Jai Kedia

@jaikedia

Research Fellow @CatoCMFA with a focus on monetary policy and macro-finance | PhD in Econ from @UCIrvine. Views expressed are my own, not Cato’s.

ID: 3027563139

http://www.jaikedia.com 10-02-2015 03:32:37

624 Tweet

222 Followers

261 Following

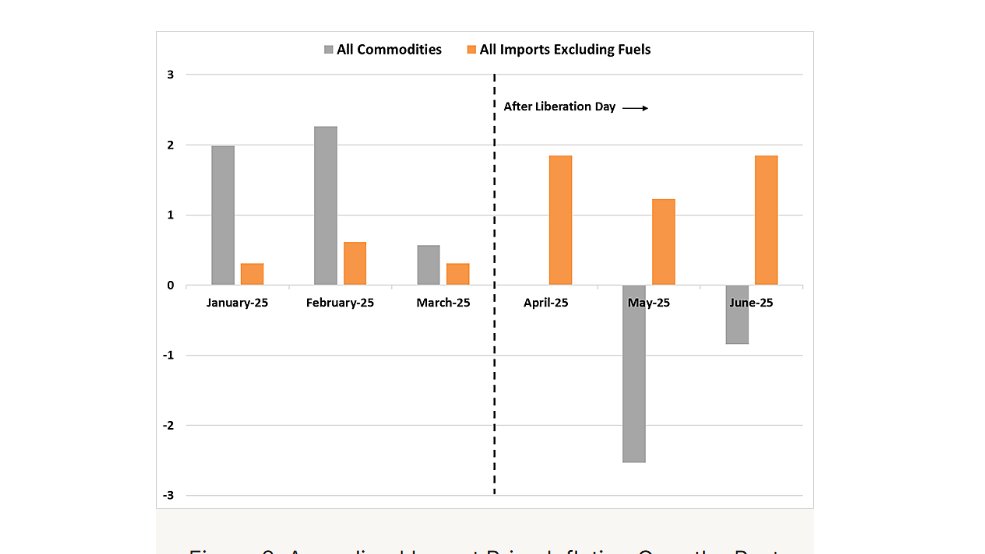

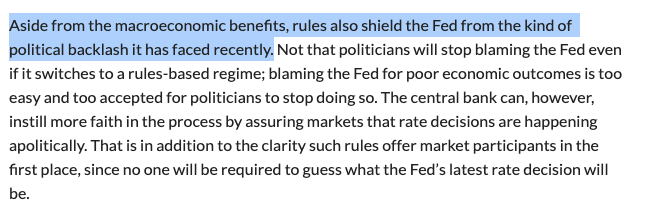

We recorded this video a couple of days ago and decided against talking about all the ridiculous insults and calls to resign being thrown at Jerome Powell. With the escalation today, maybe we should have discussed the ridiculousness. cato.org/multimedia/cat… via Cato Institute

Fifteen Years of Dodd-Frank: A Legacy of Missed Targets and Regulatory Overreach cato.org/blog/dodd-fran… via Cato Institute

Medicare and Medicaid fail a basic scientific test. The programs don’t do what they claim to. If they were drugs, regulators would pull them from the market, writes Michael F. Cannon 🇮🇪🇺🇸 on.wsj.com/44Mdk2N

An Updated Interview with George Selgin on Free Banking and Bitcoin cato.org/blog/updated-i… via Cato Institute

Presidential overreach into monetary policy always ends one way, no improvement to the real lives of Americans and much higher inflation, Cato Institute's Jai Kedia told Amy Lu Hearst Television. "We could be heading towards very dangerous territory." wcvb.com/article/federa…