Matthew Martin

@mattmartin128

SWFs, money & power in the Middle East @BloombergNews. Opinions my own. Pls send tips to: signal: @mmartin.48 Telegram: @MatthewMartin [email protected]

ID: 252562935

https://www.bloomberg.com/authors/ARnJal27ChA/matthew-martin 15-02-2011 13:04:52

2,2K Tweet

4,4K Followers

1,1K Following

Saudi Arabia is the new China for investors hunting down growth bloomberg.com/news/articles/… via Bloomberg Wealth

Saudi Arabia’s Public Investment Fund emerged as the world’s most active sovereign investor last year, boosting its deal activity even as most global peers including GIC and Temasek slashed spending, according to Global SWF data bloomberg.com/news/articles/… via Bloomberg Markets

Launched earlier this month, Alat | #TomorrowMadeBetter aims to transform the kingdom into an industrial and manufacturing powerhouse --- hear it from the CEO who spoke with Matthew Martin in Riyadh

Aramco is set to pay at least $124b in dividends this year, a rise of 66% over the past few years. Good news for the government and PIF, which will get 98% of it bloomberg.com/news/articles/… via Bloomberg Markets Anthony DiPaola

Investing in private credit is still a "great opportunity," the head of the Middle East’s top alternative asset manager says, despite growing warnings of a bubble developing in the asset class bloomberg.com/news/articles/… via Bloomberg Markets

As Saudi Arabia plows billions into infrastructure and investments, Larry Fink is out to make sure that money management giant BlackRock gets a share bloomberg.com/news/articles/… via Bloomberg Markets Loukia Gyftopoulou Silla Brush Dinesh Nair

Saudi Arabia’s nearly $1 trillion wealth fund swung to a profit in 2023, driven by a rally in global markets bloomberg.com/news/articles/… via Bloomberg Markets

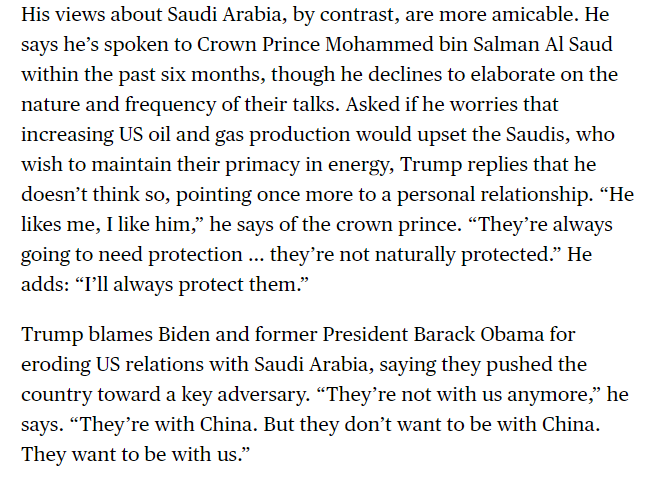

Former President Donald Trump on relations with Saudi Arabia “He likes me, I like him,” he says of the crown prince. “They’re always going to need protection … they’re not naturally protected.” He adds: “I’ll always protect them.” bloomberg.com/features/2024-… via Businessweek

Princeville Capital, which counts Hollywood star Leonardo DiCaprio as an adviser, is set to open an office in Abu Dhabi and commit to funding startups in the emirate developing technologies to tackle climate change bloomberg.com/news/articles/… via Bloomberg Green

Wall Street's biggest firms are making new compromises to win the $4 trillion sovereign wealth business in the Middle East bloomberg.com/news/articles/… via Bloomberg Wealth

How London’s Olympic Legacy Reshaped the Forgotten East End bloomberg.com/features/2024-… via Bloomberg CityLab

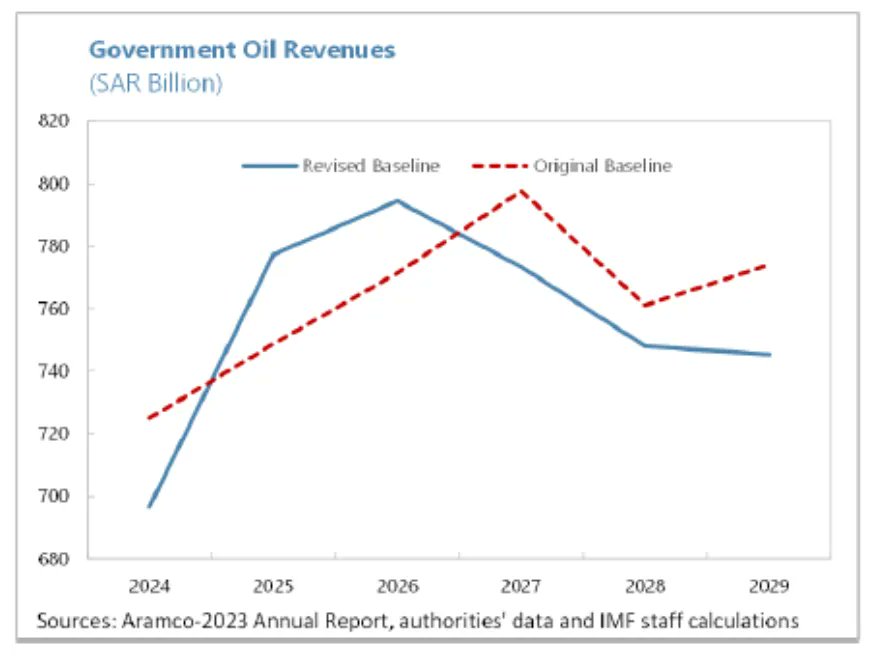

Saudi Arabia’s oil revenue is seen rising to 2026 before declining quicker than previously expected through to the end of the decade, says the IMF bloomberg.com/news/articles/… via Bloomberg Economics

Two Saudi investment firms will launch ETFs that will be the country’s first to track Hong Kong shares and are expected to raise close to $1 billion, offering the latest sign of growing ties between the oil rich kingdom and China bloomberg.com/news/articles/… via Bloomberg Markets

The governor of Saudi Arabia’s sovereign wealth fund said he’s prepared to invest more in the US during President Donald Trump’s second term 🇺🇸🇸🇦 Story w/ Matthew Martin ⬇️ bloomberg.com/news/articles/…

Trump plans to allow Saudi Arabia to more easily import AI chips from the likes of Nvidia & AMD But there are lingering Qs in the talks about how to govern those data centers & prevent China from accessing US hardware annmarie hordern Matthew Martin Mark Bergen bloomberg.com/news/articles/…