Morris Miccelli

@mmiccelli

ID: 1138769182395326469

12-06-2019 11:25:05

925 Tweet

309 Followers

150 Following

Fruitful talk with Argentina MFA 🇦🇷 Amb Marcelo Cima and Secretaries Secretaría de Minería Lucero and Secretaría de Energía Chirillo on opportunities for mining companies, trends in regional energy trade, and how our gov'ts can deepen collaboration to boost investment and strengthen supply chains.

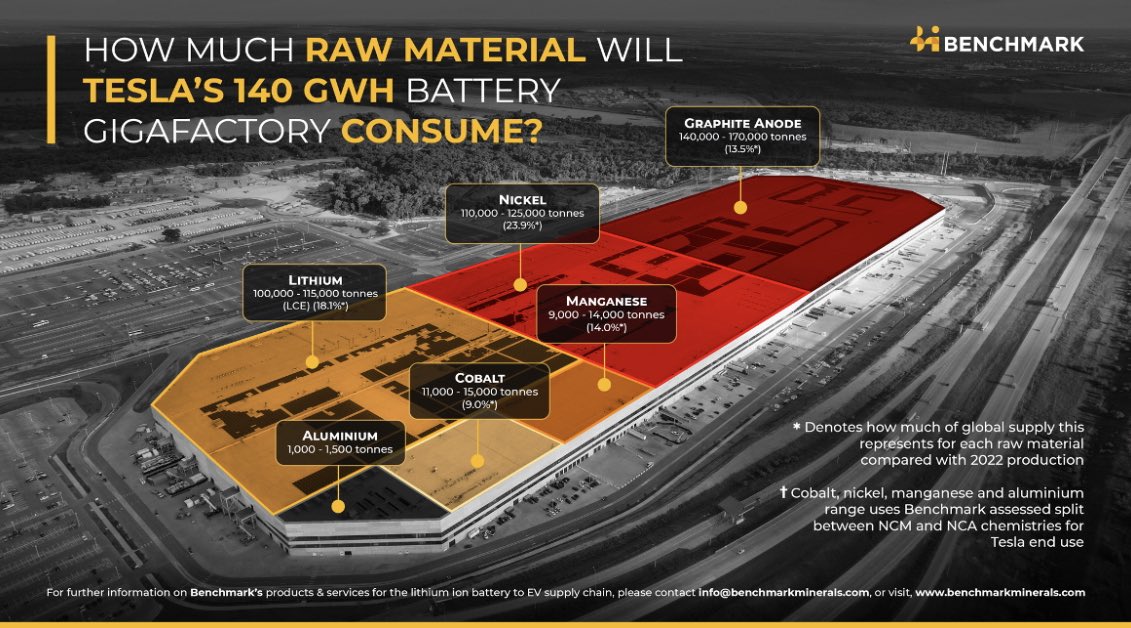

asiafinancial.com/trump-planning… Interesting opportunity for Argentina considering Milei has stated one of his first 2025 priorities is finalising an FTA with the US. Onshore US Li supply will not be enough (or ready in time) to feed proposed battery plants being built. Enter Argentina!

youtu.be/nBO6w3Ow3vY?si… When the opinions of heavy hitters like these align, you'd better sit up and take notice! Great video Howard Klein

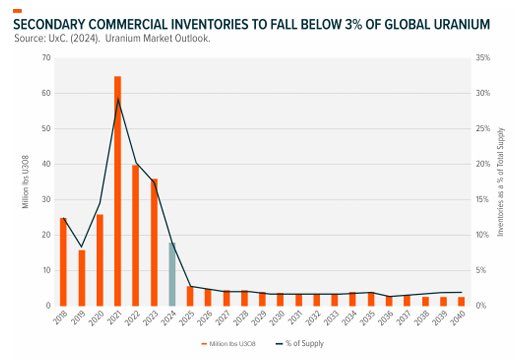

Sprott has raised $25.55 million through a non-brokered private placement as a massive statement of intent that it does not plan to sell any of the physical uranium they hold. For all those who were hoping that those pounds would be released, tough luck. globenewswire.com/news-release/2…