Erica Xuewei Jiang

@exjiang

Assistant Professor of Finance and Business Economics at @USCMarshall | Banking, IO, household finance, real estate

ID: 1346280447962042369

https://sites.google.com/view/ericajiang 05-01-2021 02:20:58

163 Tweet

1,1K Followers

427 Following

.UCLA Anderson School of Management's Jinyuan Zhang along with USC Marshall School of Business's Erica Xuewei Jiang, & Singapore Management University's Gloria Yang Yu show that uneven adoption of mobile banking across demographic groups triggers operational shifts by banks that can disadvantage older & lower-income consumers. anderson-review.ucla.edu/mobile-banking…

I am delighted to see my paper published in the Journal of Financial Economics economics! I am very grateful for the comments from the reviewing team and great experience at the JFE. authors.elsevier.com/sd/article/S03…

It is also important to understand the risk to the rest of the #banking system in the U.S. Amit Seru, Erica Xuewei Jiang, Gregor Matvos, and Tomasz Piskorski calculate the risk of further bank failures if uninsured depositors withdraw their funds. ms.spr.ly/6016g4q4a

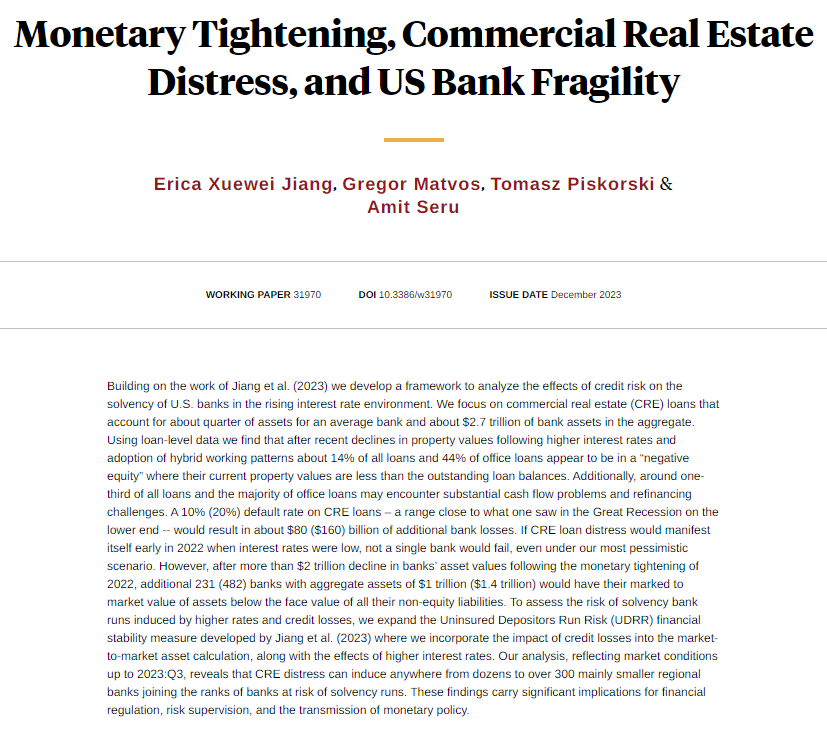

A framework to analyze the effects of credit risk on the solvency of US banks in the rising interest rate environment, from Erica Xuewei Jiang, Gregor Matvos, Tomasz Piskorski, and Amit Seru nber.org/papers/w31970

If you're attending #ASSA2024 #AFA2024 in San Antonio, join Erica Xuewei Jiang Simone Lenzu R.Clark Kairong Xiao R-Kim A.McKay Matteo Benetton and myself for a great session on Industrial Organization and Finance on Sunday at 10:15am 👇🏻 Click to expand session details👇🏻 #econtwitter

If you are into fintech, come to our #ASSA #AFA session today at 2.30 pm at Marriott Watercenter, Grand Ballroom Salon I. Thanks Nadya Malenko for organizing and discussants Paul Beaumont, Erica Xuewei Jiang, Deeksha Gupta, Emily Williams for taking the time to provide feedback on papers!

Call for Papers: Columbia & RFS AI in Finance Conference! The conference features optional dual submission to RFS. Submission deadline: April 7, 2024. I am organizing this with Ansgar Walther. RFS sponsoring editors: Itay Goldstein, Tarun Ramadorai. sites.google.com/view/ai-financ…

Capital regulation could address run risk by encouraging capital raising, but its effectiveness depends on the regulatory capital definitions and can be eroded by the use of held-to-maturity accounting, from Granja, Erica Xuewei Jiang, Matvos, Piskorski, and Seru nber.org/papers/w32293

Call for papers: AI in Finance Conference! Submission deadline February 1, 2025 Following successful inaugural conference on AI in Finance in 2024, excited to host next conference on June 10, 2025 at the University of Maryland's Smith School of Business sites.google.com/view/ai-financ…

Overjoyed that Tyler Muir won the Fisher Black prize. I have been so lucky to have worked with Tyler and learned so much from him. Congratulations !!!’

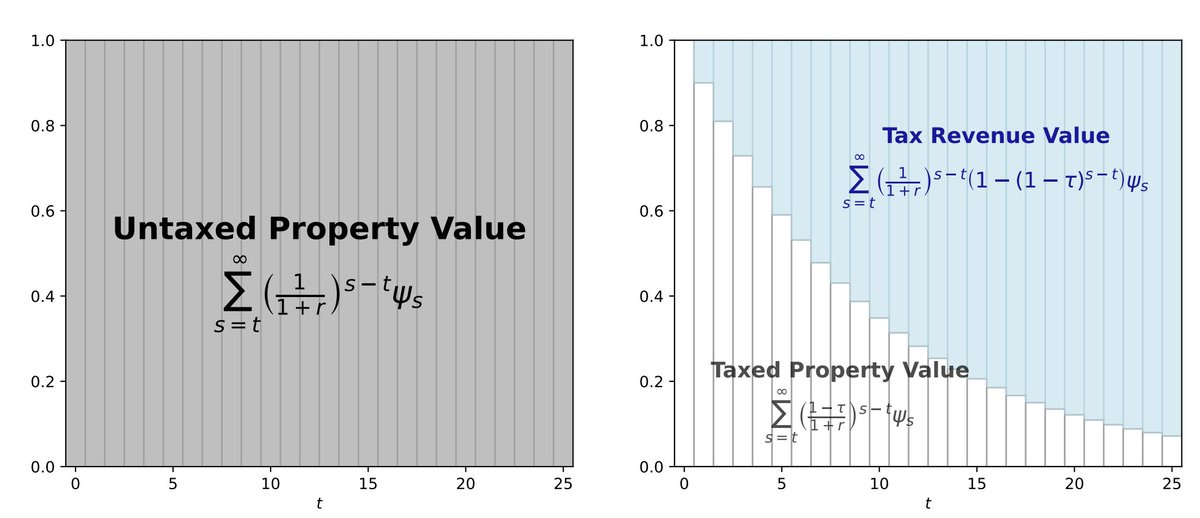

Baiyun Jing Erica Xuewei Jiang Our result is in this picture. Property taxes essentially divide the untaxed house into two financial assets. The taxed house (white bars), which belongs to the owner, and the property taxes (blue), which go to the govt

rodneywhitecenter.wharton.upenn.edu/2025-summer-sc… Luke Taylor, Stephen Terry, and I are doing it again. This will be the 5th structural summer school in finance. We do not just teach papers. We teach techniques, and then we have students work on a problem set. Please get your students to apply.

Just posted a revision of my paper with Erica Xuewei Jiang and Baiyun Jing ! Take a look if you're interested in how Black-Scholes, Modigliani-Miller, and Holmstrom apply to... property taxes!