Eric de Montgolfier

@emontgolfier

CEO @InvestEuropeEU, representing #PrivateEquity, #VentureCapital, #Infrastructure and their global investors. Views my own.

ID: 2280790693

http://www.investeurope.eu/ 07-01-2014 15:46:11

251 Tweet

265 Followers

363 Following

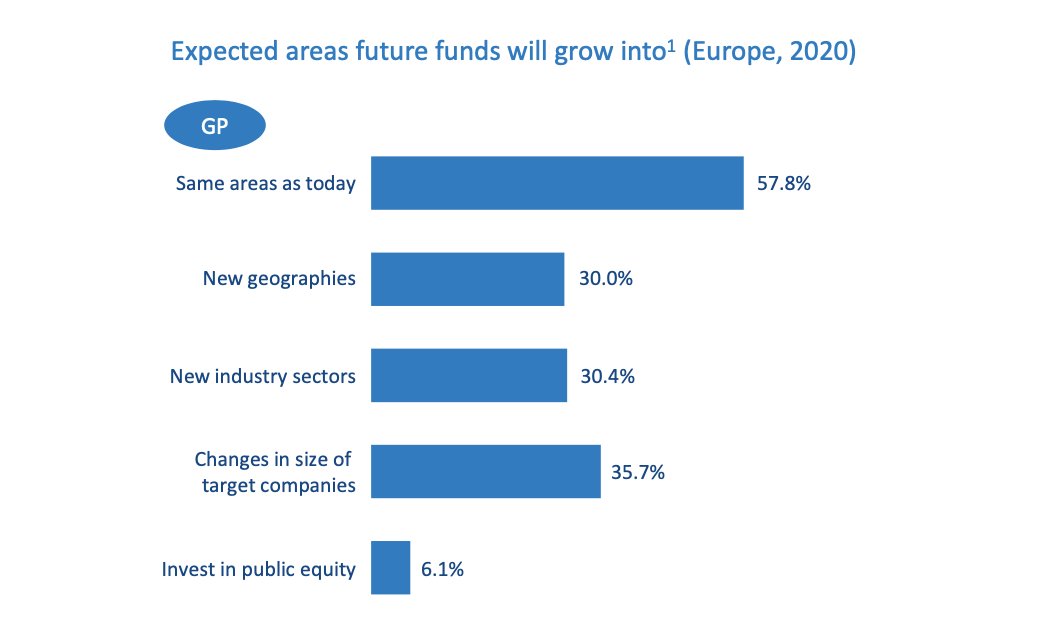

Private equity asset class remains attractive for LPs, but investment strategies may evolve: read our new research with Arthur D. Little 👉 bit.ly/PEsentiment #PrivateEquity #Covid19

We are proud to support Atomico's State of European Tech, the largest survey of tech in the region. Watch the fireside chat between French President Emmanuel Macron and Atomico's Niklas Zennström on the future of European tech. vimeo.com/488643621/0e9c… #VentureCapital #tech #startups

Irrespective of the short-term situation, private equity remains a favourite investment for LPs. Our new study with Arthur D. Little lifts the lid on Europe’s #PrivateEquity industry during #Covid19 and beyond. Find out more: bit.ly/PEsentiment

“Right now, there’s no other asset class that can match #PrivateEquity in terms of risk-reward profile, particularly in the current low interest rate environment,” Eric de Montgolfier discusses our new report, in collaboration with Arthur D. Little: bit.ly/PEsentiment #Covid19