The Exploited TaxPayer

@indianewgen

We raise practical issues of the Middle class.

We decode & explain taxation in simpler terms.

Posts on personal finance, corporate, politics, people & society.

ID: 1461605451724775424

19-11-2021 08:01:39

27,27K Tweet

32,32K Followers

1,1K Following

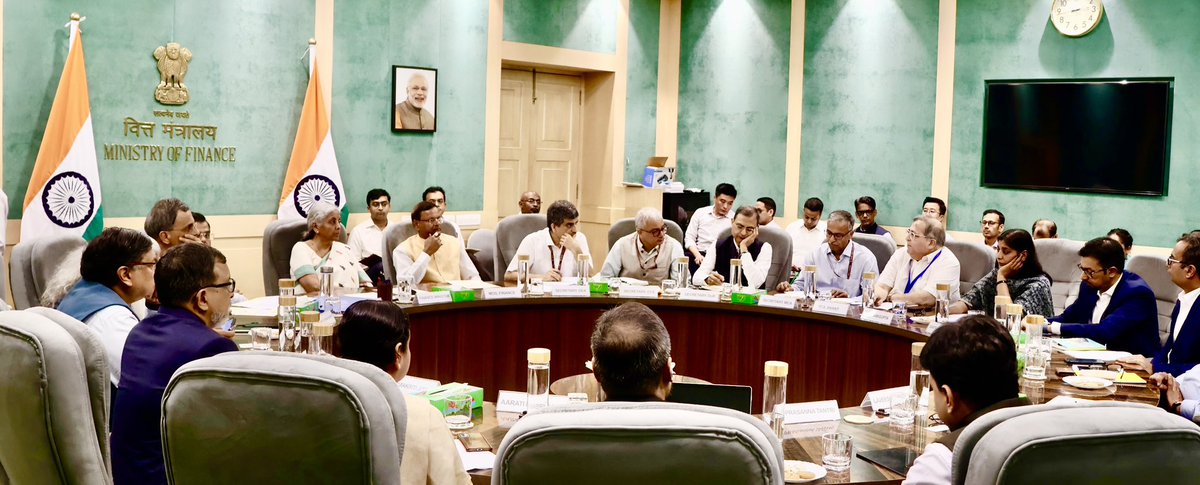

जितना tax इस साल दिया, उतने बचाने में 6 महीने लगेंगे। काम करने का motivation लाएं तो कहां से? Narendra Modi PMO India Income Tax India Nirmala Sitharaman Nirmala Sitharaman Office