David Duong

@dav1dduong

Head of Research, Coinbase Institutional

ID: 61699615

https://www.coinbase.com/institutional/research-insights 31-07-2009 05:22:59

356 Tweet

1,1K Followers

258 Following

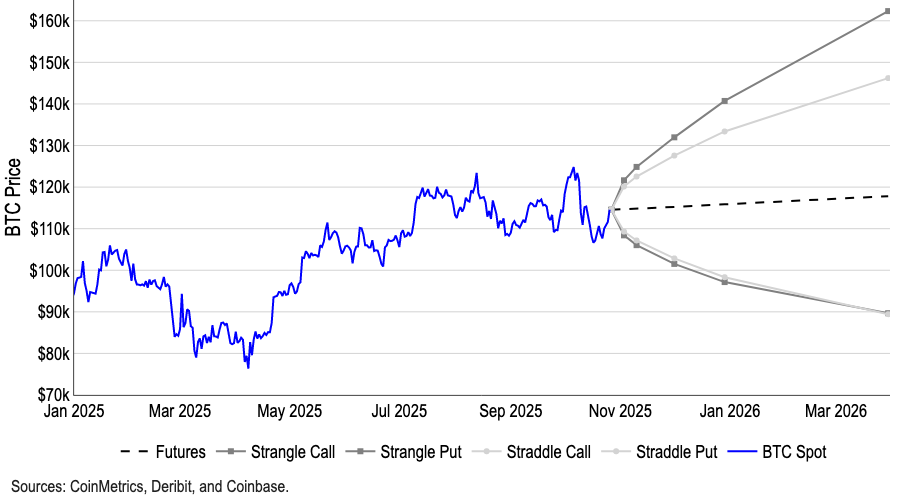

Nearly half of institutions we surveyed think we’re in the latter stages of the bull market, but only about one-quarter of non-institutions agree. David Duong🛡️ and @MilkRoadDaily discuss what this sentiment gap could mean for markets and share other key findings from Charting

#Bitcoin markets outlook from my interview with Sky News Australia