Darius Dale

@dariusdale42

CEO of 42 Macro—the leading macro forecasting and market timing service on Global Wall St. advising on $25 trillion-plus in client AUM. Not investment advice.

ID: 1374003455195545601

https://42macro.com/42-macro-sample-research 22-03-2021 14:22:21

32,32K Tweet

92,92K Followers

1,1K Following

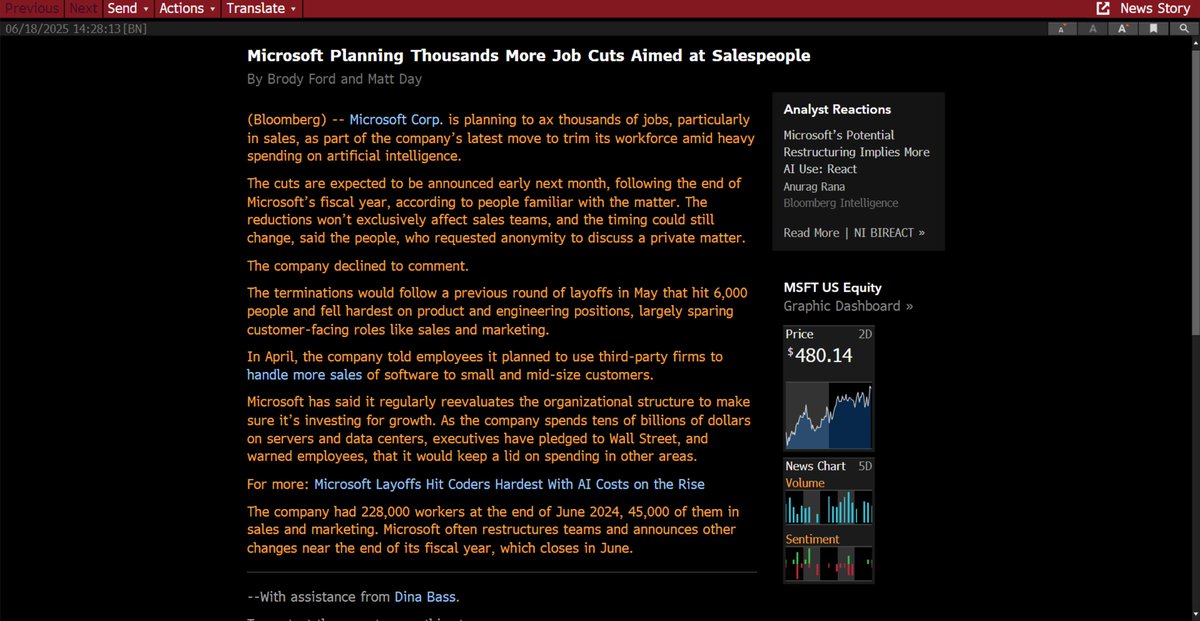

If the Federal Reserve does not cut rates tomorrow, Donald J. Trump’s soon-to-be named Fed-Chair-in-Waiting will by the next FOMC in forward guidance terms. USD money markets are not priced for the highest probability path of US monetary policy through Dec-26.

Good thread from our friend Bob Elliott RE: the pending growth slowdown. The data forces every investor to make three determinations: 1. Will the slowdown be “U-shaped” or “L-shaped”? 2. If the slowdown is “U-shaped”, can the market look through it and avoid a deep

Darius Dale My 40’s are a hell of a lot less stressful thanks to 42 Macro

Why Should I Trust KISS (Risk Managed 60/30/10 Stocks/Gold/Bitcoin)? | June 14, 2025 Enjoy this excerpt from our June 14 Around the Horn presentation in which we detail a key reason why 42 Macro 🇺🇸 has thousands of investors around the world employing our Keep It Simple &

I unpacked my thoughts regarding today's FOMC in real-time with our friend Adam Taggart (my next Thoughtful Money® appearance will be out this Sunday at 11am ET). In summary, consensus is ill-positioned for the right tail risk detailed in the clip below.

Mark Minervini IMO, novice investors are much better off by holding an ETF or following a proven and validated system that trades irregularly (which yield a better reward/risk verse ETf hold only), like Darius Dale 's KISS model. (Super easy for investors to follow) Then start trading, again

Is the Fourth Turning still a “horoscope,” Corey Hoffstein 🏴☠️? youtu.be/9Rh9_1sKTv0?si…

Is The Next Big Move In Markets Still Ahead? youtube.com/watch?v=Lmd0HX… I recently joined Adam Taggart to break down why markets are primed for a major repricing. Growth expectations remain unrealistically low, setting the stage for upward revisions in earnings, tighter credit