Hellenic Bank Economics

@hb_economics

Economic news and analysis from Hellenic Bank’s Economic Research Team. Follow us to stay a step ahead as our team tries to make sense of the Cyprus economy.

ID: 1024021694162382850

http://www.hellenicbank.com/portalserver/hb-en-portal/en/about-us/who-we-are/overview/economic-research 30-07-2018 19:59:32

67 Tweet

524 Followers

1,1K Following

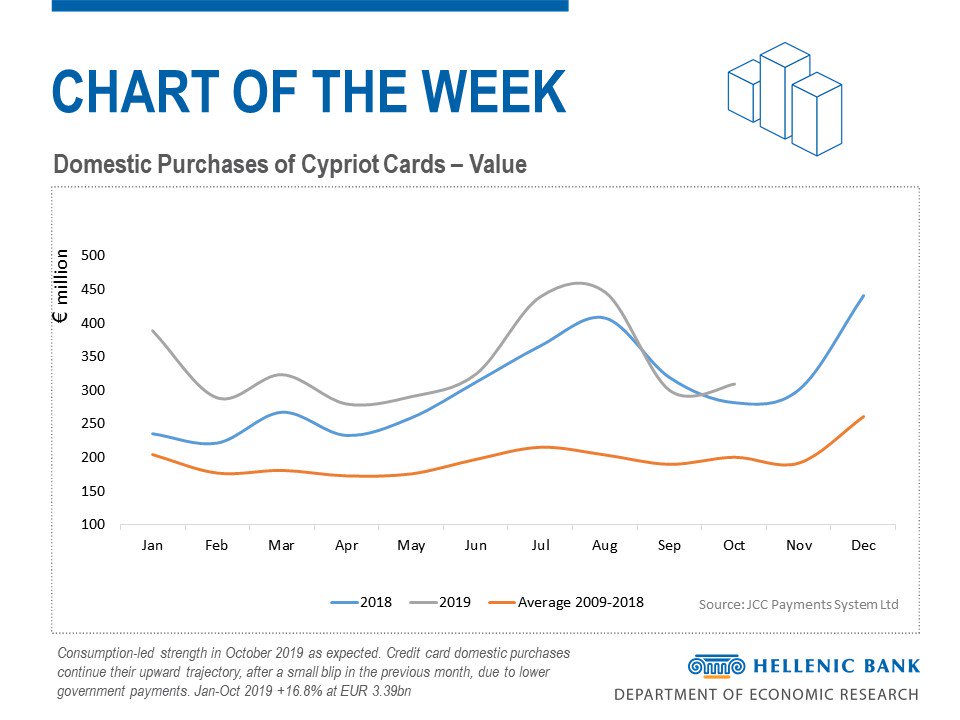

#Cyprus #creditcard transactions in August rose 6%, reflecting steady consumer confidence while tax & online payments to the state played a part in the upswing #FMcy Cyprus Business🇨🇾🇪🇺 Hellenic Bank Economics Cyprus Reporter 99% SIM Fiona Mullen financialmirror.com/news-details.p…

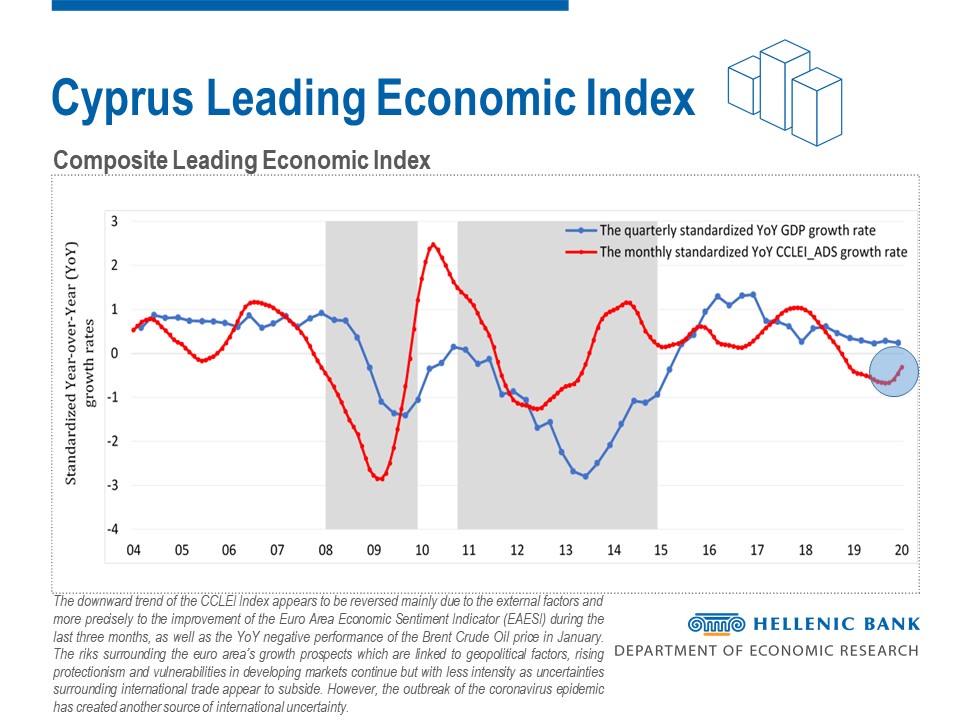

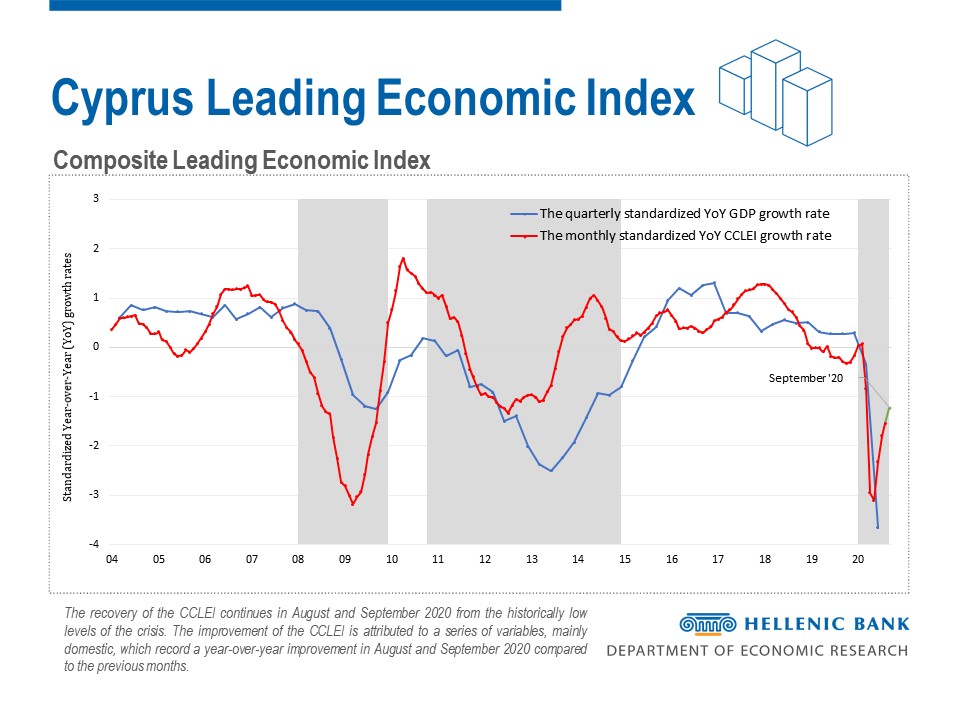

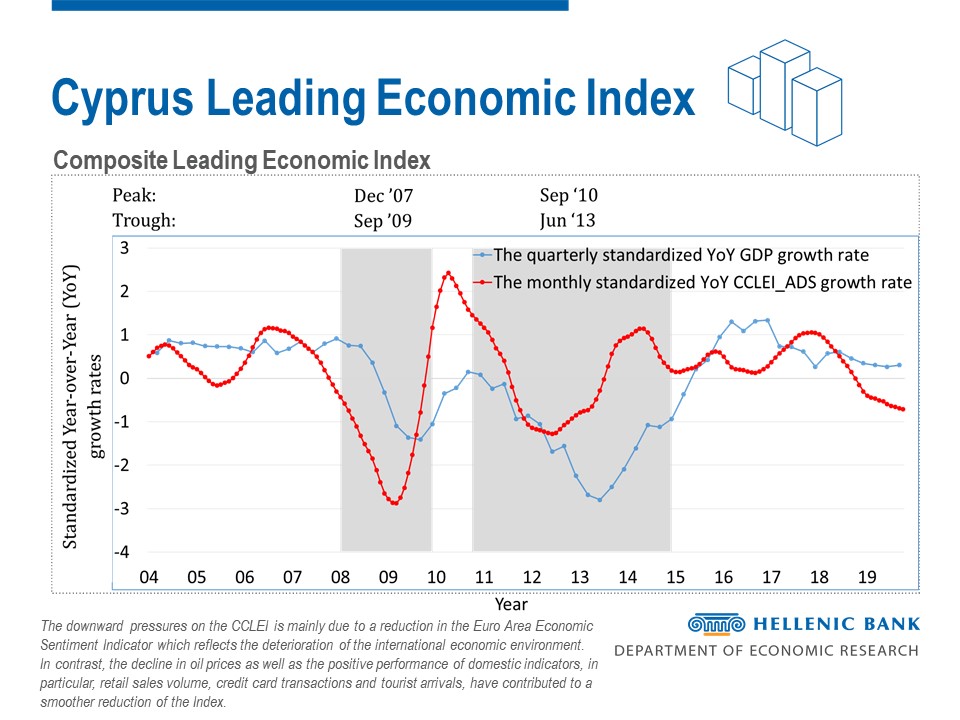

We are excited to announce the collaboration of Hellenic Bank with the University of Cyprus University of Cyprus (Economic Research Center) for the construction of a national economic leading indicator. The index is designed to provide early signals of turning points in business cycles

Dont miss out today's publication of the "The Cyprus Composite Leading Economic Index" #Cyprus #Economy with University of Cyprus Hellenic Bank

"From the closing to the gradual restart of the economy" Cyprus Economy #Cyprus #Economy University of Cyprus Hellenic Bank

Κέρδος €50,5 εκατ. μετά τη φορολογία για την Ελληνική Τράπεζα #economy Hellenic Bank Hellenic Bank Economics brief.com.cy/etairika-nea/k…

Despite uncertainty of the #COVID19 #pandemic, Hellenic Bank announced a 19% increase in first half profits in #Cyprus to €21 mln, from €17.7 mln in the same period last year, with CEO Oliver Gatzke describing it as “solid performance”. financialmirror.com/2021/09/24/hel… Hellenic Bank Economics