IEEFA Europe

@ieefa_europe

Global think tank working to accelerate the #energytransition through economic and financial analyses.

Global account 👉 @ieefa_Institute

ID: 1567168955780931585

http://IEEFA.org 06-09-2022 15:13:20

257 Tweet

319 Followers

213 Following

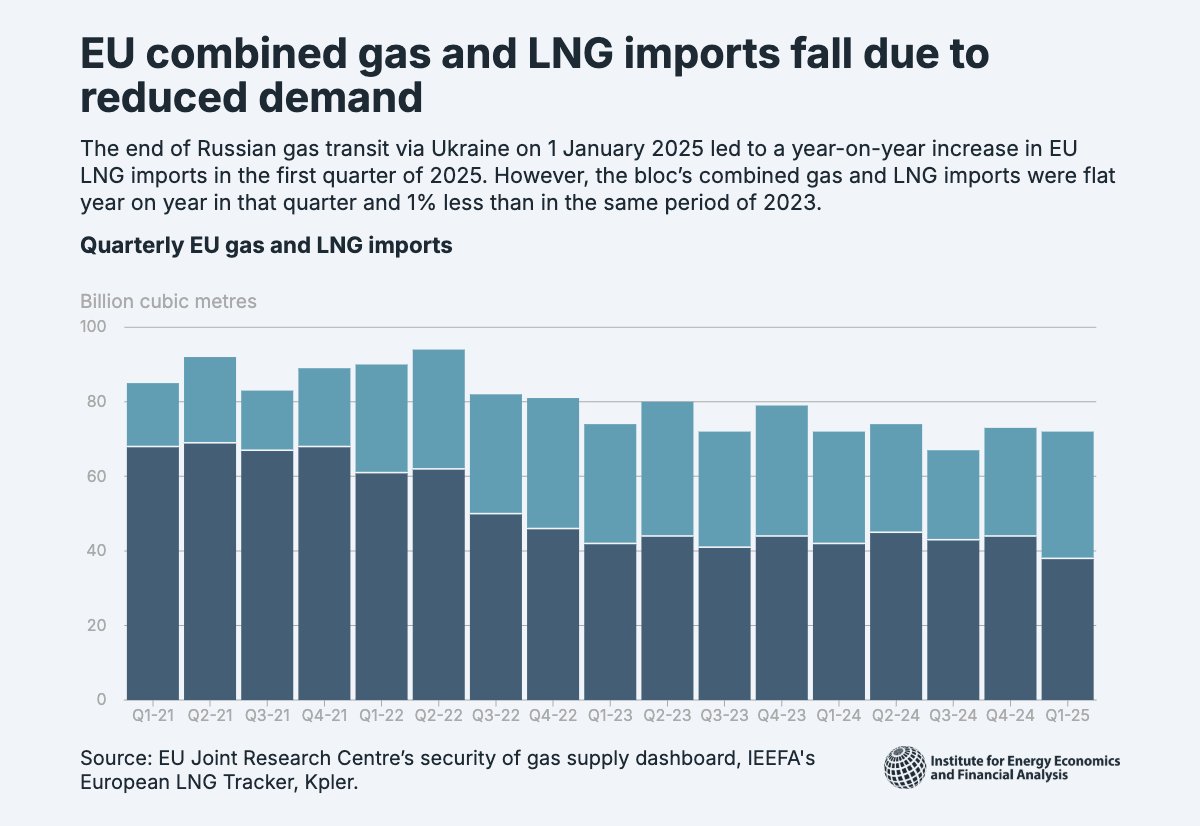

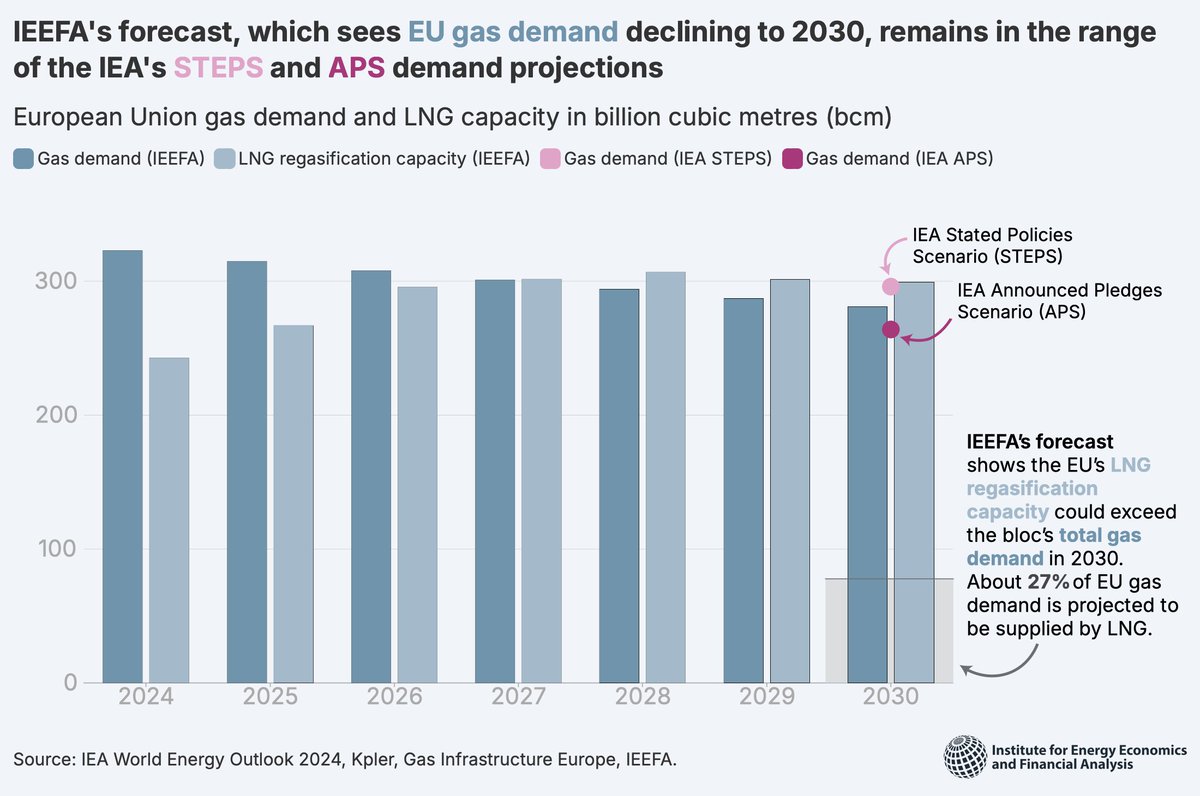

The International Energy Agency World Energy Outlook 2024 #WEO2024 is out today. 🎯 IEEFA’s EU gas demand forecast remains in the range of the IEA's STEPS and APS demand projections. 👉 Explore all our data about European LNG: ieefa.org/european-lng-t… Ana Maria Jaller-Makarewicz

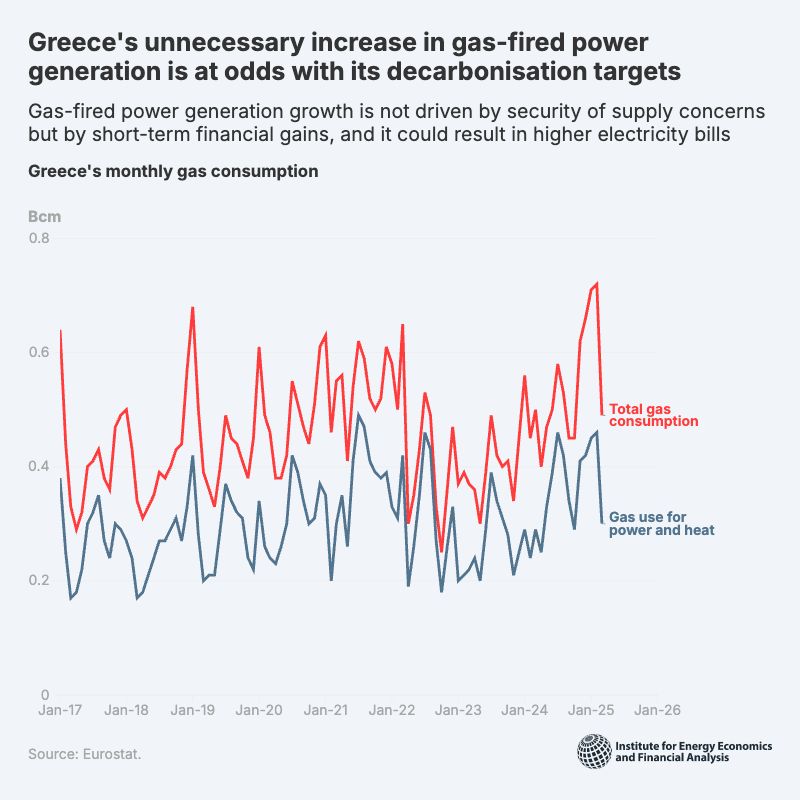

Long-term #LNG deals create significant financial and regulatory risks and will not guarantee the security of energy supply that the #EU urgently needs, writes Ana Maria Jaller-Makarewicz. Italian energy company #Eni has secured a 20-year deal to purchase 2 million tonnes per annum (around

Greece increased its dependence on natural gas - Monthly consumption at an 8-year high last February IEEFA: Η Ελλάδα αύξησε την εξάρτησή της από το φυσικό αέριο - Σε υψηλό 8ετίας η μηνιαία κατανάλωση τον περασμένο Φεβρουάριο IEEFA Europe energypress.gr/news/ieefa-i-e…