Matthieu

@mlgavaudan

Co-founder at @infpools

ID: 617262880

24-06-2012 16:24:45

670 Tweet

1,1K Followers

1,1K Following

Congrats to the bera homies on launching; building truly new things is usually correlated w/ getting ship timelines wrong Pic below w/ bera team member unrelated Also funny seeing InfinityPools as a server in the Discord at the beginning of video - whomever filmed we salute you 🫡

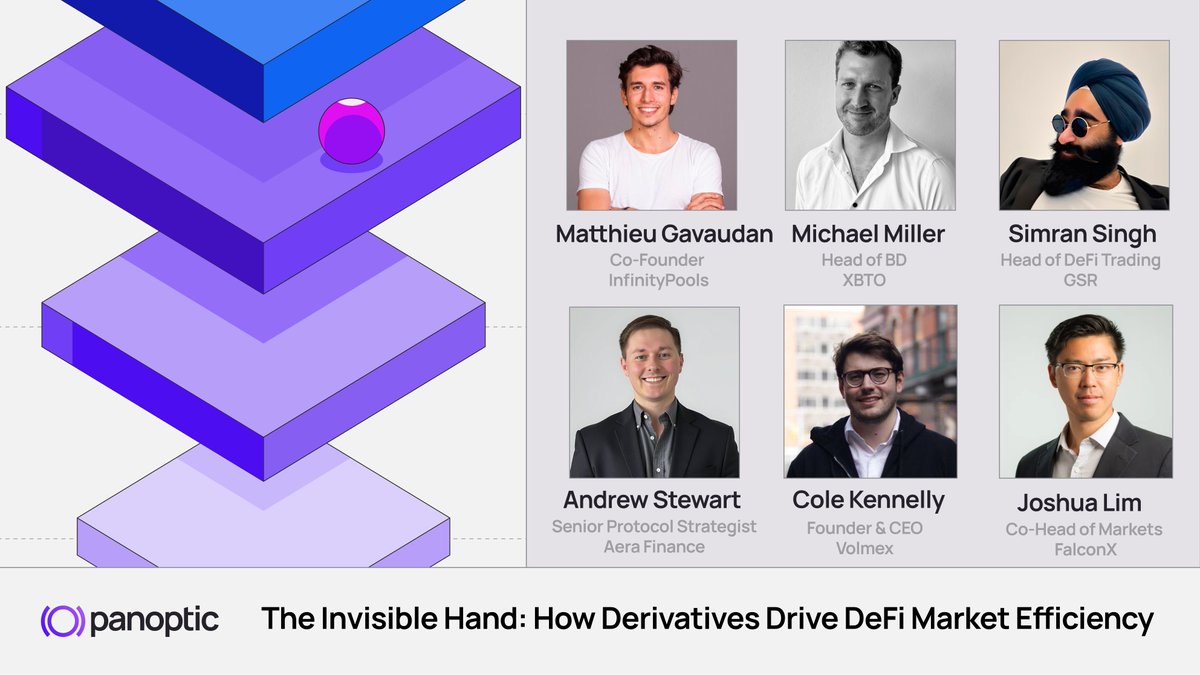

Join Panopticon—a #DeFi side event at #ETHDenver2025—for a deep dive into how derivatives drive market efficiency! Panelists: 🔹 Matthieu – Co-Founder, InfinityPools 🔹 Mike Miller – Head of BD, XBTO 🔹 turbanurban – Head of DeFi Trading, GSR 🔹 Andrew (Crypto A S) –