Mike Singleton, CFA

@invictusmacro

Senior Analyst at Invictus Research | Check out our FREE Macro Handbook at manage.kmail-lists.com/subscriptions/…

ID: 1442539492582166536

http://invictusresearch.ai 27-09-2021 17:20:15

3,3K Tweet

5,5K Followers

557 Following

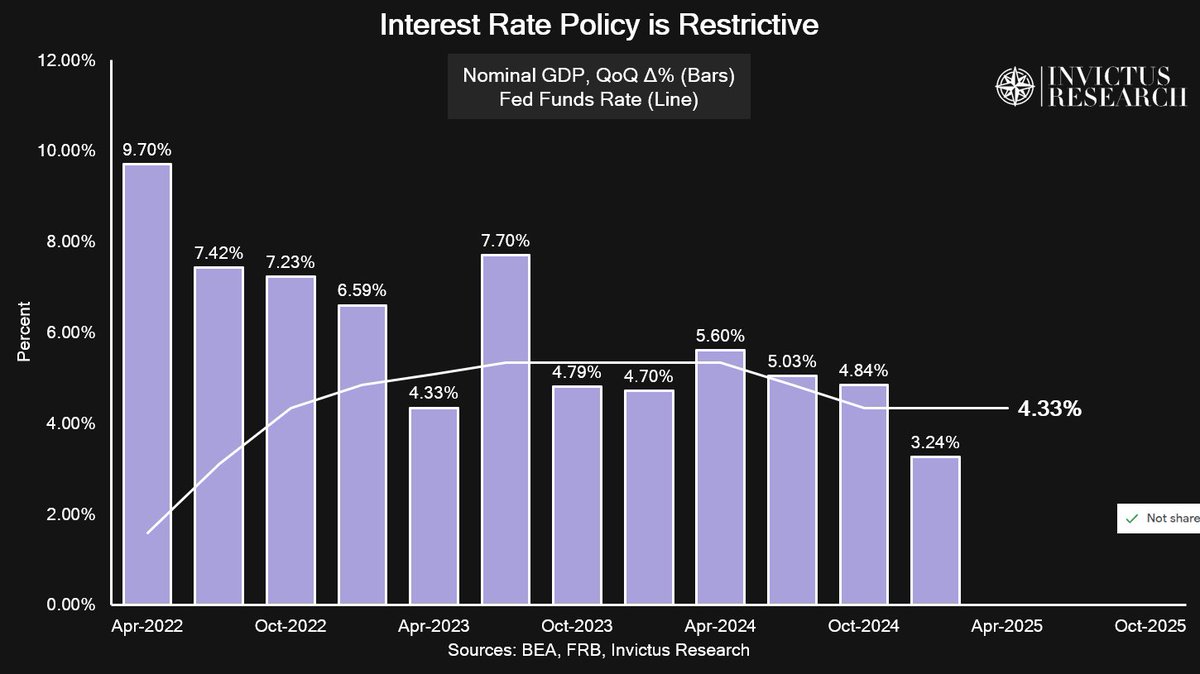

Industrials, Gold, and Bitcoin: How Mike Singleton (Mike Singleton, CFA) Is Positioning for the Second Half of 2025 financialsense.com/podcast/21343/…