kirkshinkle.eth

@kirks

Some investing stuff, some product stuff, some newsy stuff. Views my own. Ex @kiplinger, @usnews. Now ETF stuff @ProShares.

ID: 8731732

https://www.linkedin.com/in/kirkshinkle/ 07-09-2007 19:57:54

724 Tweet

363 Followers

1,1K Following

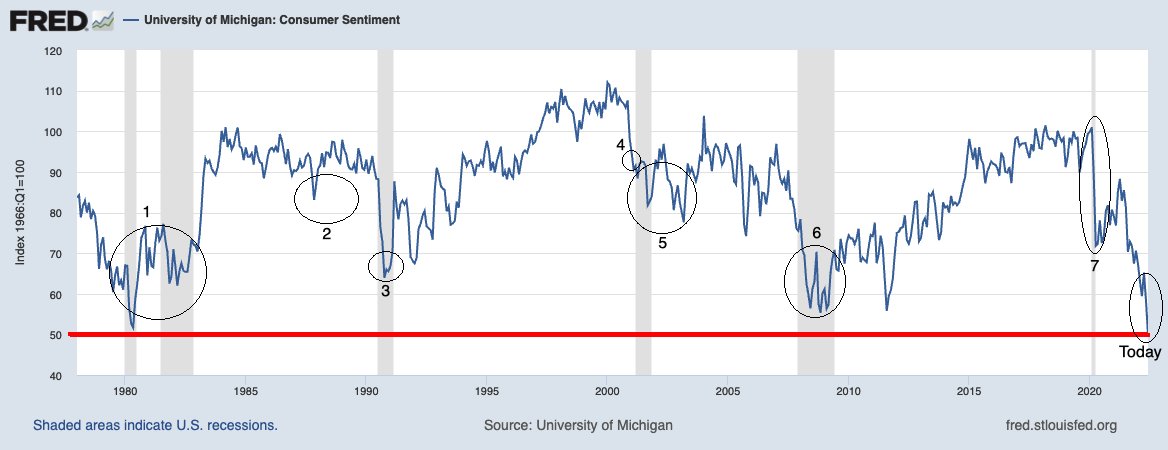

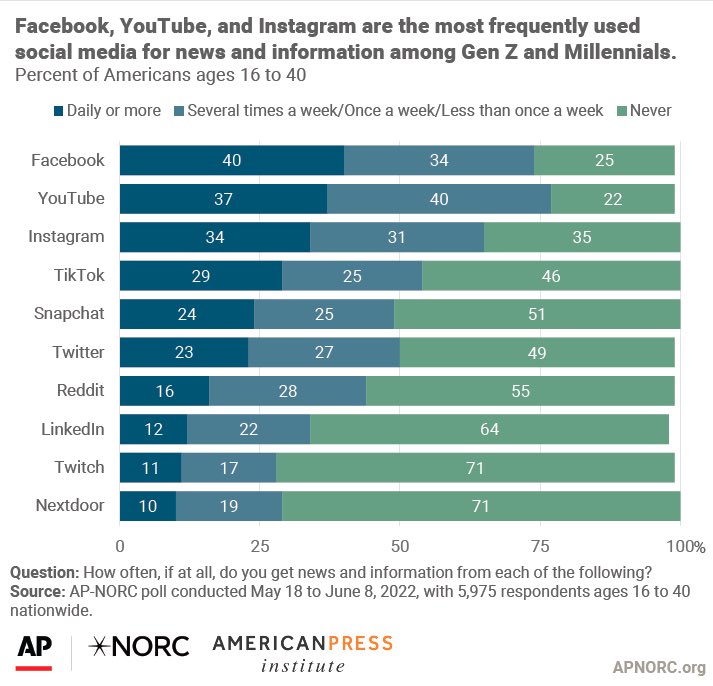

ESG investing brings political fights to the investing world buff.ly/3QZdmKI by andy serwer

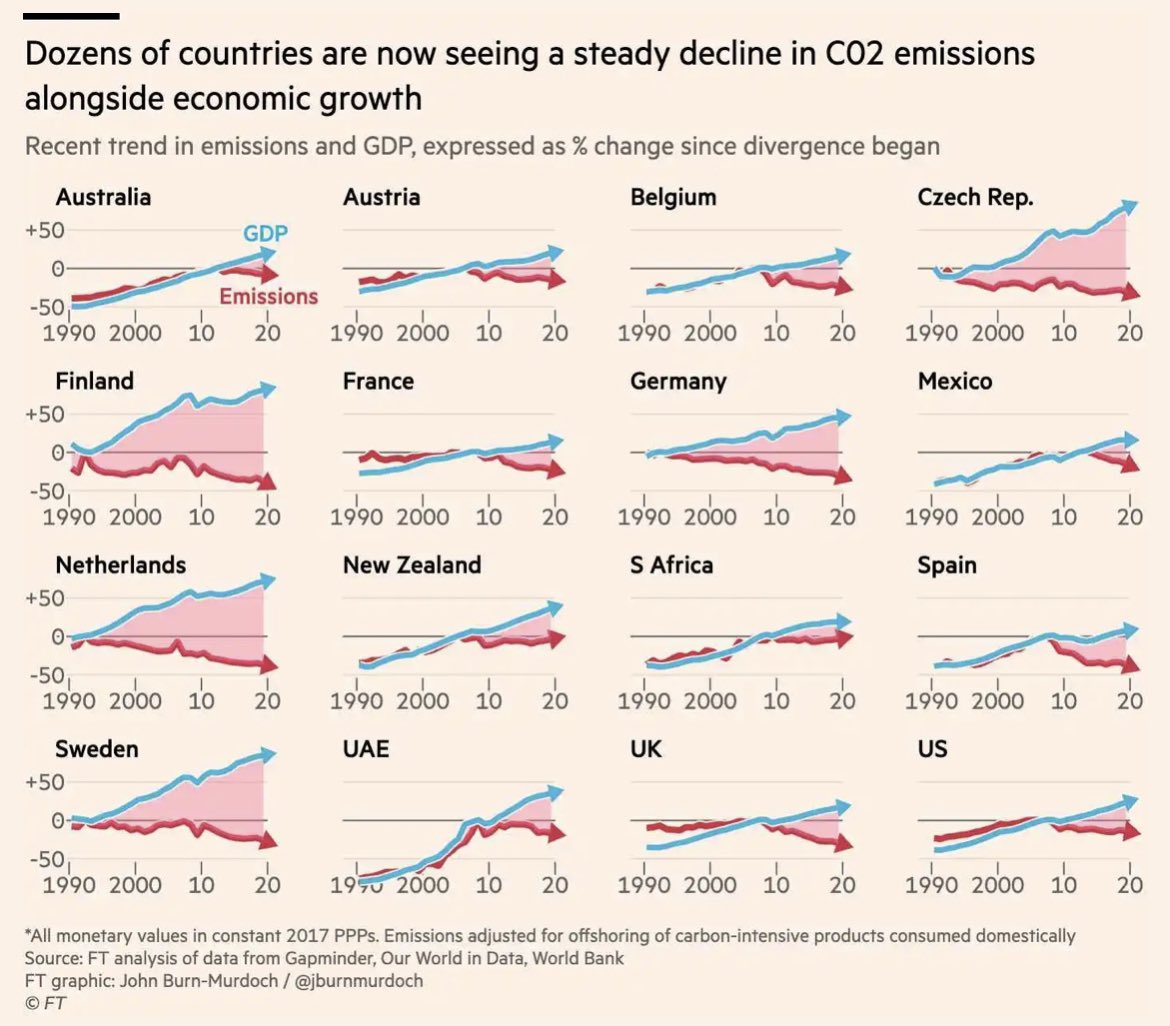

Decoupling growth and CO2 emissions is now a global phenomenon Cc: Noah Smith 🐇 David Wallace-Wells Ramez Naam Jesse D. Jenkins