Bradley Duke

@bradleydukebtc

Managing Director: Head of Europe @Bitwiseinvest . Co-Founder of ETC Group. 7 years in crypto. Surfer, snowboarder and labradoodle wrangler.

ID: 1825791429794263040

https://bitwiseinvestments.com/ 20-08-2024 07:06:36

423 Tweet

1,1K Followers

301 Following

𝗖𝗮𝘁𝗰𝗵 𝘂𝗽 𝗼𝗻 𝘄𝗵𝗮𝘁 𝗵𝗮𝗽𝗽𝗲𝗻𝗲𝗱 𝗶𝗻 𝗯𝗶𝘁𝗰𝗼𝗶𝗻 & 𝗰𝗿𝘆𝗽𝘁𝗼 𝘁𝗵𝗶𝘀 𝘄𝗲𝗲𝗸 𝘄𝗶𝘁𝗵 𝗼𝘂𝗿 𝗹𝗮𝘁𝗲𝘀𝘁 𝗖𝗿𝘆𝗽𝘁𝗼 𝗠𝗮𝗿𝗸𝗲𝘁 𝗥𝗼𝘂𝗻𝗱𝘂𝗽. #Bitcoin #Ethereum #Crypto #DigitalAssets #Bitwise #CryptoMarketRoundup Max Shannon André Dragosch, PhD⚡

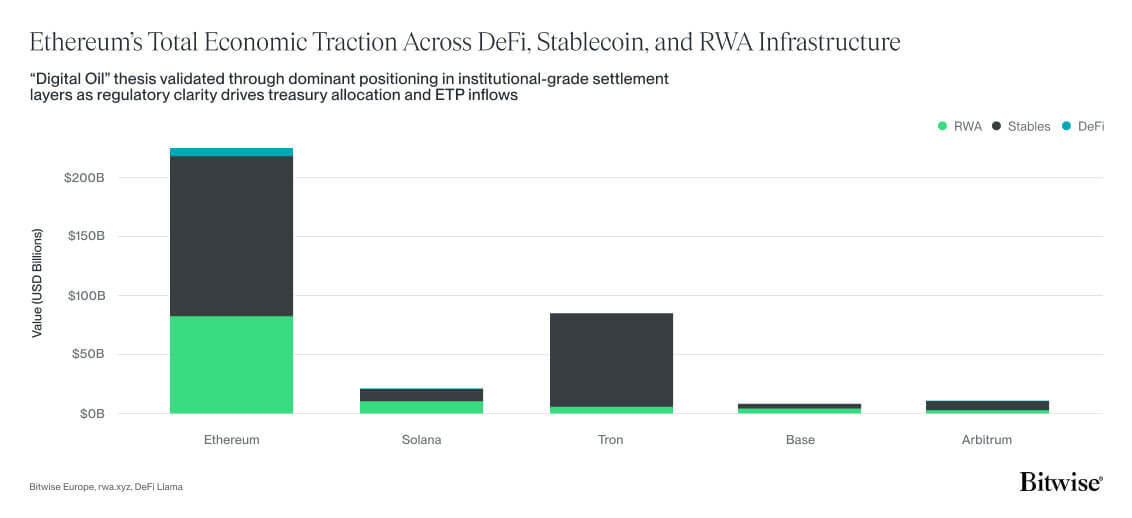

"The full picture emerges only when you trace the journey across a decade of experiments, pivots, and reinventions". Read the full Alt View on Ethereum from Bitwise Europe 's talented research team:

Happy Friday everyone! Every Friday the research team at Bitwise Europe sends out a recap of the week's main crypto stories in the Crypto Market Roundup: 🧵

A great thread from André Dragosch, PhD⚡ on why having some BTC in an investment portfolio is so important 👀