John B. Taylor

@economicsone

Blog:EconomicsOne.com

Website:JohnBTaylor.com

ID: 1403901656

05-05-2013 02:31:34

2,2K Tweet

19,19K Followers

370 Following

On Oct. 5th, the Hoover Institution hosted a policy seminar with William Poole, former President of the St. Louis Fed and Member of the Federal Open Market Committee, moderated by Hoover fellow John B. Taylor. Watch now: hvr.co/3Mf4qjf

Shadow Open Market Committee with special guests John Taylor (John B. Taylor) and Don Kohn Friday November 11 830am-2pm Yale Club NYC or via Zoom RSVP via bulkmail.manhattan-institute.org/w/4RQxuTduyAEW…

John Taylor's Formula for the Fed economicsone.com/2022/11/03/joh… An NPR interview and conversation posted on John B. Taylor

I just saw this... Thanks a lot for retweeting John B. Taylor! I also show how simultaneously accounting for household heterogeneity and people's behavioral biases can help us to understand the current high inflation rates Link to the paper: opfaeuti.github.io/website/BHANK_…

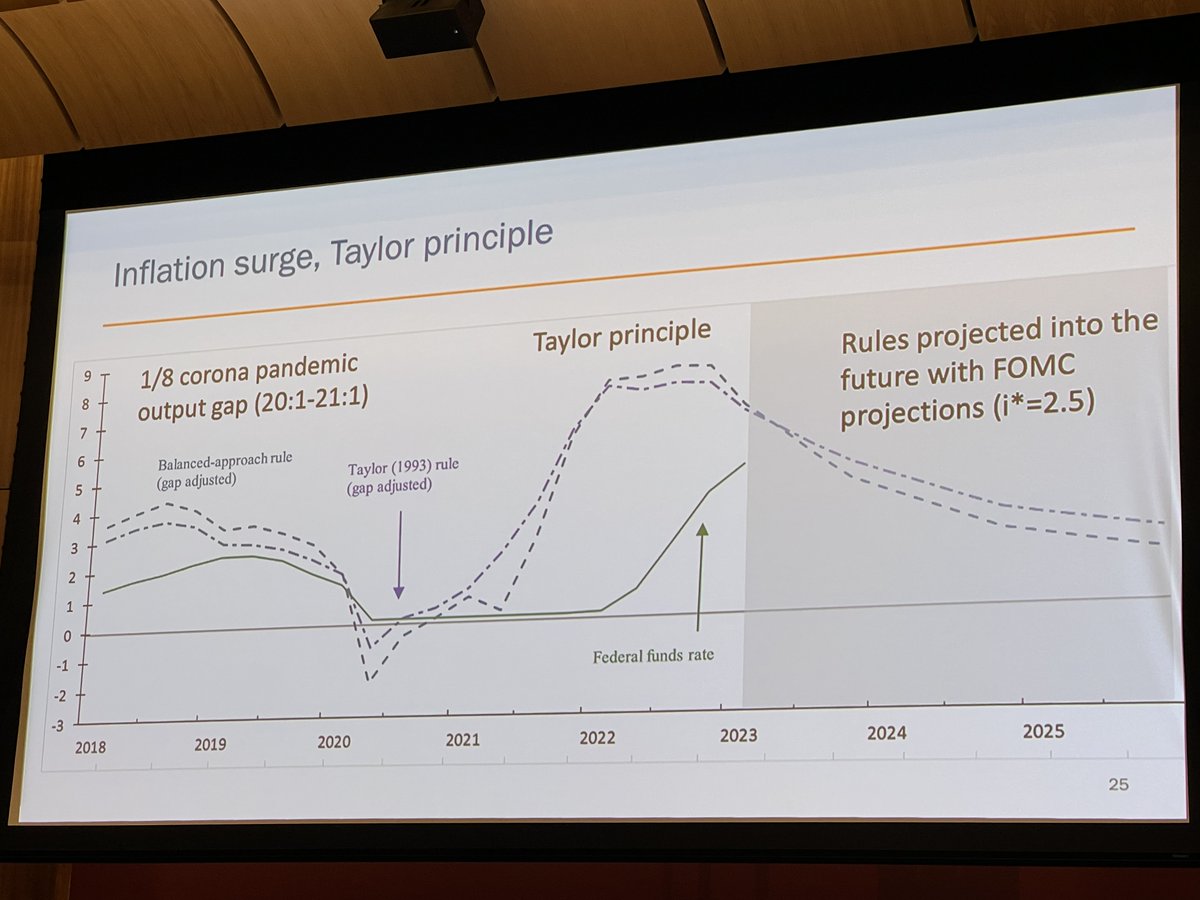

David Sacks John B. Taylor thinks the rate won’t stop at 5% and I tend to agree because inflation is very sticky and takes a while to come down to 2-3% target. Recession started in Q1 already, I think. Just my quick guess..

A Very Big 15-Year Anniversary economicsone.com/2023/02/05/a-v… via John B. Taylor

Great Bloomberg Interview: Now How to Get Back economicsone.com/2023/02/14/gre… via John B. Taylor

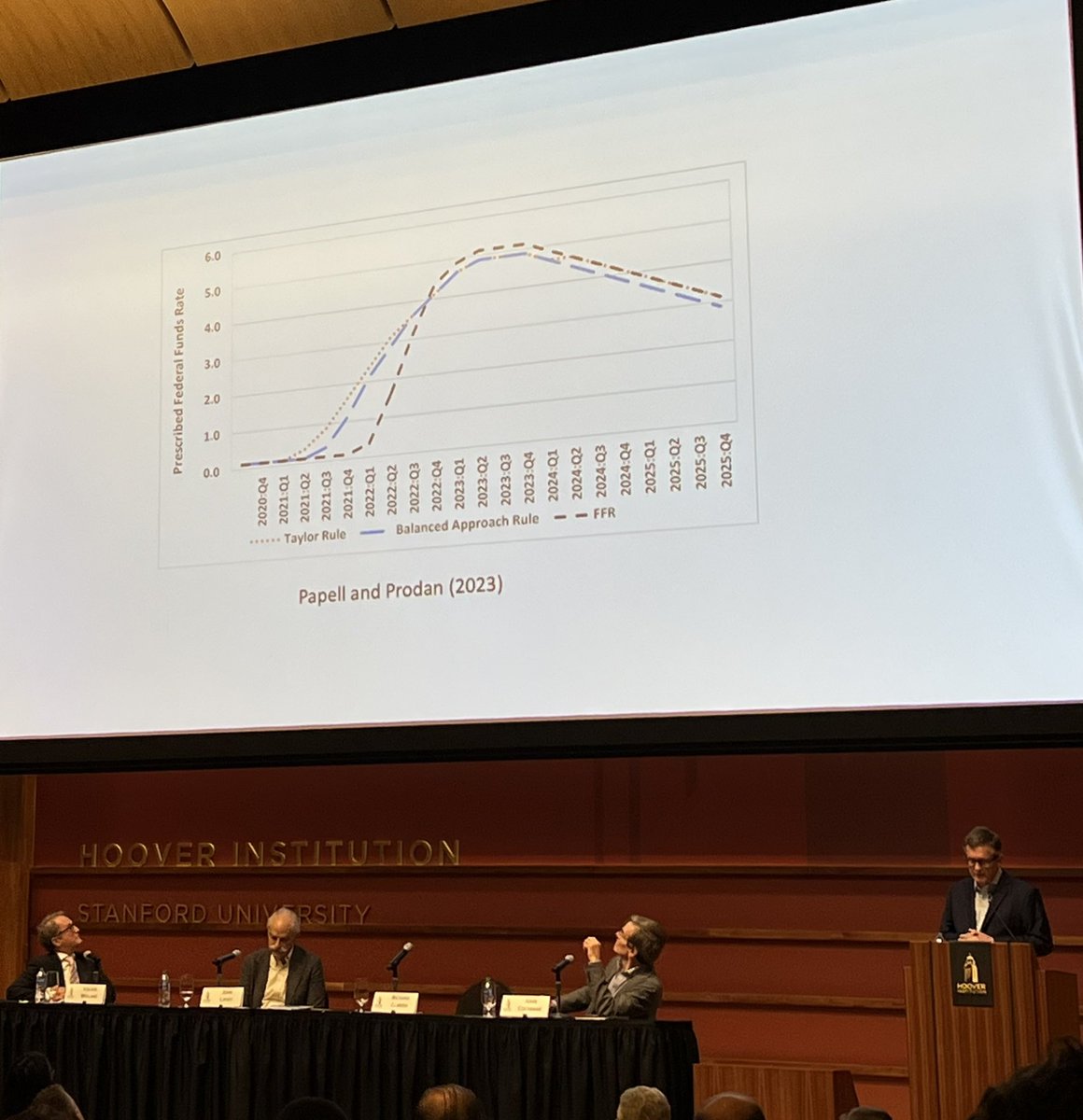

Today is the 13th annual #HooverFedConference organized by John B. Taylor. First session: The 30th Anniversary of the Taylor Rule. John Cochrane, Richard Clarida, John Lipsky, and Volker Wieland offering remarks about the impact and robustness of the Taylor Rule.

I’m looking forward to comparing the tone of this year’s conference to last year’s conference. Last year everyone was emphatic about raising the federal funds rate. This year’s theme is “getting back on track.” (Cc: Hoover Institution)

Thirty years after the Taylor rule was published, Atlanta Fed's website features the Taylor Rule Utility. This Economy Matters articles examines the prime spot in the town square of monetary policy discussions for John B. Taylor, economist John B. Taylor. atlfed.org/3Qsc7Xw

Day 2 of #HISPBC: "Monetary rules provide guidance and accountability for central bank officials. When adopted, rules result in more predictable policy outcomes," say Hoover fellow John B. Taylor.