Junior Mining Insights

@jmi_newsletter

A Newsletter that focuses on Exploring the Explorers #mining #exploration #gold #silver #copper #lithium #investing

ID: 1747572191405694976

https://www.linkedin.com/build-relation/newsletter-follow?entityUrn=7084151325373911040 17-01-2024 10:52:12

492 Tweet

287 Followers

1,1K Following

El Perdido Project: Unveiling a Promising Copper-Gold-Moly Porphyry System Dr Ryan D. Long $KBX.CN $KBXFF #Copper #Copperstocks #Argentina #ResourceInvesting #JuniorMining #mintwit #MiningStocks #Mining

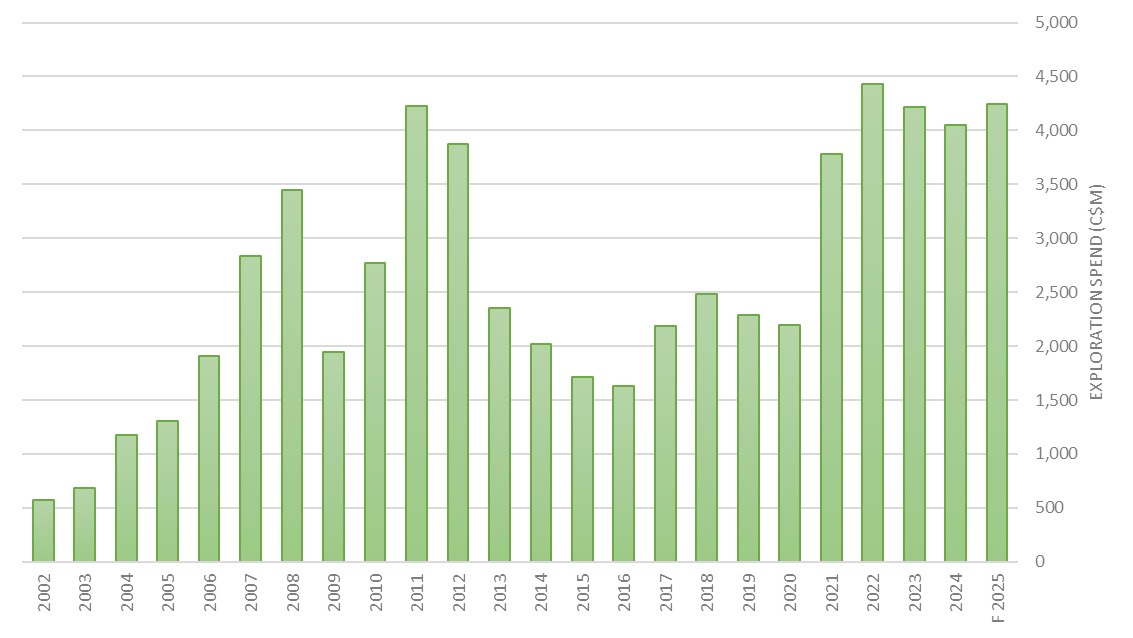

Mining and Metals Research Corp. #Ontario and #Quebec have consistently dominated exploration spend due to their geological richness, established infrastructure, and supportive policies, capturing 44% of total spending between them since 2002. 2025 could see pivotal shift between the two big players in

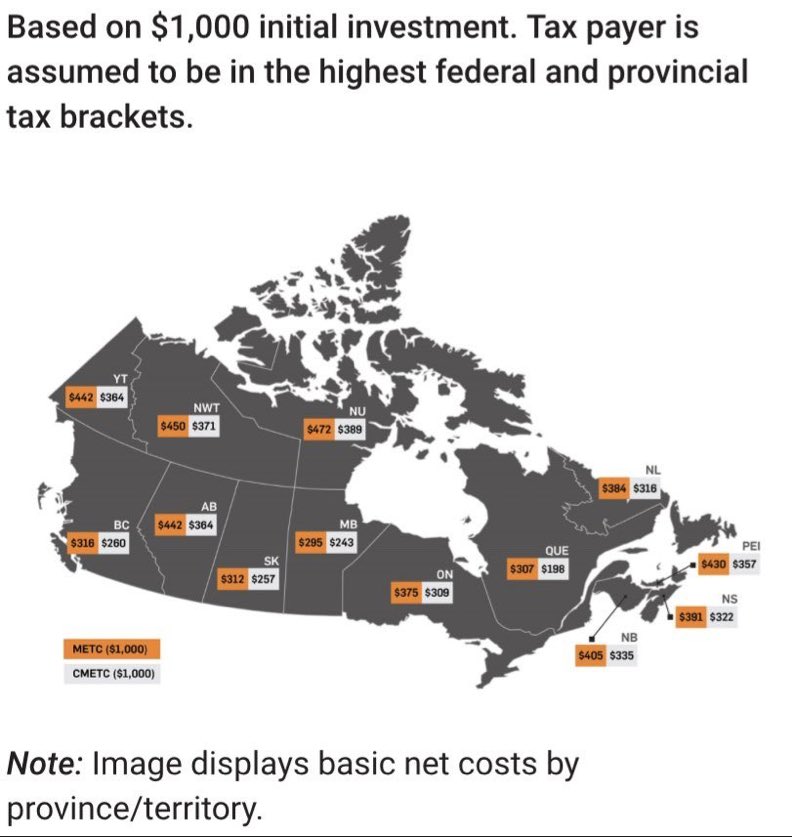

Dr Ryan D. Long Mining and Metals Research Corp. Net cost of $1,000 invested in flow-through (FT) shares for #Mining financing across #Canada 👇👇 METC = mineral exploration tax credit CMETC = critical mineral exploration tax credit

Junior Mining Insights After two years of declining exploration spending, recent data suggests that Canadian exploration is once again on the rise, with spending forecast to increase by 4.9% to C$4.2 billion in 2025.