David Beckworth

@davidbeckworth

Senior Research Fellow @mercatus || Podcast Host at macromusings.libsyn.com || Former U.S. Treasury Economist || Micah 6:8

ID: 465922900

https://macroeconomicpolicynexus.substack.com/ 16-01-2012 21:43:36

39,39K Tweet

27,27K Followers

1,1K Following

From program associate to a PhD scholar in 8 years! 🙌 Starting in the monetary policy program under Scott Sumner (TheMoneyIllusion) and David Beckworth, Patrick Horan ☘️ worked his way up while earning his master’s and PhD at George Mason University. Hear his story of growth, learning, and the

I'm now off to join William Beach in a new venture, The Fiscal Lab on Capitol Hill! More to come, but here is a sneak peek 3/3 washingtonstand.com/news/pressure-…

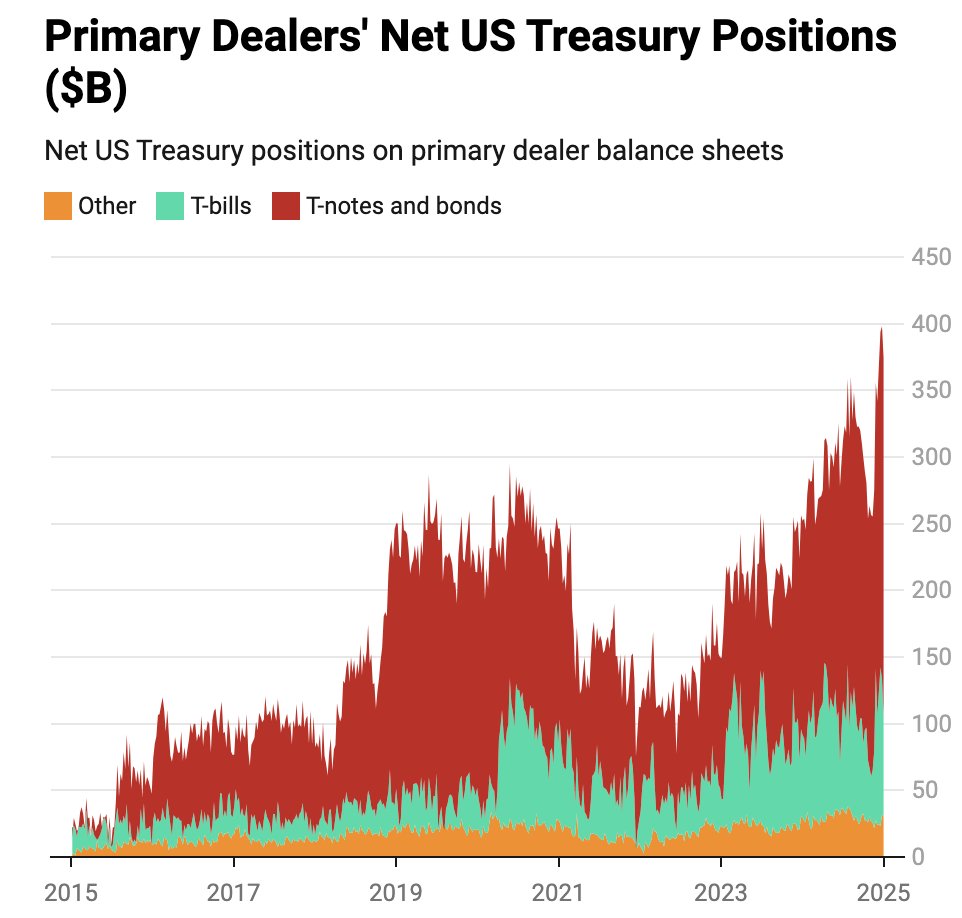

New Andersen Institute for Finance and Economics Note: "When financial regulation becomes financial repression" (link below) We take a macro view on the interactions between: (i) high and rising debt (ii) OBBB expansionary spending (iii) GENIUS Act stablecoin legislation (iv) SLR bank capital reform