Andrew Thrasher, CMT

@andrewthrasher

Portfolio Manager for The Financial Enhancement Group & Founder of Thrasher Analytics. Chartered Market Technician. 2x Dow Award winner & Founders Award winner

ID: 34671618

https://thrasheranalytics.substack.com/ 23-04-2009 17:28:15

32,32K Tweet

37,37K Followers

1,1K Following

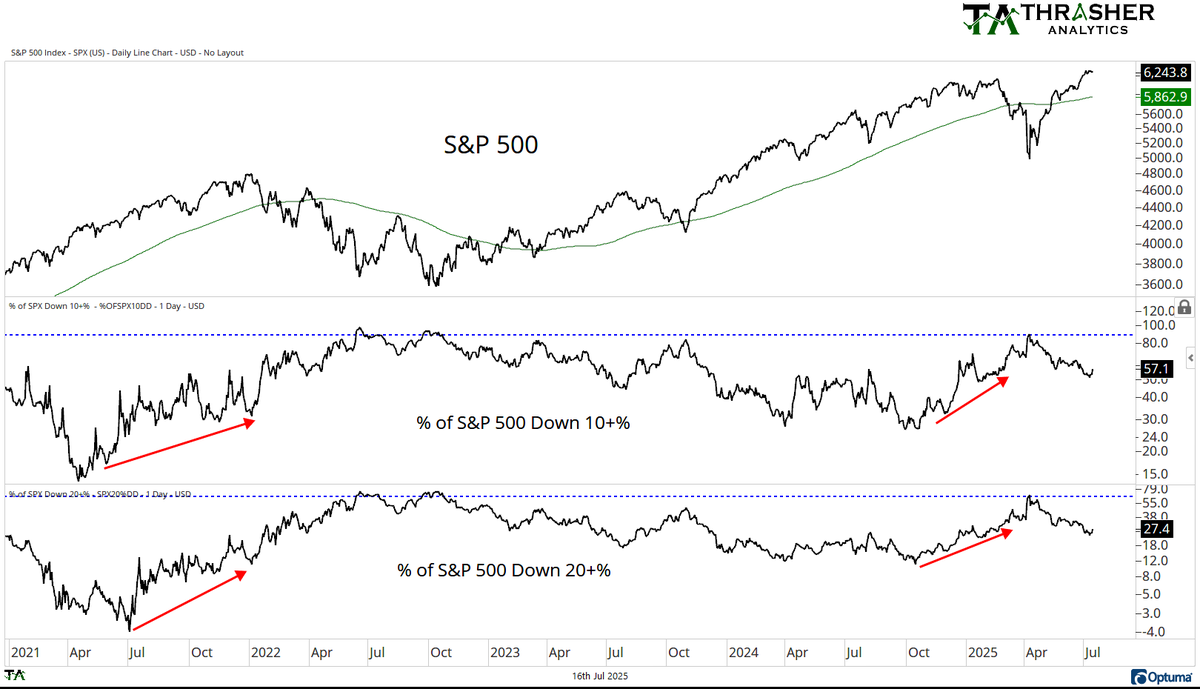

"The Sentiment Spread fell from 19 to 17.8 with a rise in Defensive Sector Sentiment last week." Andrew Thrasher, CMT

The stock market has been running low on investors who want to sell. That might be starting to shift. Thank you Andrew Thrasher, CMT for the interview and the insight. marketwatch.com/story/the-stoc…