Daniel Kral

@danielkral1

Europe macro. Opinions my own. All of them.

danielkral on the other platform

ID: 1171989673

12-02-2013 13:34:29

6,6K Tweet

13,13K Followers

3,3K Following

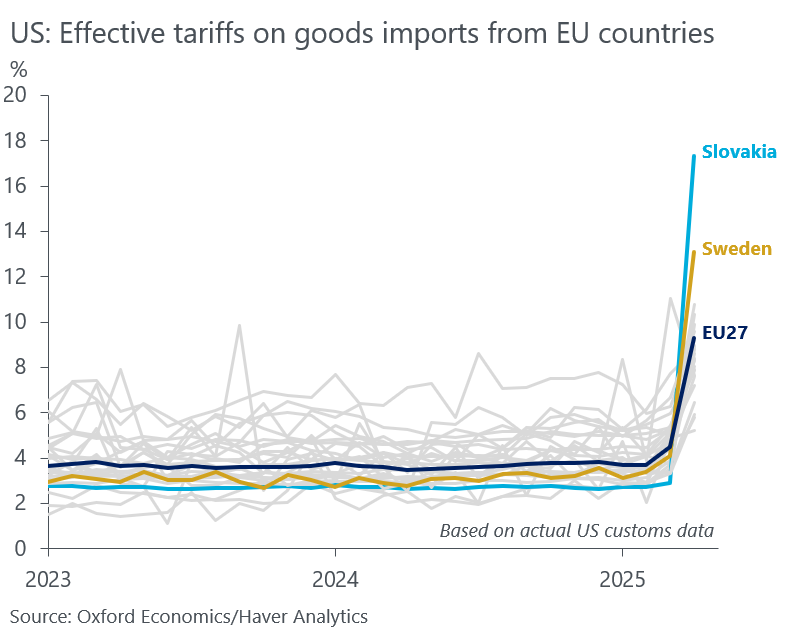

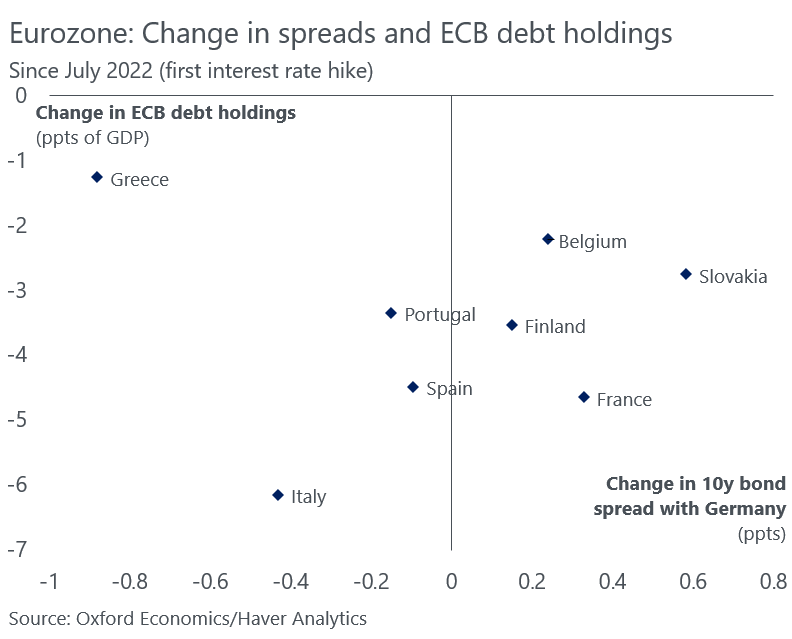

Even as the European Central Bank's balance sheet run-off accelerated this year (no more reinvestments), spreads with Germany for periphery govts have continued to drop, reaching multi-year lows for Italy or Greece. Europe looking a lot more fiscally responsible and stable than the US.

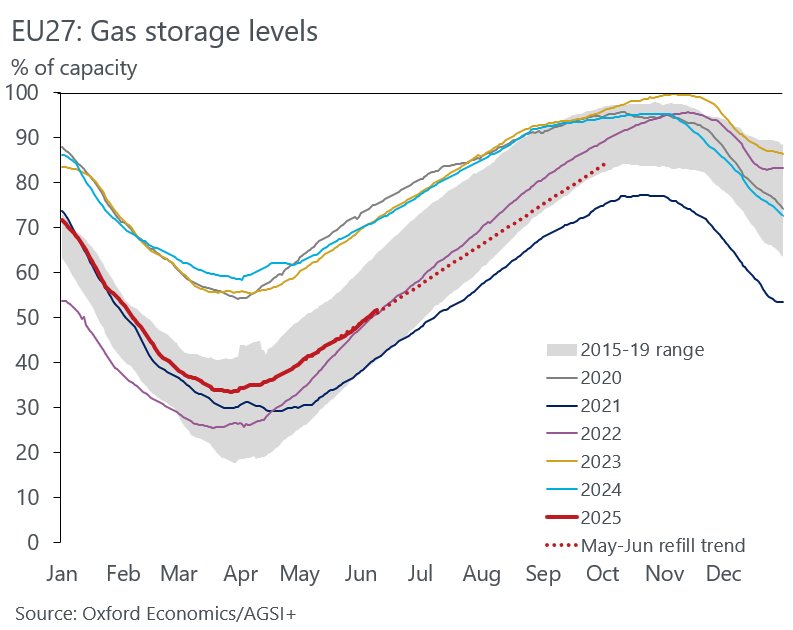

🇪🇺 gas storages are currently more in line with normal after two years of exceptionally warm winters. Even with the current slower pace of refill, storages should be 85% full by early October. Probably also why the European Commission tightened Russia energy sanctions.

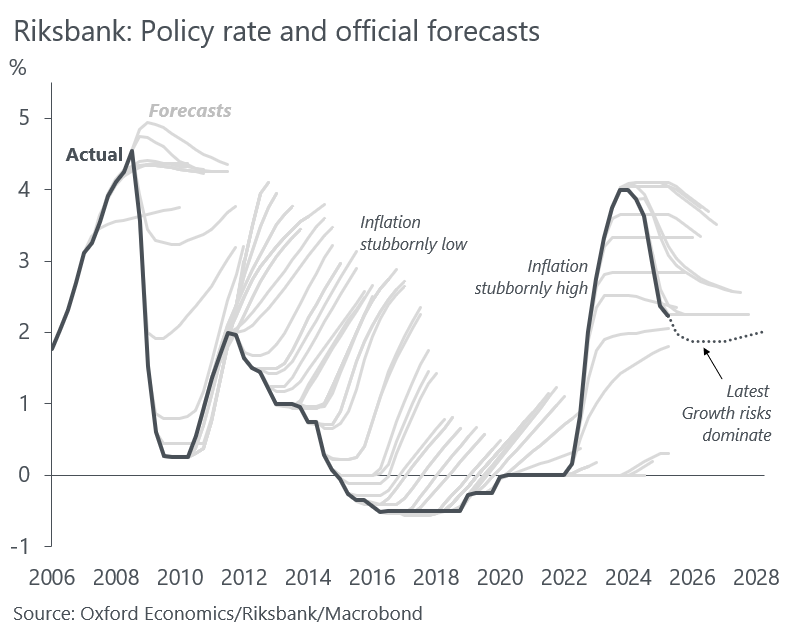

Sweden's Sveriges riksbank cut rates today citing growth concerns after signalling it is done easing and will be data-dependent at previous meetings. European Central Bank's focus also likely to shift to growth as US tariffs prove disinflationary (negative demand shock), although uncertainty remains.

Quite the decade at the European Central Bank. From fighting deflation risks in late 2010s to the largest inflation shock in living memory in 2020s. Given uncertainty and more supply shocks (climate, geopolitics), European Central Bank now more alert to upside risks to inflation. The bar to restart QE very high.

Since European Central Bank started tightening policy, spreads with Germany shrunk in some high debt economies (🇮🇹🇬🇷🇵🇹) but rose in others (🇫🇷🇫🇮🇧🇪). Public debt often rolled off the ECB's balance sheet faster in *the former* group. Growth & fiscal outlook & govt credibility drive yields/spreads.

The recent sharp decline in fertility rates across the EU has huge implications for the long-term. United Nations & other forecasters keep assuming fertility rates will rebound. Instead they only go lower. As 🇵🇱 shows, it's not a matter of govt spending on families, other factors at play.