Carolin Pflueger

@carolinpflueger

University of Chicago, Harris School of Public Policy. Research on finance and monetary policy.

ID: 2271019027

01-01-2014 01:22:28

185 Tweet

3,3K Followers

131 Following

At the AEA meetings in San Francisco? Check out this nice session on Friday morning: "Identifying Monetary Policy" With presentations from Amy Handlan Michael Bauer Niklas Kroner myself and Philippe Andrade Thank you Philippe for organizing! #ASSA2025

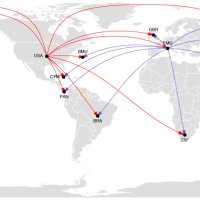

New NBER working paper “A Theory of Economic Coercion and Fragmentation” on economic security. By Christopher Clayton Matteo Maggiori and Jesse Schreger Read here: shorturl.at/mAKVL Video presentation: shorturl.at/evt5b

Our new Economic Letter provides new evidence of monetary policy perceptions by the public, using both surveys and financial market data. Huge thanks to my coauthors Carolin Pflueger and Adi Sunderam.

The program for the 25th MFS Workshop at UCLA Anderson School of Management (May 16–17, 2025) is now available: macrofinancesociety.org/25th-macro-fin… If you plan to attend, please register as soon as possible using the link provided. Looking forward to seeing you all in Los Angeles this May!

Kicking off Day 1 of our Macro Finance Research Program Frontier Topics in Macro-Finance Conference—organized by my The University of Chicago colleagues, Yueran Ma, Carolin Pflueger , and myself—with an exciting first session on Monetary Policy and Financial Markets. #macroeconomics #macrofinance #econtwitter

We’re delighted to have Luigi Bocola (Stanford/NBER) and Anna Cieslak (Duke) discuss the working paper, “Bond Market Views of the Fed.” Thanks to our participants for the engaging questions! #EconTwitter

To wrap up our conference, we have Manuel Menkhoff (LMU) and Ian Dew-Becker (FRB Chicago) discussing macroeconomic tail risk expectations of firms. Many thanks to all speakers and guests for your participation! #EconTwitter

🚨 Call for Papers: JIE–GCAP–BGS Conference on Geoeconomics 📍 Stanford GSB | 📅 Feb 27–28, 2026 📝 Submit papers by Sept 15, 2025 🔗 Call for papers: shorturl.at/r26Do Global Capital Allocation Project, Stanford Graduate School of Business

Please submit! I am very excited about this conference with Matteo Maggiori Jesse Schreger Jeff Frieden Reka Juhasz Christoph Trebesch

Excited to be co-organizing the next MacroFinanceSociety meeting in Chicago with Rohan Kekre, co-sponsored by Macro Finance Research Program. Lars Peter Hansen Submit your best papers!

Very clear article by Lydia DePillis The New York Times discussing our Becker Friedman Institute for Economics / NBER working paper and other aspects of healthcare job growth. For more detail, the full paper together w/ Neale Mahoney Stanford Institute for Economic Policy Research Kevin Rinz Victoria Udalova is here: gottlieb.ca/papers/HealthC…

One week left to submit to this! Excited for conference and the Journal of International Economics special issue. Feel free to reach out directly if you're considering submitting and have any questions on process etc.

During the late 20th Century, nominal government bonds and stocks tended to comove positively, whereas during the first quarter of the 21st Century they have tended to comove negatively, from John Y. Campbell, Carolin Pflueger, and Luis M. Viceira nber.org/papers/w34323