Lorenzo Valente

@lorenzoark

Crypto at @ARKinvest I Director of Research I Disclosure: arkinv.st/2rxmMRG

ID: 1792929584377155584

https://ark-invest.com/ 21-05-2024 14:46:08

445 Tweet

1,1K Followers

230 Following

“I heard Tom Lee ( Thomas (Tom) Lee (not drummer) FSInsight.com ) describe the Circle IPO as the ChatGPT moment. Before, we were spitting in the wind with institutional investors. Now they’re finally studying crypto hard because you cannot miss the equivalent of AI and crypto together.” Cathie Wood of

For $100B, Apple could’ve bought 1 Anthropic, 5 Perplexity , or 20+ Mistral AI . Instead… more buybacks.

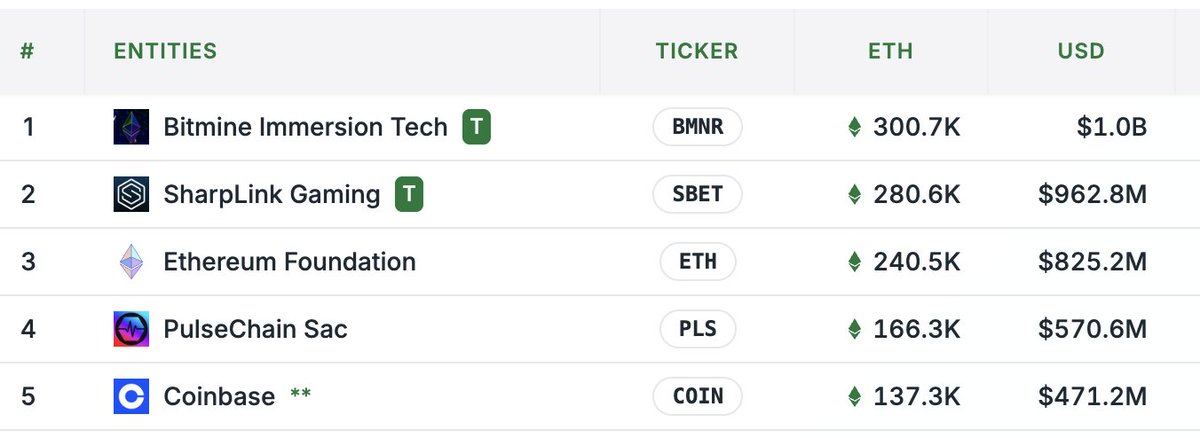

Imagine if, instead of just one Strategy, you had two, racing head-to-head to see who can accumulate the most ETH. That’s exactly what’s happening right now. Both Bitmine Immersion Technologies, Inc. and SBET (SharpLink Gaming) now hold more ETH than the Ethereum Foundation. They both have roughly 30 bips

Sharplink is set to buy $5B worth of ETH through a common stock offering. At today’s prices, that’s over 1.4 million ETH. Since the Merge (2 years, 307 days ago), Ethereum supply has only increased by ~389K ETH. In other words: SBET (SharpLink Gaming) is buying 3.6x all ETH issued

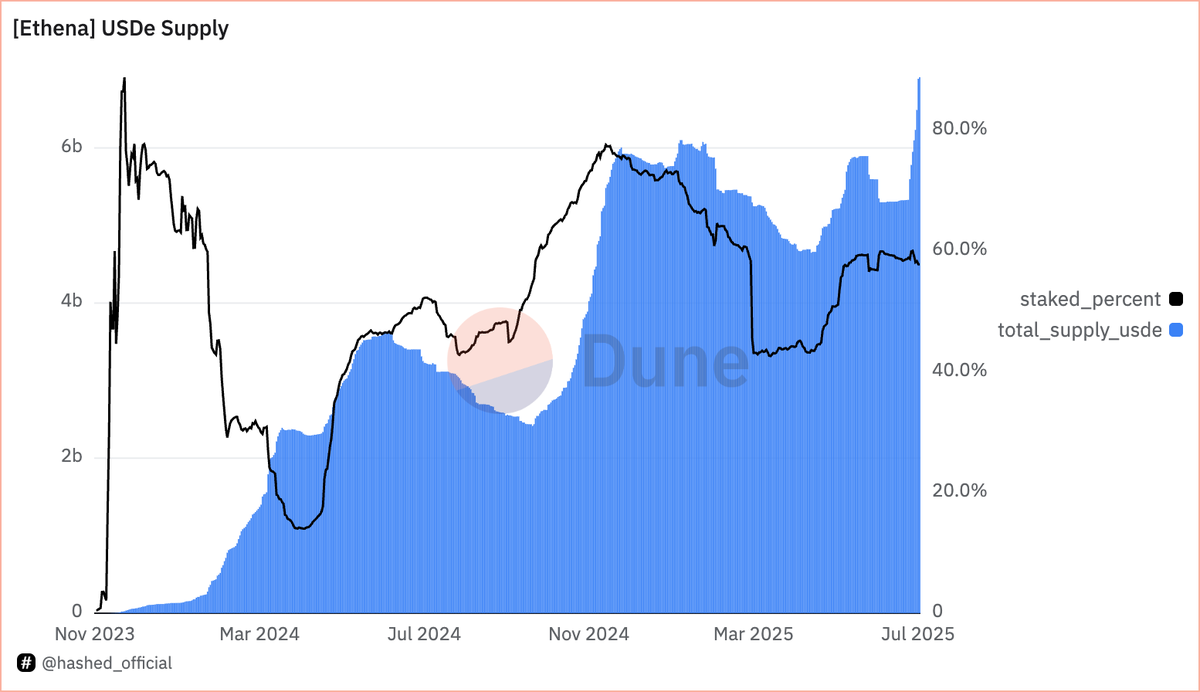

+1.6B USD in USDe supply in the last week. Entering the next phase of expansion, there is going to be ample room for Ethena Labs to grow USDe supply and capture more of that funding rate revenue. Open interest usually grows much faster than marketcap in the bull market.

Scaling blockchains: where do things stand in mid-2025? Lorenzo Valente shares how Ethereum, Solana, and more are advancing scalability and shaping the future of decentralized infrastructure. He also reflects on how these trends align with our "Big Ideas 2025" research.