Gandalf

@gandalfwizz

Numbers don’t lie

ID: 1338819979043622912

15-12-2020 12:15:53

3,3K Tweet

4,4K Followers

637 Following

🧐🧐🧐 Well look at that....somebody gettin' ready to spill some tea??? #discovery $MMTLP $MMAT $TRCH Meta Materials Inc. (META®) George Palikaras Wes Christian

NHL Public Relations Just Did What FINRA or the SEC Wouldn’t… After being indefinitely suspended by the NHL for “unacceptable and inappropriate” posts, the “high-frequency hockey bro” has vanished from social media. (Guess we finally found a circuit breaker he couldn’t override.) Thank

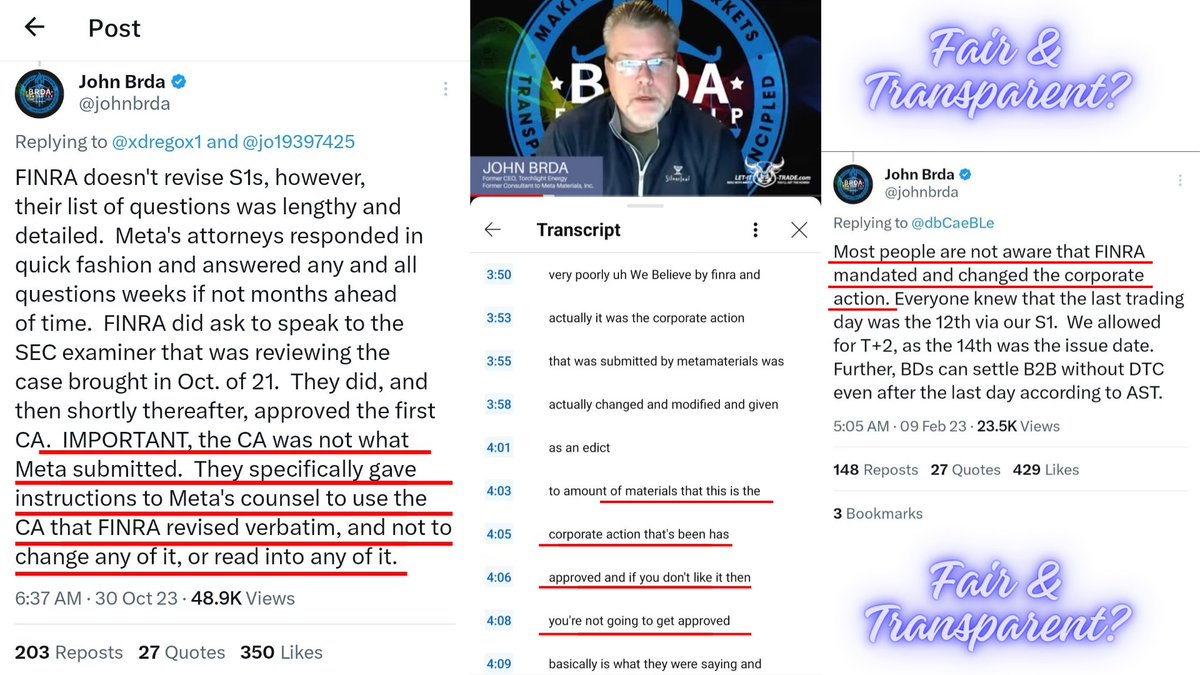

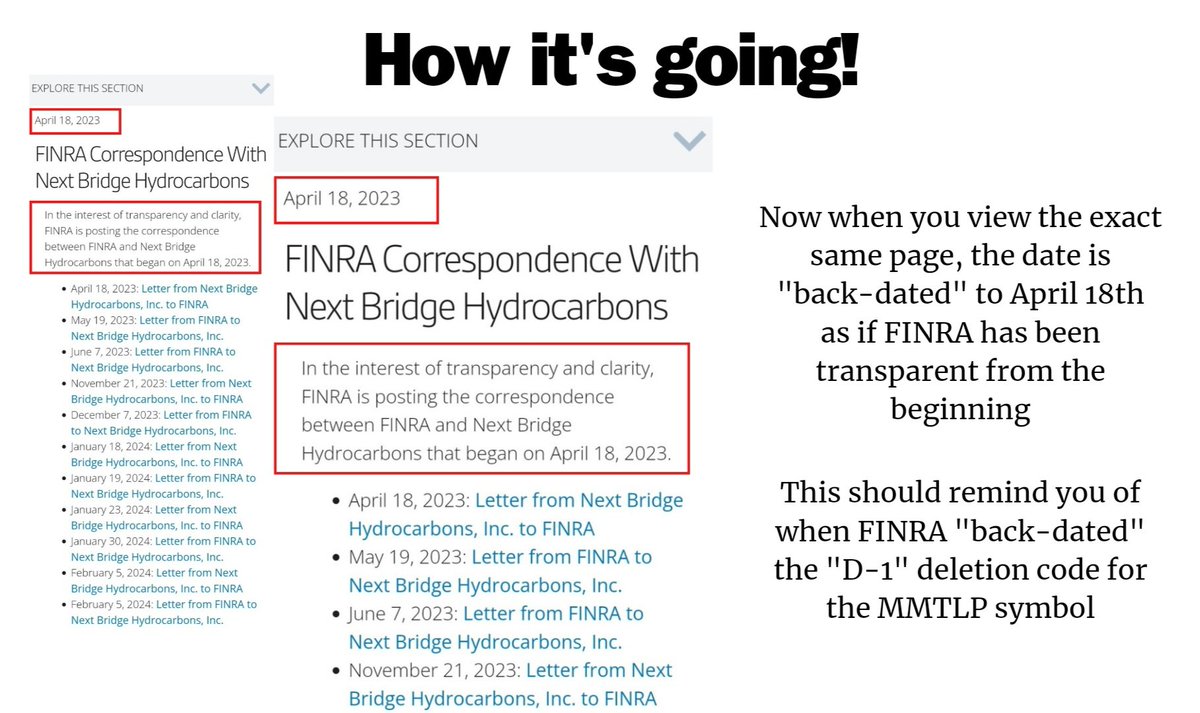

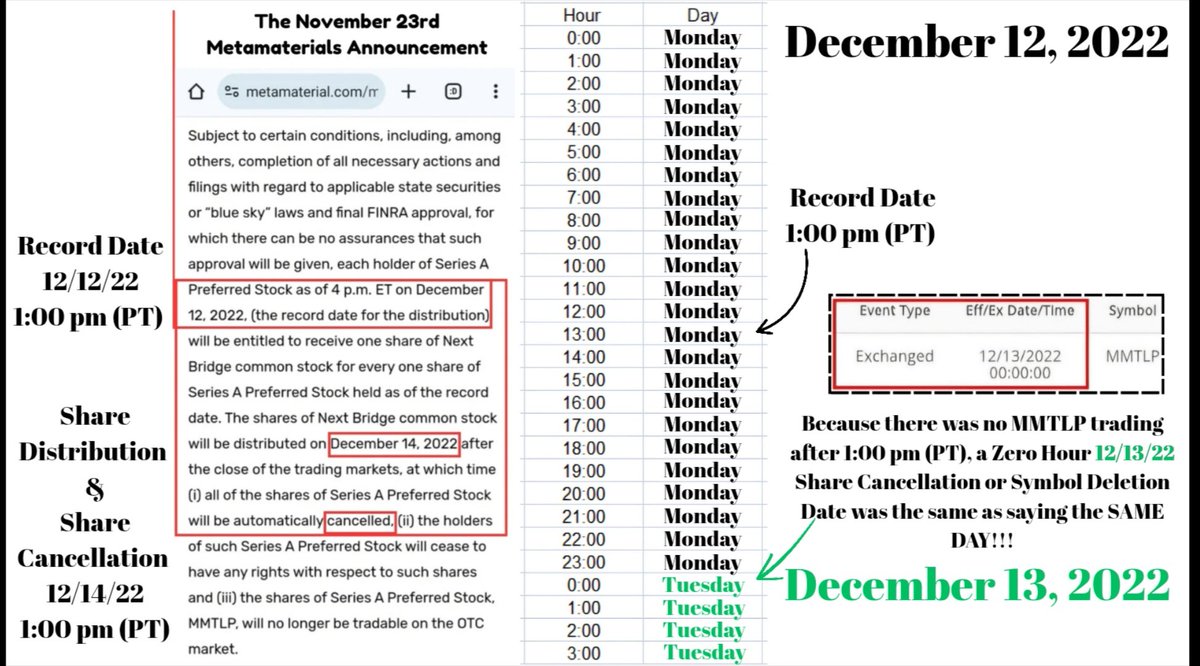

Take a moment to recognize the fraud on behalf of FINRA! FINRA's $MMTLP Corporate Actions placed the focus on the Zero hour of 12/13/22, when the focus should've been on 12/14/22, after Market Close. This removed two full (Market) days of settlement!!! DOGE SEC U.S. Securities and Exchange Commission FBI

1/10 Thank you Dennis Kneale for your timely article backed by the March 2025 research working paper "Reg SHO at Twenty". I read the 81-page paper by John W. Welborn, PhD in Economics, who works at Dartmouth University. He is a well-published academic with a proven track record

Hey Dr. Phil — there’s a real truth no one wants to talk about: captured regulators like FINRA and U.S. Securities and Exchange Commission are enabling billions of counterfeit, sold-but-not-purchased “securities” to flood our markets. These naked short positions artificially drive down company valuations, hurt