Ingo Payments

@ingopayments

We power instant account funding, transfer, payout and account issuing solutions for banks, fintechs and brands.

ID: 25056020

http://ingopayments.com 18-03-2009 11:00:17

3,3K Tweet

3,3K Followers

845 Following

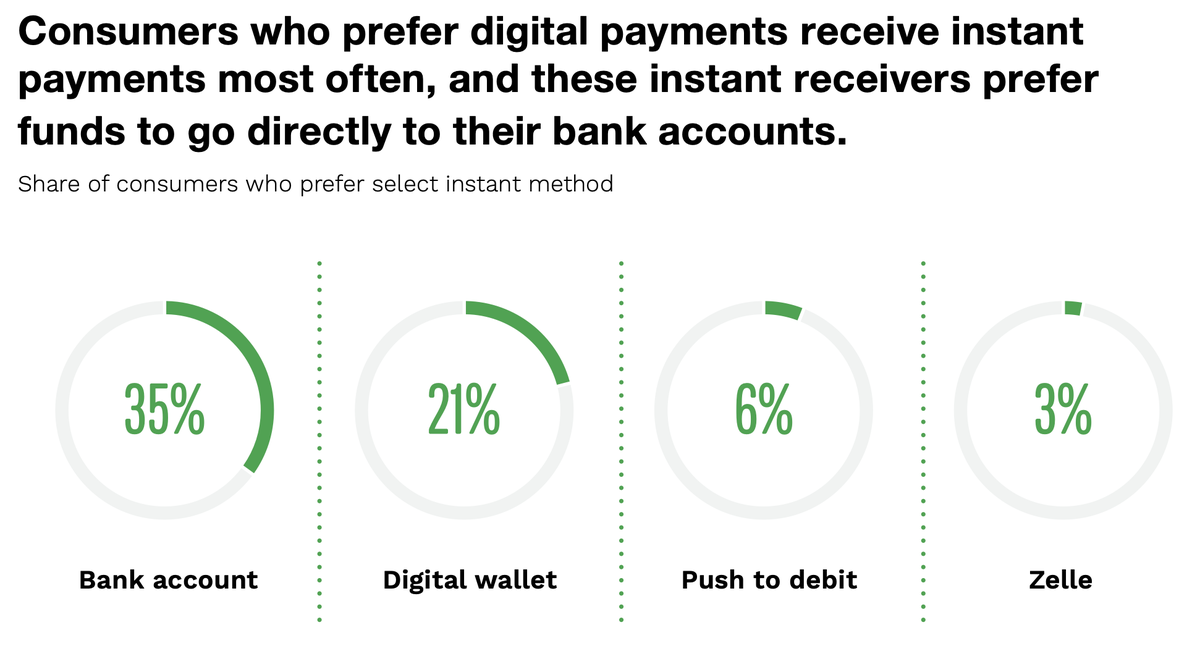

Direct to bank still rules the money game. 35% of instant payment fans want funds straight to their accounts, with digital wallets gaining ground at 21%. Our new research with Ingo Payments reveals why consumers are willing to pay extra for 30-minute transfers and what's

INSTANT GAINS: SMBs receiving ad hoc payments via instant methods jumped to 32% in 2024—a 60% increase from last year. Our latest Money Mobility Tracker® with Ingo Payments reveals how digitally-advanced sectors gain crucial cash flow advantages while others struggle with

We're thrilled to share that Ingo Payments is a finalist for "Best Embedded Payments Solution" at the Banking Tech Awards USA 2025 from FinTech Futures! This nomination speaks volumes about our relentless commitment to reimagining financial experiences for everyone. Why

🗽 Fueling up on bagels and fintech—we're hitting the ground running at Empire Startups's NY FinTech Week! 🥯 Next week, Ingo's very own Anita Hayrapetian will be in the big apple, diving into the latest fintech innovations, compliance trends, and embedded banking breakthroughs