Dan Goss

@dangoss222

Senior researcher @demos looking into tax and wealth inequality

ID: 1435565951022473221

08-09-2021 11:29:35

959 Tweet

464 Followers

729 Following

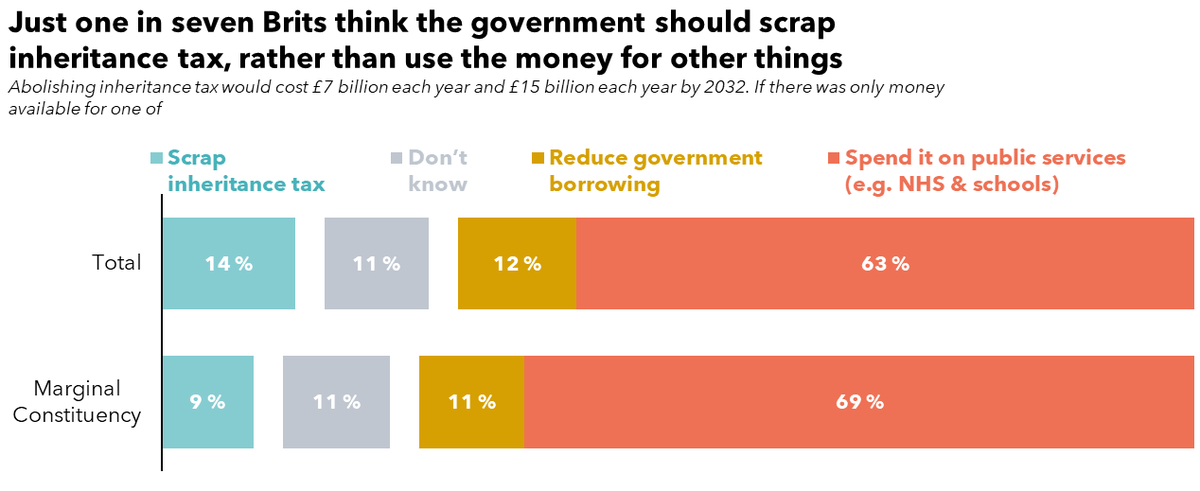

Big day for reasoned debate on farms/inheritance today - a debate undermined by BBC News (UK) repeatedly and wrongly reporting as fact that “farms worth more than £1m would have to pay inheritance tax”. This is just flatly wrong in vast vast majority of cases

Is inheritance tax the most hated tax? Why are farmers up in arms about recent changes? That and much more on inheritance tax is discussed on the latest abrdn Financial Fairness Trust podcast with David Sturrock Institute for Fiscal Studies and Dan Goss Demos Lister here: buff.ly/4iIHp8q

Our CEO Mubin Haq caught up with Dan Goss from Demos and David Sturrock at Institute for Fiscal Studies on our latest podcast where they dug into the recently announced changes to inheritance tax and public attitudes towards them. Listen to the full episode buff.ly/4iIHp8q