Gideon Bornstein

@gidibo

Economist. Assistant Professor of Finance at @Wharton

ID: 2651390018

http://www.gideon-bornstein.com/ 16-07-2014 15:33:42

70 Tweet

365 Followers

134 Following

New research shows that informal borrowing and lending relationships between firms greatly enhance the liquidity of modern financial systems, but they can also make them more fragile, from Luigi Bocola and Gideon Bornstein nber.org/papers/w31026

Excited to see the NC #MedicaidExpansion pass! My work with Gideon Bornstein finds expanding Medicaid significantly improves peoples' financial health---and it can even crowd *in* the supply of credit by making people more financially resilient

The SED is super exciting this year which is why I put together the best of all sessions 😝! Come for Simon Mongey & Mike Waugh and Dan Greenwald 🇺🇦, stay for my brand new project with Gideon Bornstein: we show how high market power firms exacerbate consumption inequality!

How does changing social insurance programs, like Medicaid, affect household debt? Gideon Bornstein and I find borrowing can *increase* when insurance makes consumers more financially resilient! Thanks for the chance discuss this research on The Wharton School's new podcast Ripple Effect 👇

We’re hiring pre-docs! Gideon Bornstein, Sergio Salgado, and I are accepting applications for a full-time pre-doc. Work alongside us at The Wharton School on research in macroeconomics, household finance, and inequality. Priority deadline is *Nov. 26* Apply: wd1.myworkdaysite.com/en-US/recruiti…

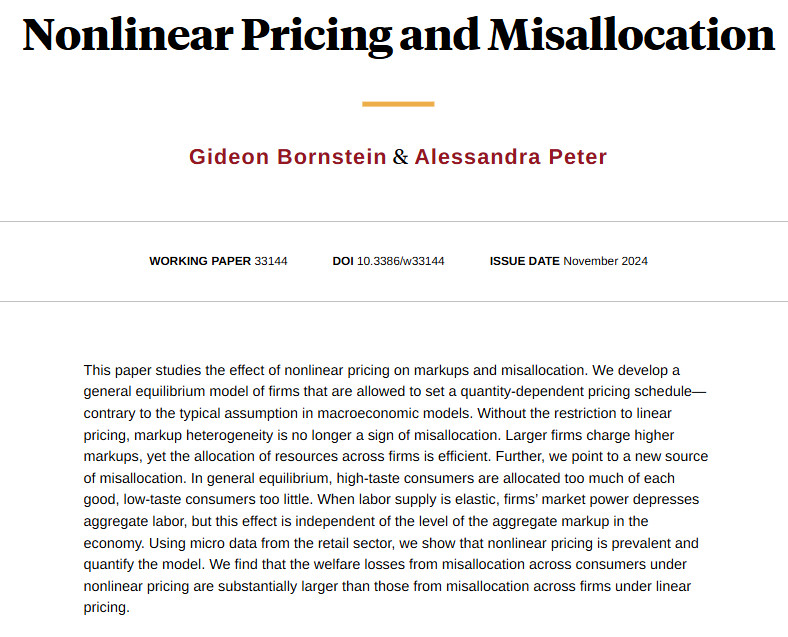

New CEPR Discussion Paper - DP19672 Nonlinear Pricing and Misallocation Gideon Bornstein Gideon Bornstein Penn The Wharton School, Alessandra Peter Alessandra Peter New York University ow.ly/EzQY50U5otc #CEPR_MG #economics

Think quantity discounts only make you end up with expired painkillers? Our 🚨new and revised paper🚨 shows how in general equilibrium, they overturn classic results on misallocation across firms and across consumers. Gideon Bornstein 🧵

Great paper by Alessandra Peter and Gideon Bornstein conditionally accepted at American Economic Review. I agree with the paper of the year (though, admittedly I’m biased 🙃)