Alex Hsu 許家樺

@mgofinance

Finance and Macro. Monetary policy and fiscal policy. Prof @GeorgiaTech @GATechScheller. Previously @MichiganRoss. @BrownUniversity alum. Uncertainty is here.

ID: 294799319

https://sites.google.com/site/alexchiahsu/ 07-05-2011 20:01:07

2,2K Tweet

1,1K Followers

955 Following

Extremely happy to share that the paper “Interlocking Directorates and Competition in Banking”, joint with Guglielmo Barone and Fabiano Schivardi, has been published in the Journal of Finance Journal of Finance -doi.org/10.1111/jofi.1… (1/N)

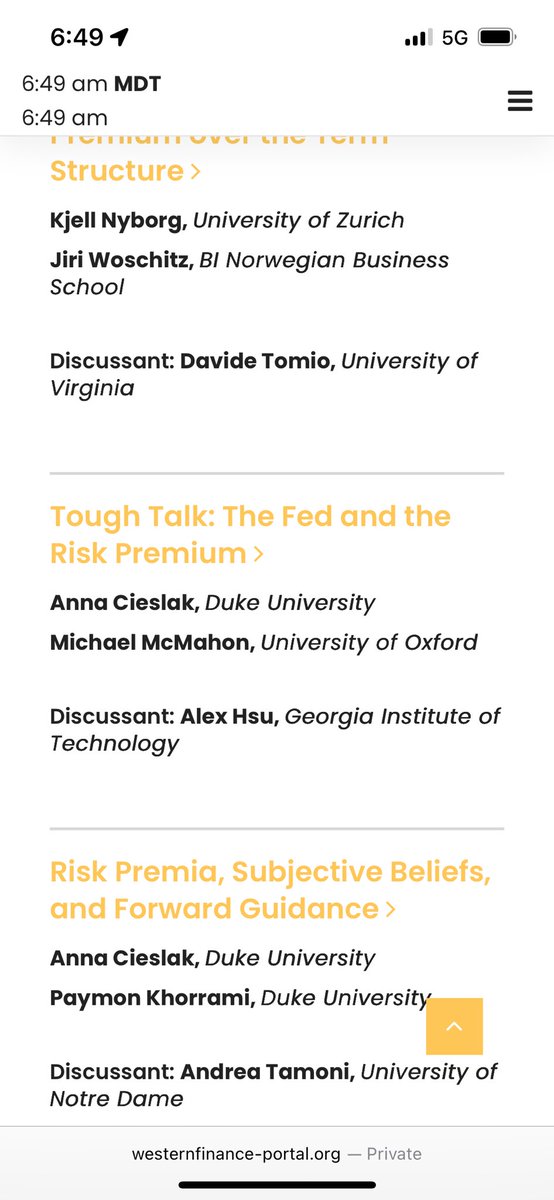

🚨If you are a macroeconomist using the “sequence-space” to solve your models, come share your work at this SITE conference, September 8-10! Both substantive and methodological contributions are welcome. The deadline is this Monday, June 16! with Ludwig Straub and Matt Rognlie

🚨 "Consumption in Asset Returns" (w. Svetlana Bryzgalova & Jiantao Huang) forthcoming Journal of Finance We use asset returns to uncover the elusive dynamics of consumption. Turns out, financial markets know a lot about future consumption—and it matters for both macro & asset pricing🧵👇1/n