forward to presenting the R** concept (Ozge Akinci, Marco Del Negro (he, him), Albert Queralto ) at the XXVII Annual Conference of the Banco Central de Chile Central Bank of Chile entitled “Medium- and Long-Run Trends in Interest Rates: Causes and Implications for Monetary

Happy to be in San Francisco 🌉 and looking forward to presenting a joint paper with Albert Queralto, Ricardo Reyes-Heroles and Mikaël Scaramucci, in the "Inflation" session on Sat, 4 at 8 am. Join us if you are around. #ASSA. Thanks to Jean-Paul L'Huillier for organizing the session.

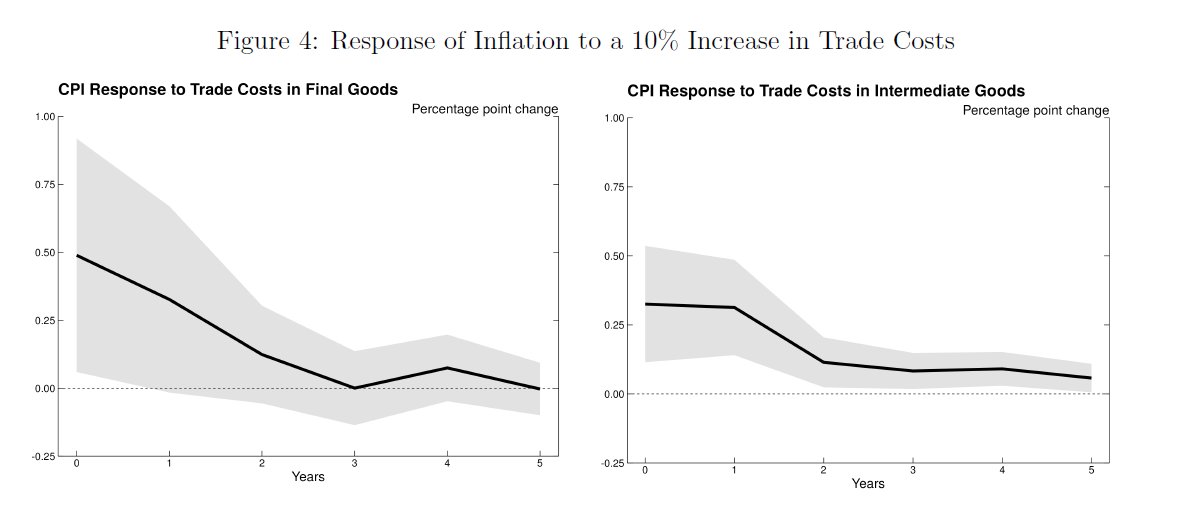

How do changes in trade costs affect inflation dynamics? Interesting new paper by Pablo Cuba Borda, Ricardo Reyes-Heroles, Scaramucci, and Albert Queralto ➡️Contrast effect on inflation dynamics of higher trade costs on final goods vs. intermediate inputs

Just posted! A note related to recent work with Pablo Cuba Borda, Albert Queralto, and Mikael Scaramucci. -> Magnitude and dynamics of positive inflationary effects induced by trade disruptions depend crucially on the type of trade disrupted---trade in final or intermediate goods.