Cloud Ratings

@cloudratings

We are an analyst firm that verifies the business value of software.

ID: 1574556108726730755

https://cloudratings.com/ 27-09-2022 00:27:30

255 Tweet

339 Followers

48 Following

📨 latest issue, featuring: - Menlo Ventures Enterprise AI report - Cloud Ratings B2B AI Interest Index for October = very strong - curated AI content from Sapphire Ventures PricingSaaS Janelle Teng saasletter.com/p/menlo-ventur…

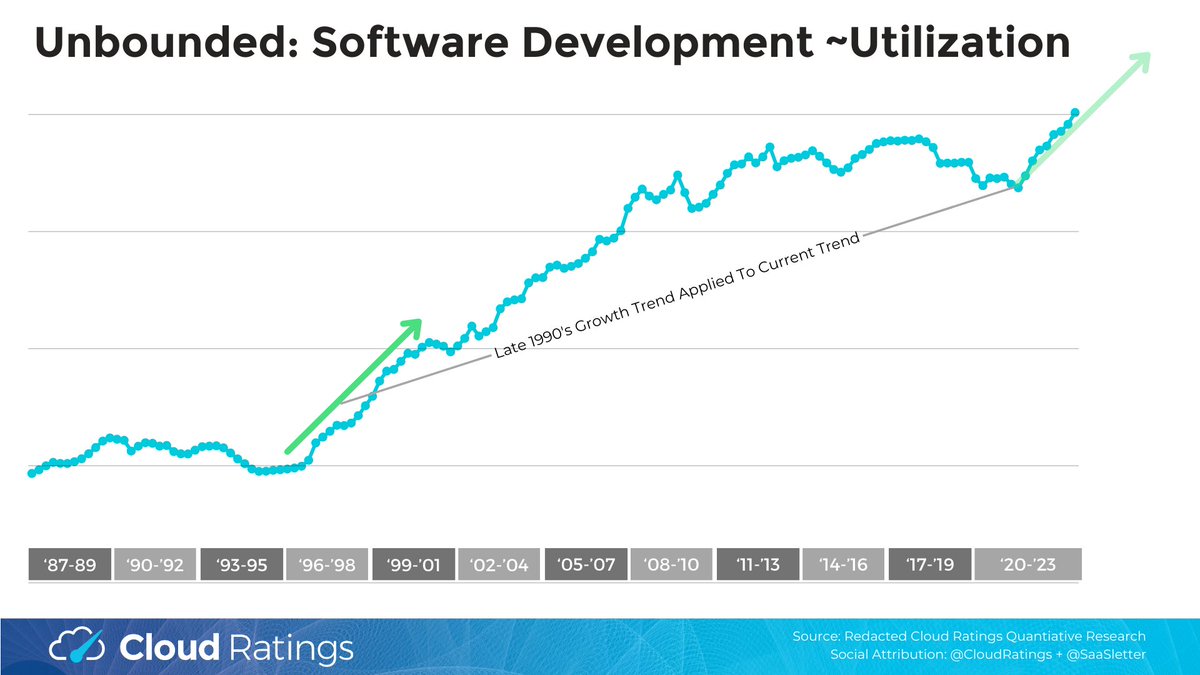

With some (redacted) Cloud Ratings analytical work on the "software = unbounded" theme... showing a current trendline above the late 1990s tech boom

📨 Best Content of 2H 2024 Curation of the best of Software x AI Featuring ICONIQ Dave Yuan/Vertical SaaS Knowledge Project Battery Ventures Jared Sleeper Edward Robson G2 Kyle Norton Sapphire Ventures ChartMogul High Alpha Bessemer/Alex Konrad Pavilion + more

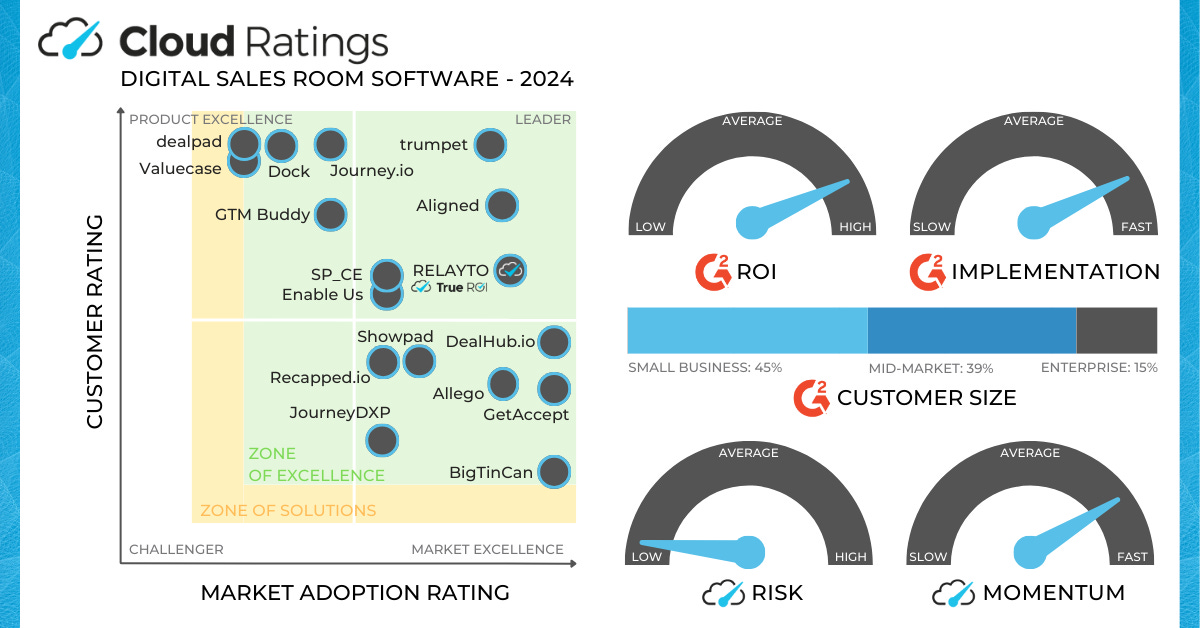

For any Analysts looking for another platform, Cloud Ratings has: - Principal Analyst roles, - data partnerships, - efficient quadrant methodologies, - and category coverage whitespace Email + DM open

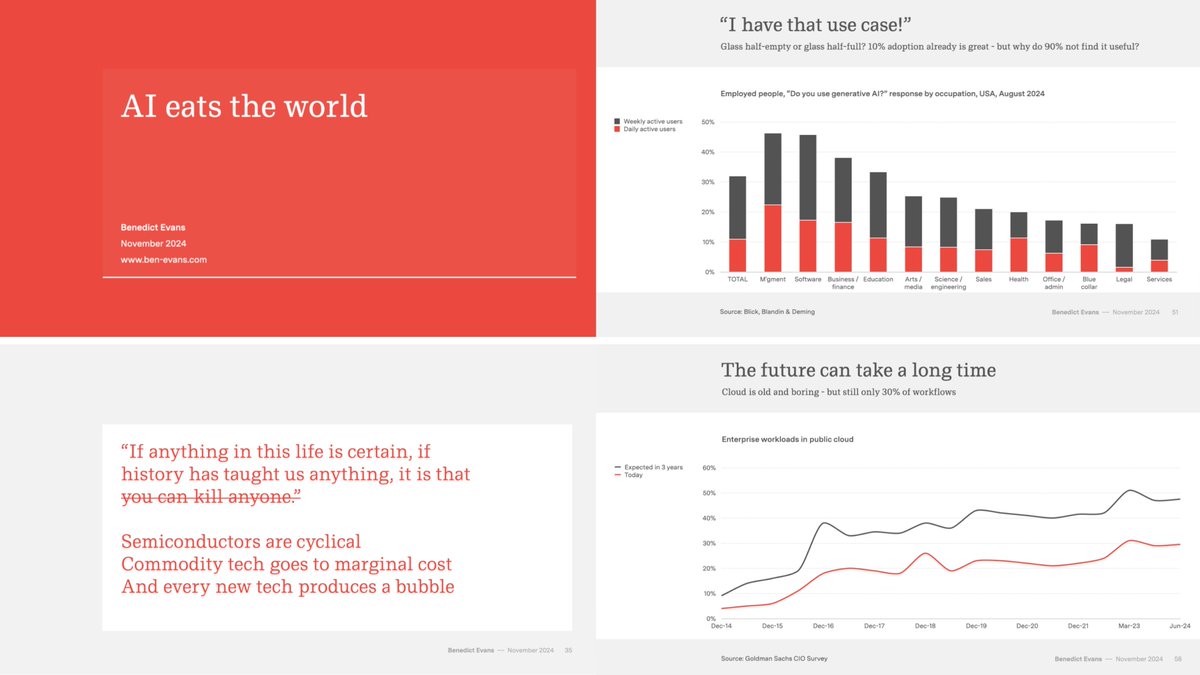

📨 latest edition: - adding quantitative support to Buck's "unbounded software task TAMs" - Dec '24 Cloud Ratings B2B AI Interest Index - more from Benedict Evans Bowery Capital Lukas Petersson The Deal Director

Excited to partner with Emergence Capital + Benchmarkit / rayrike on their 2025 B2B SaaS Benchmark report. Submit *your* metrics here: cloudratings.saasbenchmarks.ai/survey/saasper…

✉️ latest edition = my latest "State of Software + AI" slides, 1st debuted at Bowery Capital's Annual Meeting research.cloudratings.com/view/80310106/

Proud to have been a supporting partner to Benchmarkit / Emergence Capital 2025 Benchmarks. We updated our historical SaaS metrics database to reflect the new report