Julianna Tatelbaum

@cnbcjulianna

@CNBC Anchor | 📺 Street Signs M-F 9am GMT | 🇺🇸 Boston-born | 🇬🇧 London-based | 🏦 Banker in former life | 💉 Pharma enthusiast

ID: 1039878498356264960

http://instagram.com/julianna_tatelbaum/ 12-09-2018 14:08:48

9,9K Tweet

14,14K Followers

982 Following

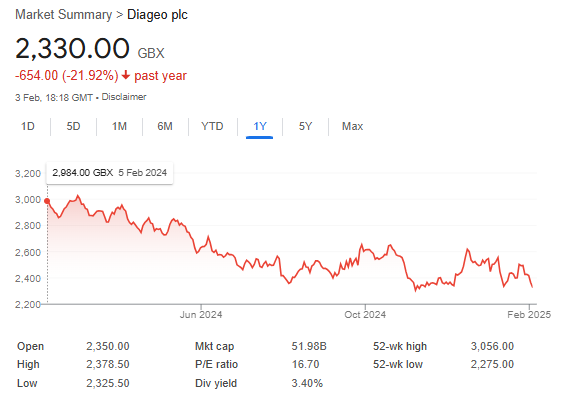

#Diageo continues to struggle. People just aren't drinking as much as they used to. Company withdrew medium-term guidance this AM. Tariffs couldn't come at a worse time. Shares off -22% in past year. How can they turn it around? We're analyzing drinks industry at 945 on CNBC International

I spoke to Anastasia Amoroso this morning on CNBC International and asked her how to play the trade war in markets. Where to invest: Look to financials, real estate and utilities as well as alternative investments Avoid: Consumer discretionary & consumer staples and Information Technology

Saudi oil giant Aramco post a drop in full year profit and slashed its dividend. CNBC International