GammaSwap 👽

@gammaswaplabs

Trade perpetual options, hedge IL and earn yield on synthetic tokens that provide onchain liquidity (coming soon) | discord.gg/gammaswaplabs

ID: 1531385369463345155

http://gammaswap.com 30-05-2022 21:22:27

1,1K Tweet

26,26K Followers

203 Following

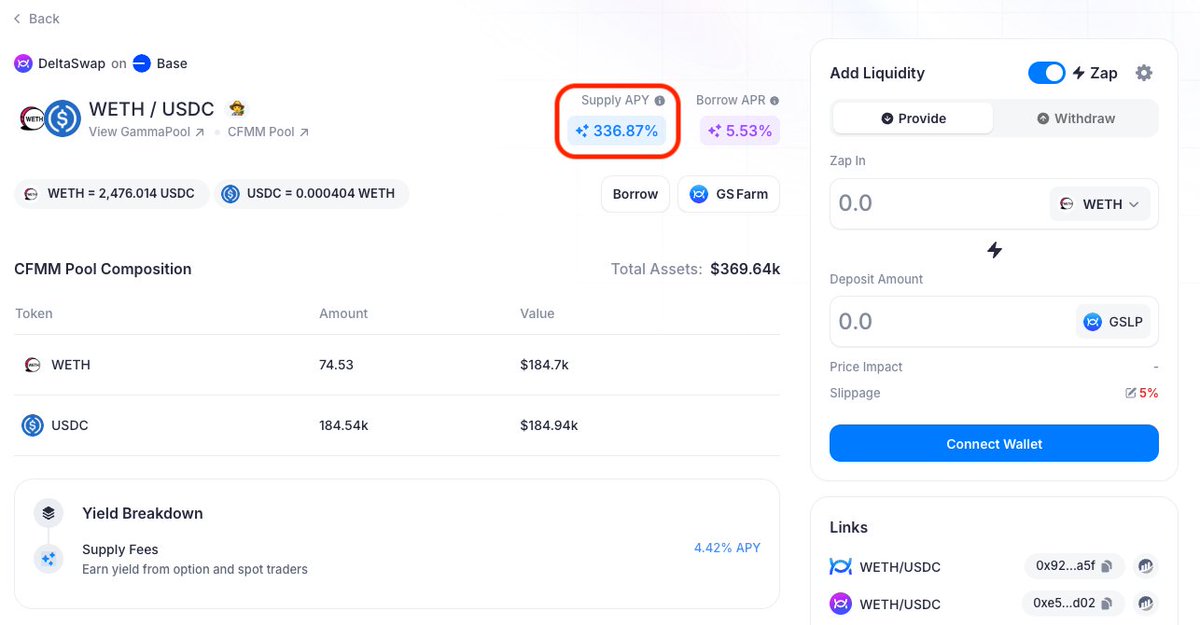

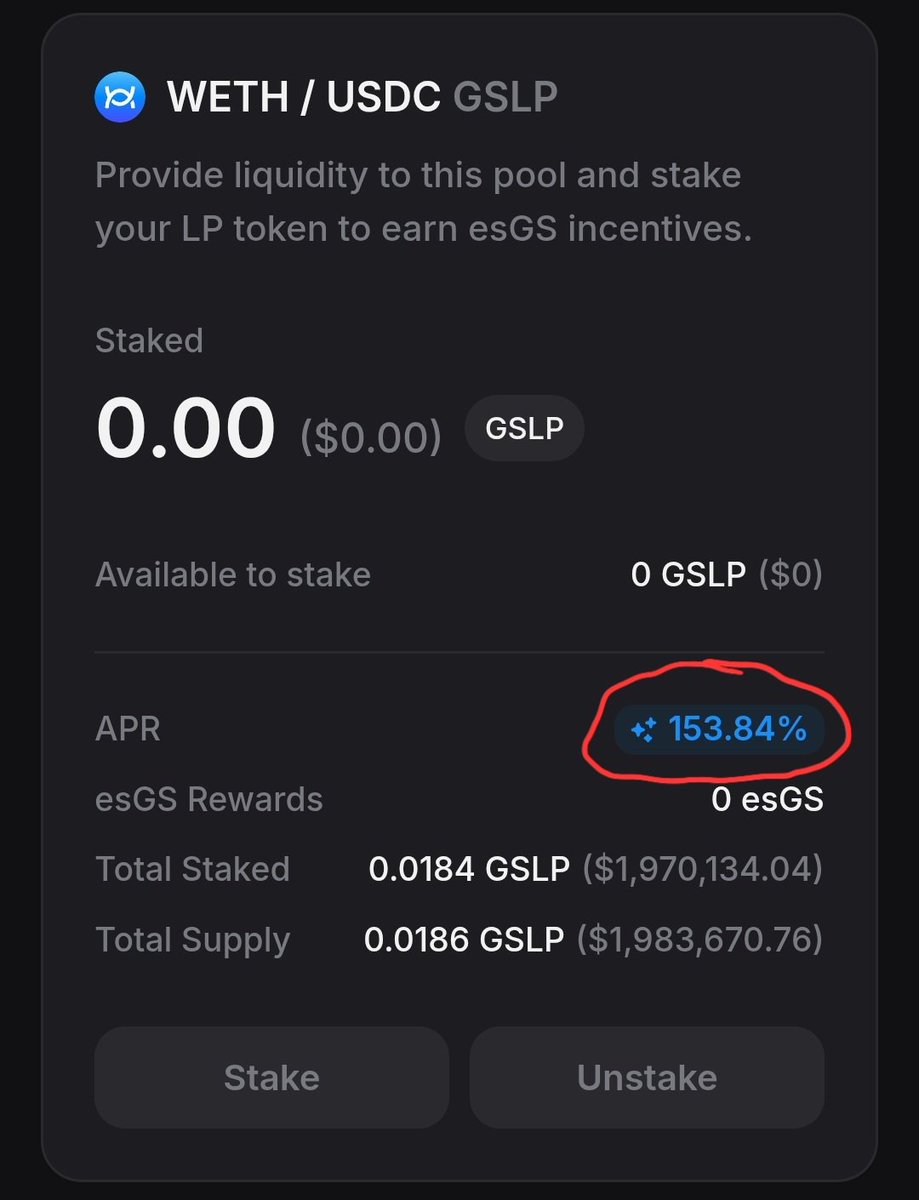

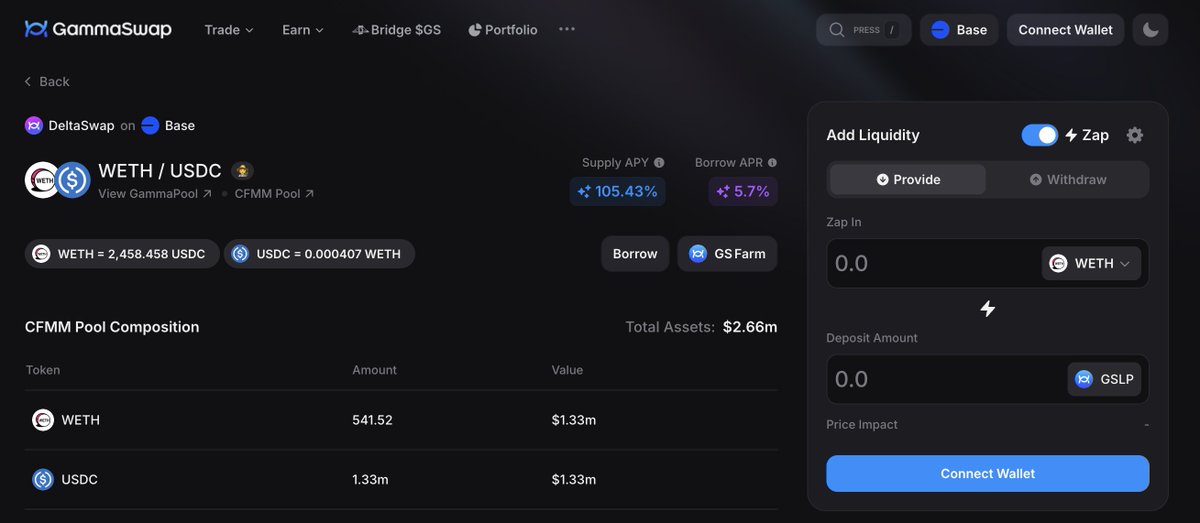

GammaSwap Summer is live now with Phase 1! 4 weeks of 1M in weekly esGS Liquidity Mining incentives for the WETH/USDC pool on Base GammaSwap 👽

When GammaSwap 👽 yield tokens on concentrated liquidity positions for tokenized stocks? Hold Tesla stock yielding 20% - 40% with no IL. Is this possible DeFi Devin?

The GammaSwap 👽 Yield Token is right around the corner gETH is estimated to have 15-25% APR (Like Ethena basis trade but using Concentrated Liquidity AMM yield and hedging the IL) To hedge the IL for clAMM they need more liquidity for full range v2 LPs for WETH/USDC and are

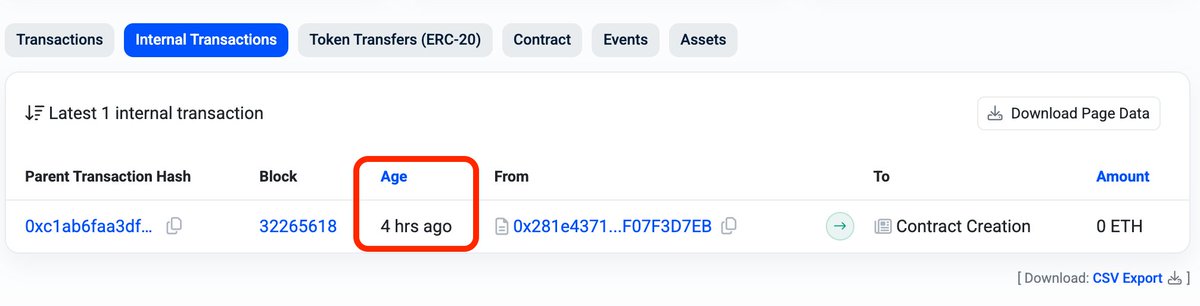

1️⃣ Final version of gETH deployed on Base today. Just setting up UI now 2️⃣ GammaSwap Summer incentives started today 3️⃣ Already 2M in TVL added to WETH/USDC pool on Base with ~115% in APY still Bullish GammaSwap 👽

GammaSwap is launching an incentive program to build liquidity for its yield token launch. You can now earn 105% APY on WETH/USDC without Impermanent Loss! It's time to enjoy summer while earning money with GammaSwap 👽.

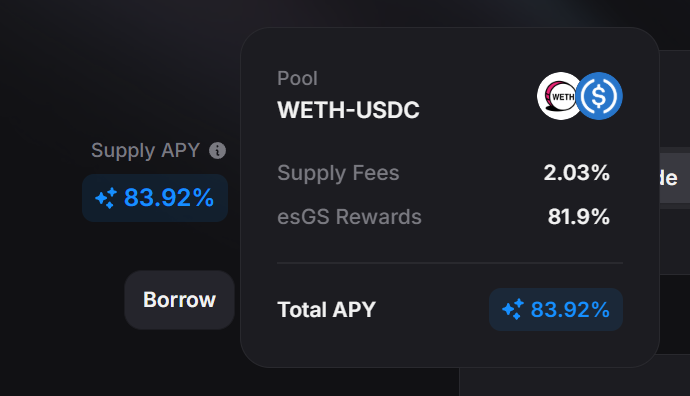

83.92% APY on GammaSwap 👽's WETH-USDC pool. This is by far the best yield on v2-style exposure for 'blue-chip' pairings. Unfortunately the so-called 'bluechips' are USD (horrible currency) and ETH (horrible currency)

From 800k in TVL in WETH/USDC yesterday to almost 5M in TVL today GammaSwap 👽 summer is off to a hottt start 😩

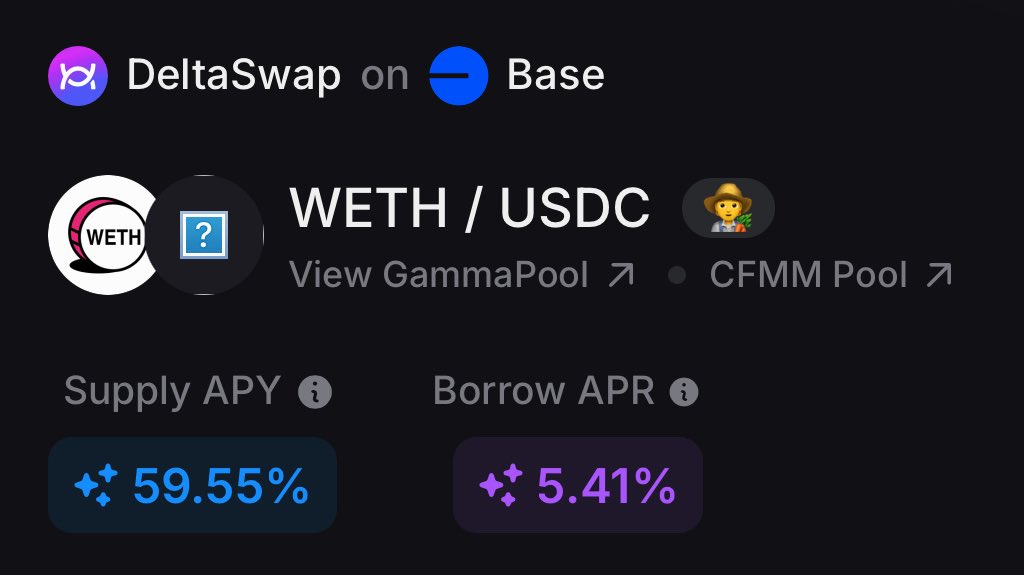

Market pumping, resting & enjoying vacation, farming top tier yields on GammaSwap 👽 Life is gud ☀️ Pools available below 👇

.Sam Battenally is right on the money. Providing liq is like selling a perpetual option straddle. It is clunky to execute with a trad option bc of the expiration and difference in delta. In GammaSwap, you can hedge the IL by borrowing from the AMM perpetually Guide below 👇

I would say there's almost zero protocol incentivizing LPs for CPMM nowadays. But it's actually happening on GammaSwap 👽 with ETH-USDC pair: ✅ "Lazy LPing" (just Lping and forget, no monitoring required) ✅ No out-of-range threat ✅ Low IL ✅ Auto-compound ✅ Earn $GS -

gETH from GammaSwap 👽 is yield bearing ETH. The yield is the real interest rate in crypto based on demand for liquidity

My favorite team GammaSwap 👽 keeps shipping +Aura vibes like this squad of rowers. They’re offering juicy incentives — 46% APY on their LP pool. I’ve been thinking hard about delta-neutral strategies, and DeFi Devin himself shared a simple setup that delivers 37.98% APY