DXS: Self-Сustodial Access To Financial Markets

@dxsapp

Trade 100s of markets directly from your Web3 wallet. Commodities, stocks, indices, forex & crypto or earn as a liquidity provider **trade at your own risk**

ID: 1326119279868174337

https://dxs.app 10-11-2020 11:07:45

4,4K Tweet

6,6K Followers

693 Following

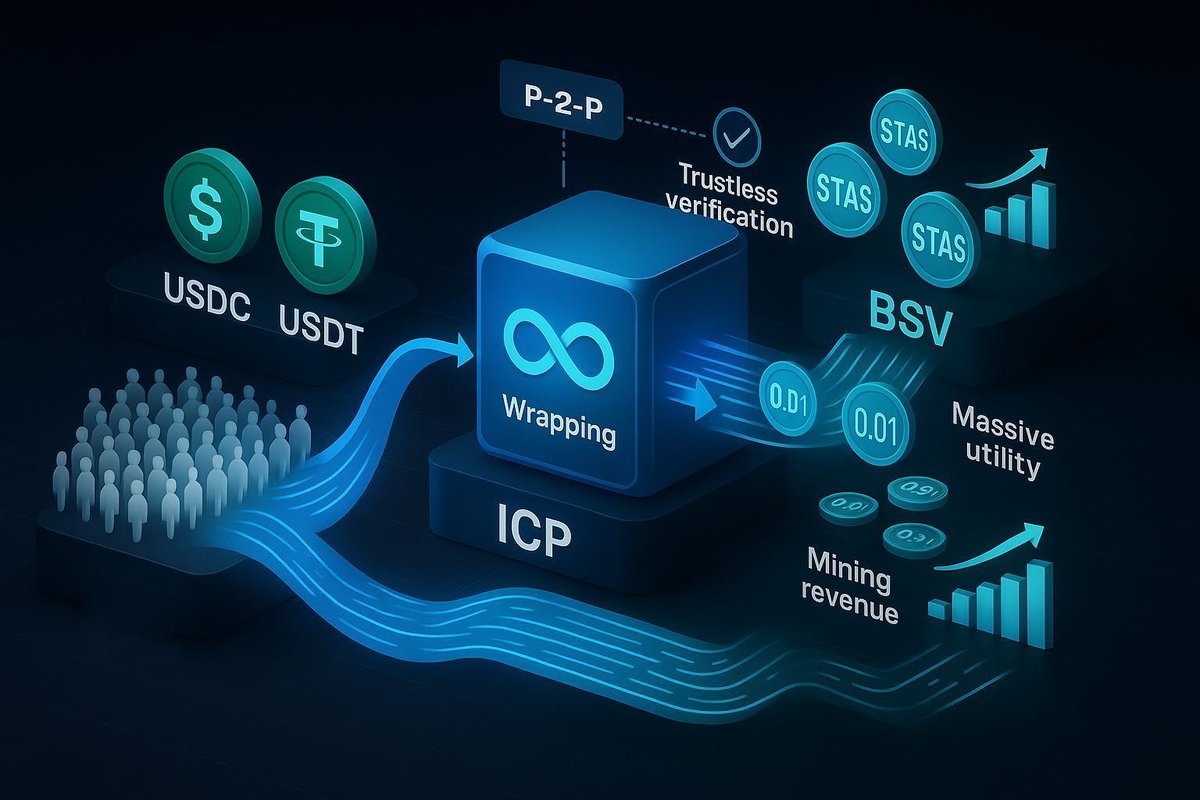

Thank you, Kurt, for taking the time to elaborate on your concerns about STAS Script. This is exactly the productive discussion we need. To be clear: we're not just advocating for STAS here, but for tokens with L1 settlement in general. This is a question of life and death for