Amanda Parsons

@amandah_parsons

Associate Professor @ ColoLaw, researching international tax law, taxation of the digital economy and cryptocurrency @amandaparsons.bsky.social

ID: 1552720276126896128

https://papers.ssrn.com/sol3/cf_dev/AbsByAuth.cfm?per_id=3595660 28-07-2022 18:19:08

329 Tweet

421 Followers

280 Following

Make sure to check out Michigan Law School’s very own Salome Viljoen in conversation with Amanda Parsons about how data creates value and power!

Briefly emerging from parental leave to report that Taxing Novelty (the article formerly known as Taxing Taxonomies) is forthcoming in UC Davis Law Review papers.ssrn.com/sol3/papers.cf… Revisions to come once I’m back!

Excited to say that my article Deterring Unenforceable Terms will be coming out in the Virginia Law Review. It builds on the great empirical work on unenforceable terms in recent years, focusing on the normative case and policy details for affirmative penalties for contract drafters:

Meet a new law prof: Jonathon Booth (@jbooth_history), incoming at Colorado Law. Welcome ! #newlawprof

Salome Viljoen’s “A Relational Theory of Data Governance” clocking in as the second most-cited article since 2021 🔥🔥🔥 Salome Viljoen Michigan Law School yalelawjournal.org/feature/a-rela…

I have shared this news with many already, but now sharing on here the exciting news that I will join the Colorado Law faculty this fall! Big thanks to all who helped me on this journey! Looking forward to many visitors in Boulder ⛰️☀️ colorado.edu/law/2024/03/04…

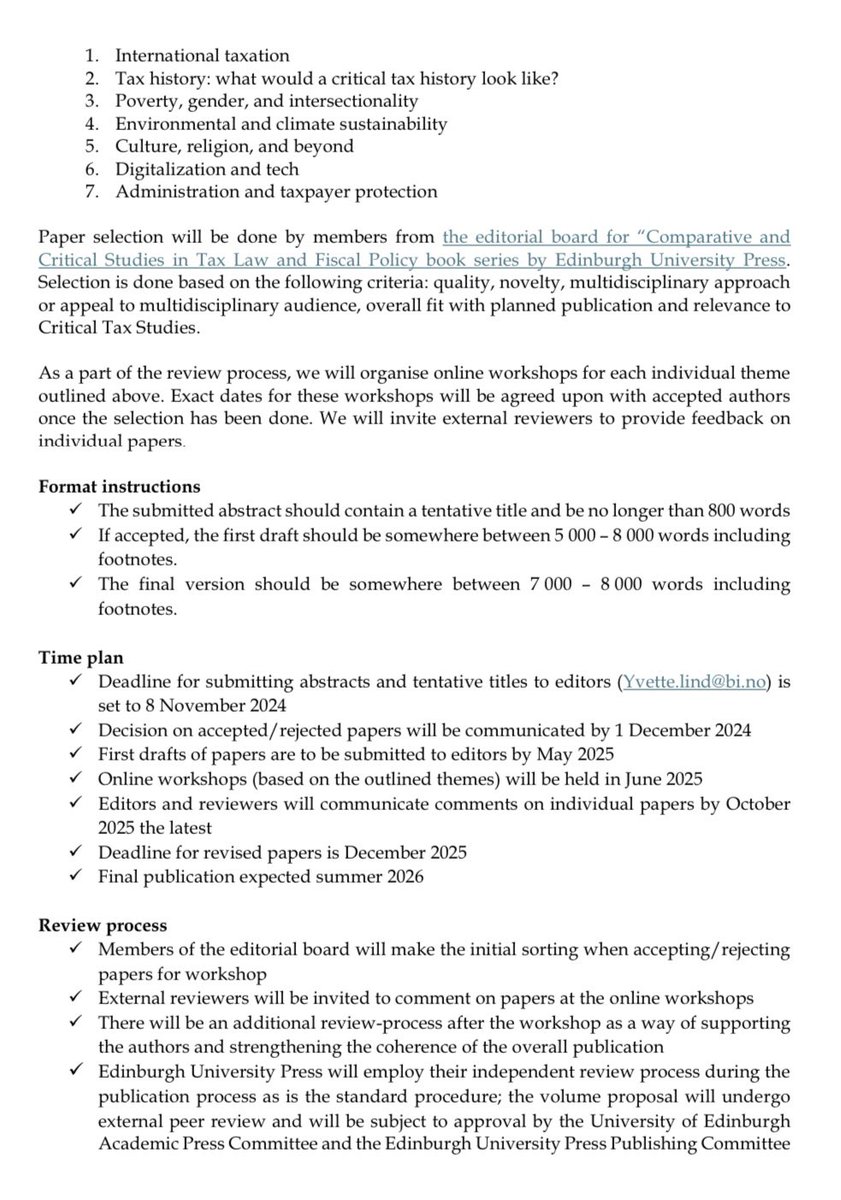

Call for papers for Research Handbook on Critical Tax Studies 🔎 edited by myself and Dominic de Cogan and considered by Edinburgh University Press Deadline: 8 November for abstracts. More info 👇

I'm looking for PhD students to join me in fall 2025 School of Information! I’m particularly focused this cycle on research related to AI regulation, government use of algorithms, and methods for anticipating the impacts of AI systems. The full program details are here: si.umich.edu/programs/phd-i…

Thanks for featuring Salome Viljoen and my article Valuing Social Data!