Brian Cubellis

@backslashbtc

Chief Strategy Officer @OnrampBitcoin \\\\\\\\ Partner @Early_Riders

ID: 270586176

22-03-2011 22:07:10

1,1K Tweet

839 Followers

745 Following

"This is another convergence of these accelerating technological disruptions that are going to have cascading impacts on our monetary paradigm... ...there's a strong positive loop between AI & bitcoin." [Matthew Pines on The Last Trade]

Cold storage. Segregated vaults. Verifiable on-chain. Onramp democratizes institutional-grade multisig custody—distributed across independent institutions. No keys to manage. No single point of failure. Peace of mind, without complexity. [Michael Tanguma]

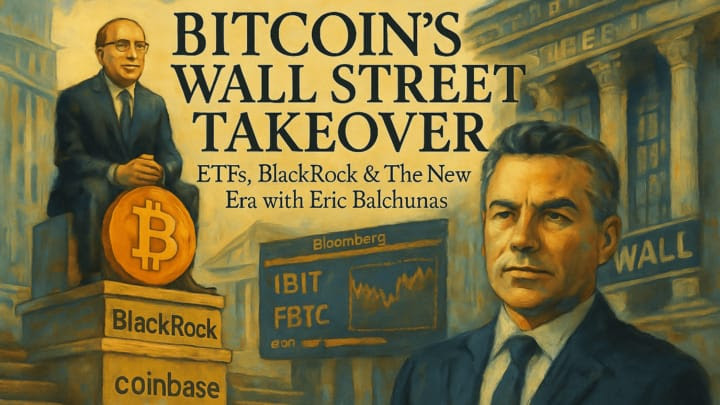

The debt is just getting started... So maybe the price isn’t that high after all Had a fun rip with Eric Balchunas Btw NOT a boomer or a suitcoiner Thanks for coming on, Eric Also forgot to ask, what’s your favorite cheesesteak in Philly?

Bitcoin ETFs? Probably nothing. • $150B+ AUM • IBIT hit $80B in 341 days—fastest ever • Top 20 U.S. ETF, youngest by 12+ years • BlackRock’s most profitable ETF • 1,000+ institutions hold IBIT Thanks for coming on, Eric Balchunas! BTW favorite cheesesteak spot?

We know liquidity drives Bitcoin. But it’s not just about dollars, it’s about access. ETFs opened the floodgates. Trillions can now flow into BTC. Most successful ETF launch ever. And we’re just getting started. Vijay Boyapati on The Last Trade

Bitcoin has no central issuer. It can't be debased. It's borderless. Alex Thorn explains why it's the perfect strategic reserve asset—credibly neutral, finite, and built for global portability.

The real "Last Trade"—printing dollars to buy BTC—isn’t an option for states. That constraint makes the case for state-level Strategic Bitcoin Reserves even stronger and more urgent. Zack Shapiro of Bitcoin Policy Institute breaks it down 👇

Regulatory ambiguity around “Qualified Custodians” misses the broader point. Bitcoin enables protocol-native custody models that are fundamentally more secure by design. Zack Shapiro of Bitcoin Policy Institute breaks down why this is relevant for policymakers on The Last Trade 👇

Bitcoin empowers individuals to hold wealth directly—but that creates real-world security risks. Onramp CEO Michael Tanguma discusses why material holdings require fault-tolerant custody models that minimize reliance on any single person or entity. [Stephan Livera]