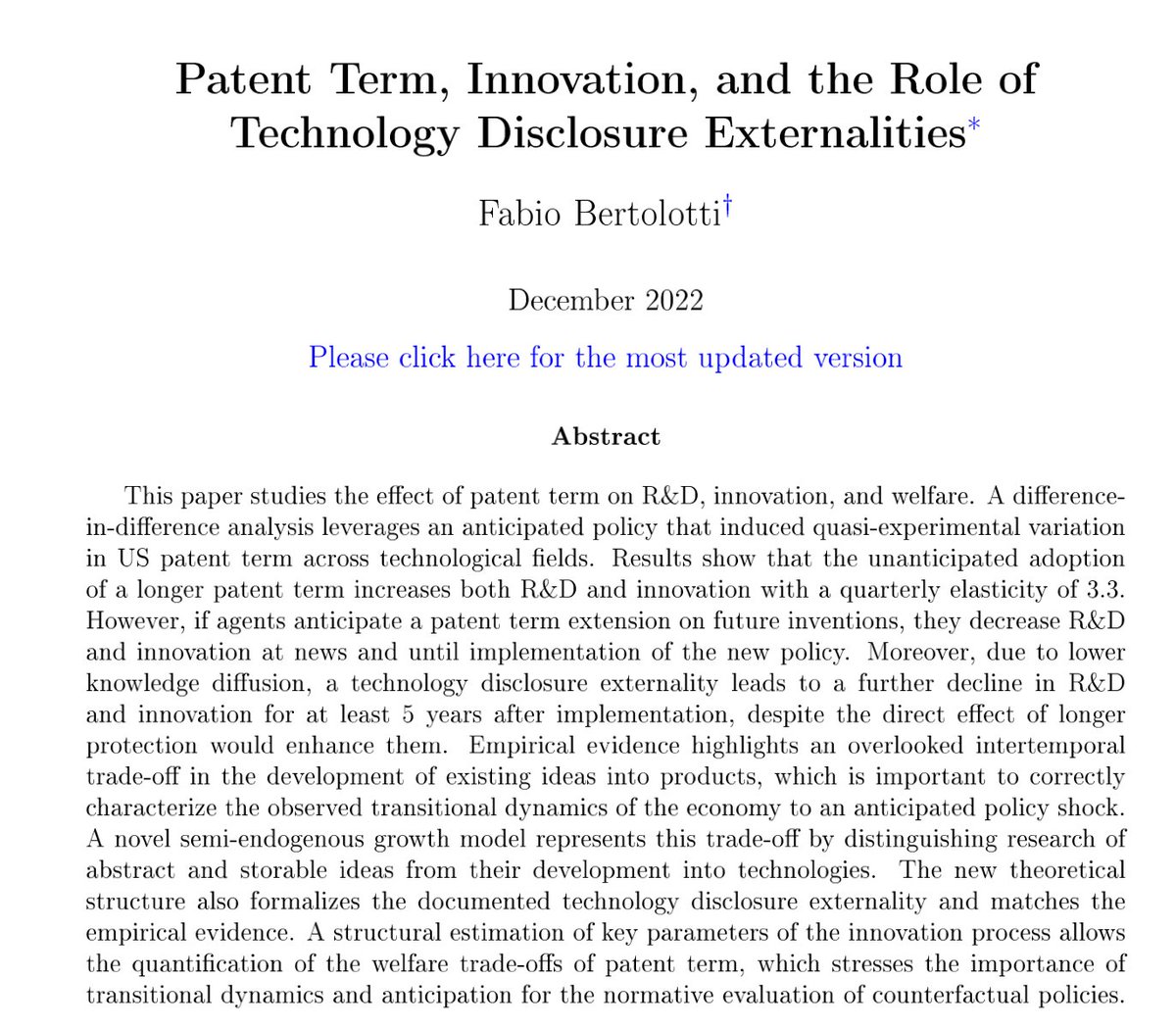

Fabio Bertolotti

@econfaber

Research Economist @bancaditalia. Macro, Innovation, Science. Affiliated to @LISH @Harvard. PhD @LSEEcon.

ID: 1376242406459326468

https://sites.google.com/view/fabiobertolotti 28-03-2021 18:39:00

38 Tweet

280 Followers

417 Following

Had a really great time SED Meeting — among the highlights, I first met Fabio Bertolotti in real life after working with him for 2 years!! Eugene Tan Alessandro T. Villa Vytautas Valaitis

Downward adjustment in demand for durable-goods quality, related to my paper with Alessandro Gavazza and Fabio Bertolotti

4. Fabio Bertolotti's work on the very difficult question of intellectual property investment dynamics in the context of patent terms split.to/CZQRygg

Very excited to be in Cartagena for SED Meeting, hearing from great researchers and presenting new work with Andrea Lanteri on “Capital Replacement and Innovation Dynamics” at the Innovation session, June 29 2.45pm room 10! See you there!

*** Continuation of an academic debate I agree with Olivier Blanchard that price-level determination is at the core of monetary policy and short-run macro. Especially because it is fundamentally different from price-theory classical micro where the price level is indeterminate. 🧵

New CEPR Discussion Paper - DP18869 #Capital Replacement and #Innovation Dynamics Andrea Lanteri Duke University Duke Economics, Fabio Bertolotti Banca d'Italia Ufficio Stampa della Banca d'Italia ow.ly/tpsg50QJbLj #CEPR_MEF, #CEPR_MG #economics

DP19099 Investment-Goods Market Power and Capital Accumulation cepr.org/publications/d… # via CEPR with Andrea Lanteri and Fabio Bertolotti

New CEPR Discussion Paper - DP19099 Investment-Goods Market Power and #Capital Accumulation Fabio Bertolotti Banca d'Italia Ufficio Stampa della Banca d'Italia, Andrea Lanteri Duke University Duke Economics, Alessandro T. Villa ChicagoFed ow.ly/nqRk50S0nFn #CEPR_MEF #CEPR_MG

Developing a method to estimate producers' productivity beliefs in settings where output quantities and input prices are unobservable and using it to evaluate allocative efficiency in the market for science, from Fabio Bertolotti, @kroymyers, and Wei Yang Tham nber.org/papers/w34000