Chemical Angel Network

@chemangels

Nationwide network of angel investors focused on #startups in the #chemistry space, including #lifesciences #materials and #energy.

ID: 1372646448571895810

https://chemicalangels.com/ 18-03-2021 20:30:06

213 Tweet

148 Followers

220 Following

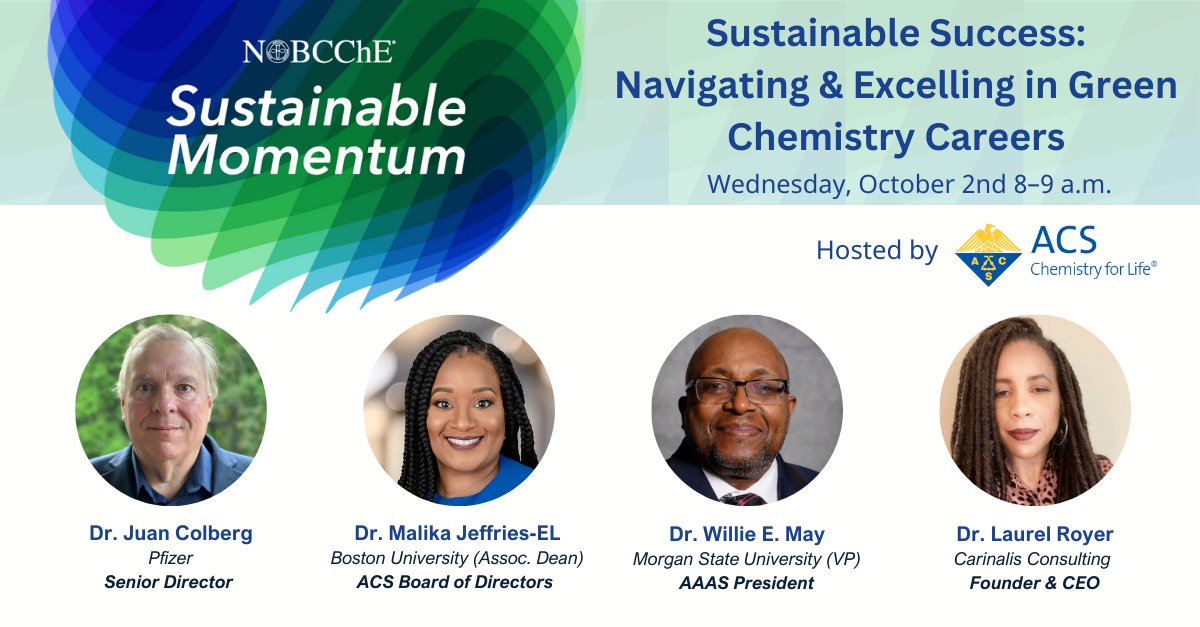

At the 2024 NOBCChE Official Conference, GCI's Sederra Ross will be organizing a panel on #GreenChemistry Careers! Panelists include Drs. Juan Colberg, Malika Jefferies-El, Willie May & Laurel Royer. Join us Wed, Oct 2 at 8am, room St. John's 30-31. Register: brnw.ch/21wNjEZ

My angel groups invest in 2% of the companies that pitch us. Here are the 5 things that separate the successful 2% from the 98% we pass on. Surprisingly, it's not the pitch. My article today in Entrepreneurship Handbook. bit.ly/4fcEUJh

Proud to announce that Chemical Angels member fund and 9 individual members have invested in the seed round of HinaLea Imaging, combining hyperspectral imaging with AI. Congrats on closing the round!

Join American Chemical Society on 1/23 for a free virtual event showcasing innovations from the 2024 Green Chemistry Challenge Awards! Learn about bio-lubricants, green hydrogen, & sustainable fertilizers: brnw.ch/21wQ9Kv

How much should startups pay their advisors? The consensus is 0.25% - 1.0% of equity, but the exact amount depends on a number of factors. See the recommendations in today's article on Entrepreneurship Handbook. bit.ly/4jjJl7o