Jai Bhavnani

@jai_bhavnani

Capitalist. @WaymontCo

ID: 955264120537866240

22-01-2018 02:21:29

7,7K Tweet

22,22K Followers

2,2K Following

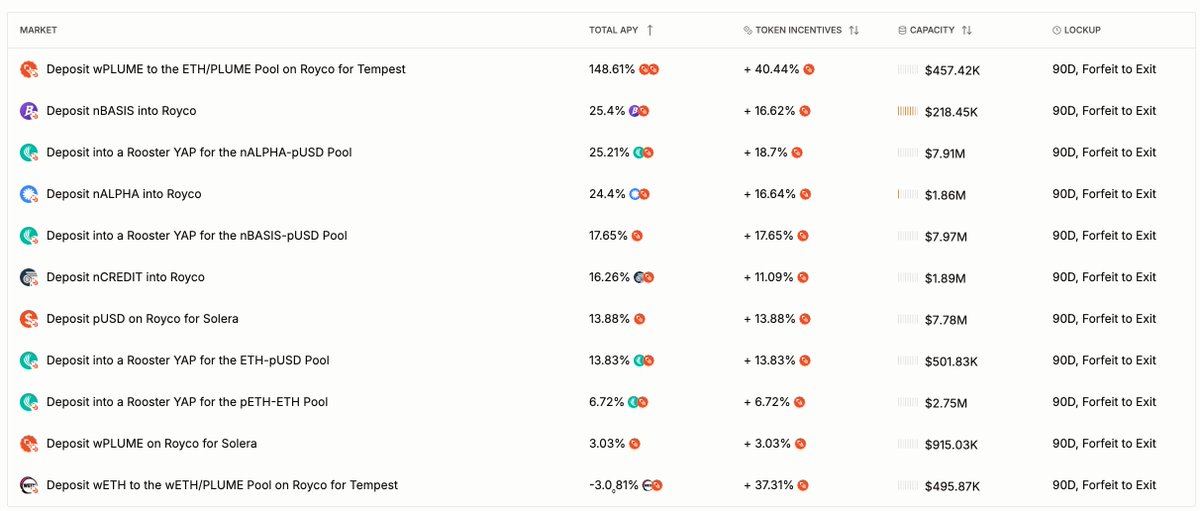

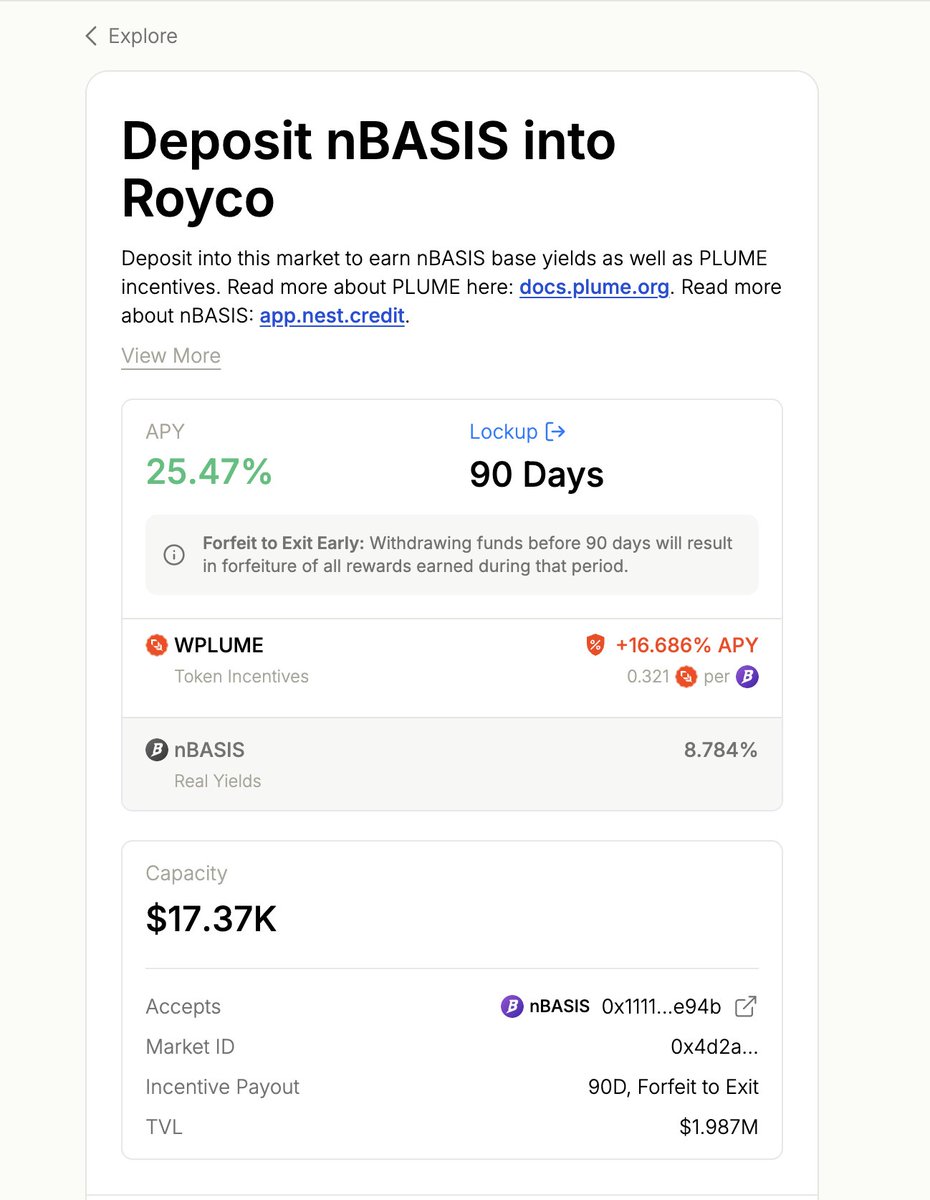

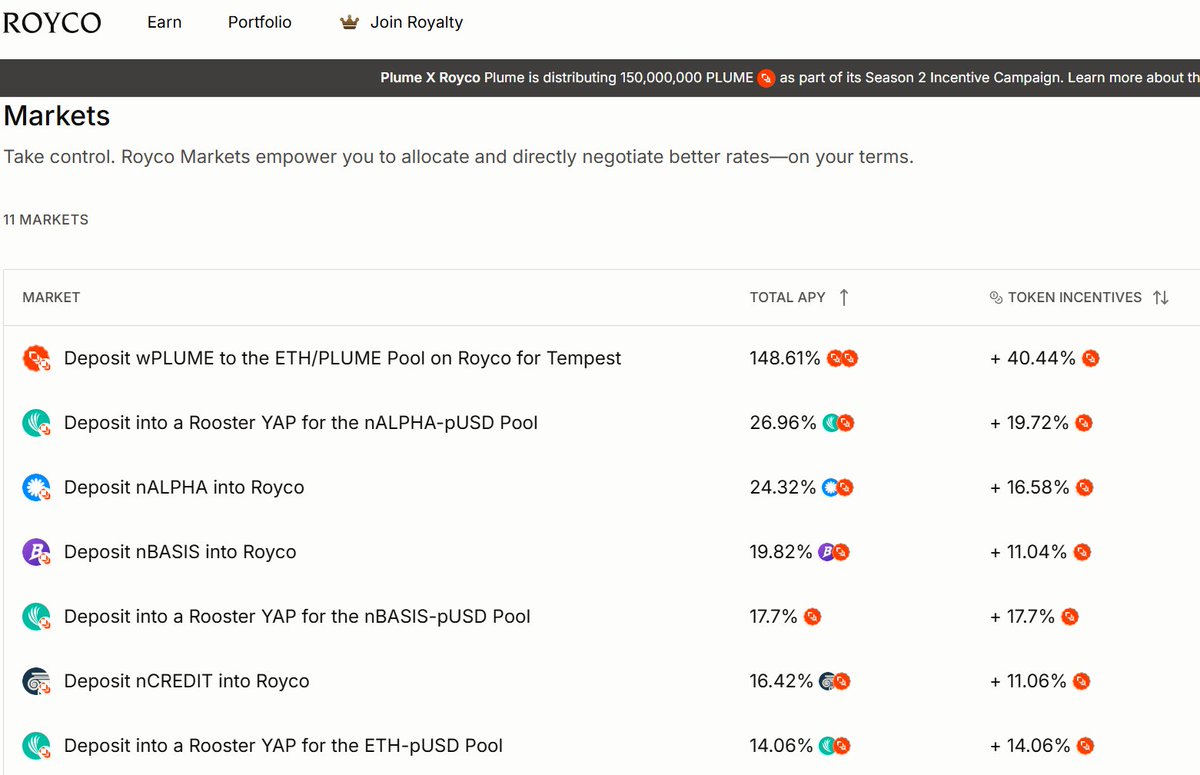

New Royco market is live for Rooster Protocol - RWA DEX LPs on Plume - RWAfi Chain. Depositors can earn 6% APY in $wPLUME.