Gina Martin Adams

@ginamartinadams

Gina Martin Adams, CFA, CMT, is the Chief Equity Strategist for Bloomberg Intelligence, a division of Bloomberg LP, and is based in New York, NY.

ID: 847552460197568513

30-03-2017 20:53:48

1,1K Tweet

20,20K Followers

783 Following

To illustrate just how nonsensically these tariffs were calculated, take the example of Lesotho, one of the poorest countries in Africa with just $2.4 billion in annual GDP, which is being struck with a 50% tariff rate under the Trump plan, the highest rate among all countries on

Episode Title🇺🇸High Stakes: The Poker Game of Global Markets & Economic Power🇺🇸 💵 ℙ𝕠𝕨𝕖𝕣𝕗𝕦𝕝 𝕎𝕠𝕞𝕖𝕟 𝕚𝕟 𝕎𝕒𝕝𝕝𝕤𝕥𝕣𝕖𝕖𝕥 & 𝕄𝕠𝕟𝕖𝕪💵series #HeadsTalk Gina Martin Adams Chief Equity Strategist Bloomberg Bloomberg Bloomberg Markets Bloomberg Economics podcasts.apple.com/gb/podcast/hea…

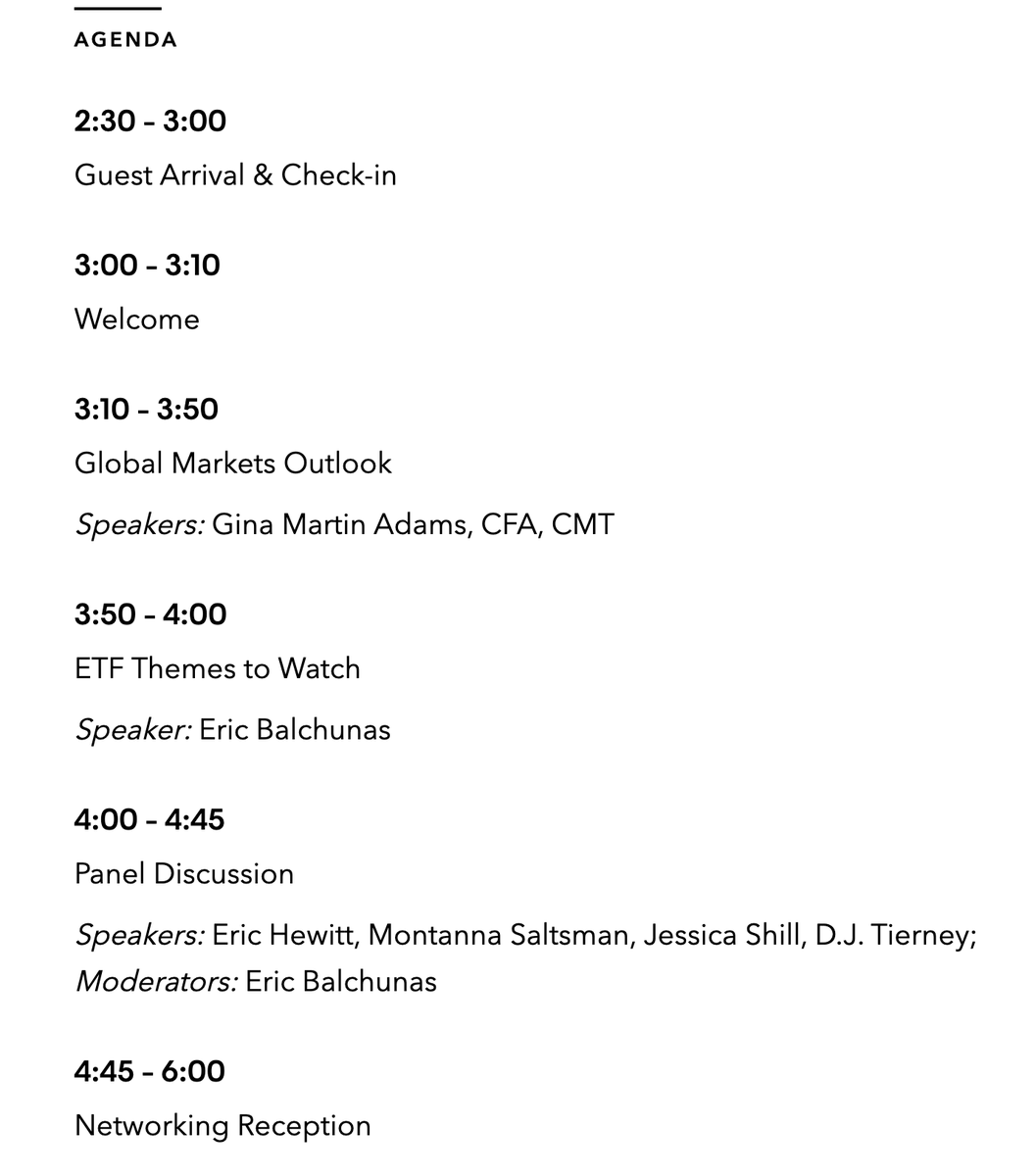

FYI, we are hosting an ETF/macro event in Denver tmrw (Thur) at 230pm feat presentations from Gina Martin Adams and myself and a panel with Janus, Schwab and ALPS. Agenda below. Register here: go.bloomberg.com/attend/invite/…