MEV Capital

@mevcapital

A digital assets investment firm focused exclusively on Decentralized Finance.

ID: 1458713033153335296

http://www.mevcapital.com 11-11-2021 08:28:24

360 Tweet

5,5K Followers

105 Following

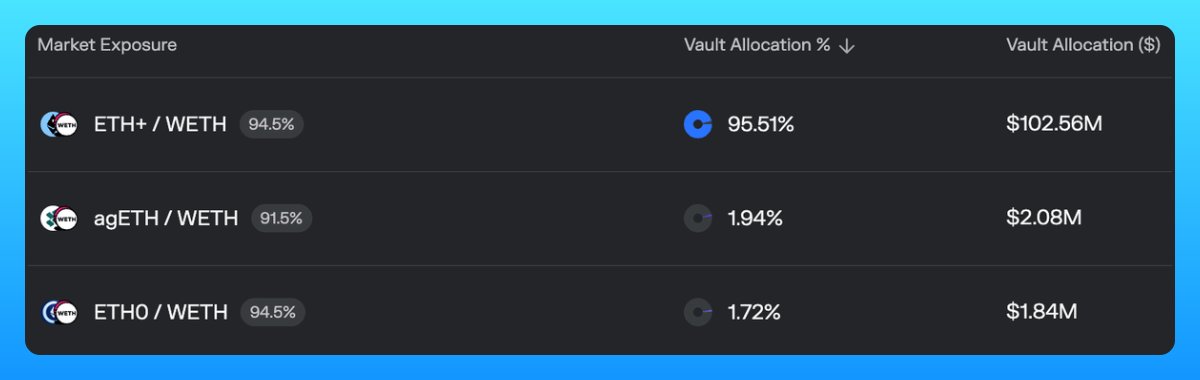

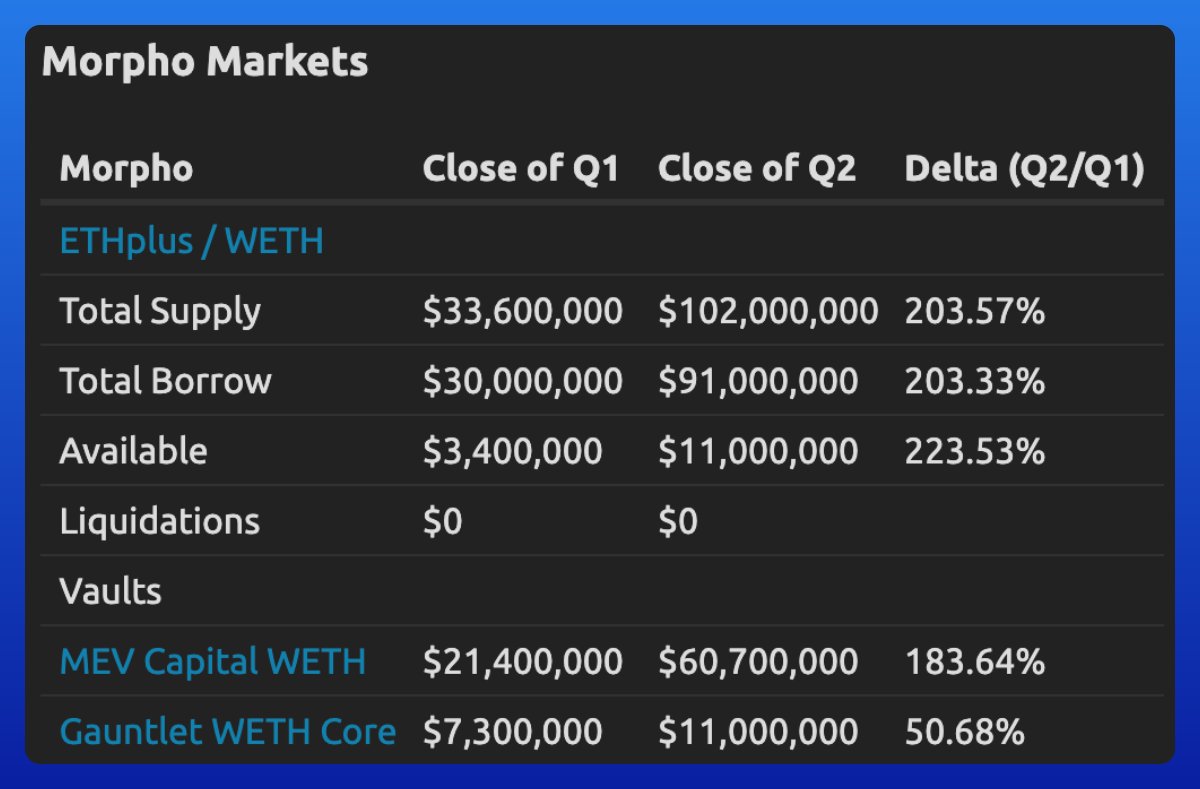

MEV Capital has been an allocator to the ETHplus market since the very beginning and remains our largest market supplier with a 55% supply share, increasing 185% in $ terms over the last quarter. MEV currently supply the market with $102m coming from their wETH vault 🫡

3/ Two earn vaults have grown to account for over 50% of all interest generated: • USDC Prime by Steakhouse Financial, with $157K+ user interest • MEV SOL by MEV Capital, with $140K+ user interest Over 1,700 unique wallets have deposited into these two vaults, making them the most

Spectra is now live Hyperliquid EVM with $700k+ liquidity, seeded by MEV Capital & Mizu Featuring Pools: • USR of Resolv Labs • hbUSDT of Hyperbeat • beHYPE pre-deposit pool of Hyperbeat Let's explore new tools for HyperEVM ecosystem and links to get started ↓

New Morphobeat Market 🦋 MEV Capital USDt0 vault has been deployed. Borrow, lend, earn. Live now on: app.hyperbeat.org/earn

Pendlebeat is live! Excited to announce that beHYPE, hbUSDT and hbHYPE pools are now live on Pendle. - beHYPE pool (expiring October 30, 2025): app.pendle.finance/trade/pools/0x… - hbUSDT pool (expiring December 18, 2025): app.pendle.finance/trade/pools/0x… - hbHYPE pool (expiring December 18,

![Silo Intern (@silointern) on Twitter photo Today your boy tasked himself with a simple goal:

Find >15% APR on USDC for his beloved followers.

Here is his fine selection:

1. Varlamore Falcon USDC → 17.1% APY

2. Varlamore USDC Growth [Arbitrum] → 18.1% APY

3. MEV USDC [Avax] → 28% APY

Job's done. Today your boy tasked himself with a simple goal:

Find >15% APR on USDC for his beloved followers.

Here is his fine selection:

1. Varlamore Falcon USDC → 17.1% APY

2. Varlamore USDC Growth [Arbitrum] → 18.1% APY

3. MEV USDC [Avax] → 28% APY

Job's done.](https://pbs.twimg.com/media/GwjeF0oakAA1A70.png)