Bryan Armour

@mstararmour

Director of passive strategies research at Morningstar. Proud dad/husband. Hopeful (edited) Bears fan. Important disclosure information: bit.ly/MRS0818

ID: 1553090205560758273

https://newsletters.morningstar.com/mei 29-07-2022 18:49:03

693 Tweet

477 Followers

156 Following

Private investments are making their way into publicly traded ETFs. US director of ETF and passive strategies Bryan Armour joins Investing Insights to discuss who’s leading the charge and what you should know before investing in a private equity or private credit ETF.

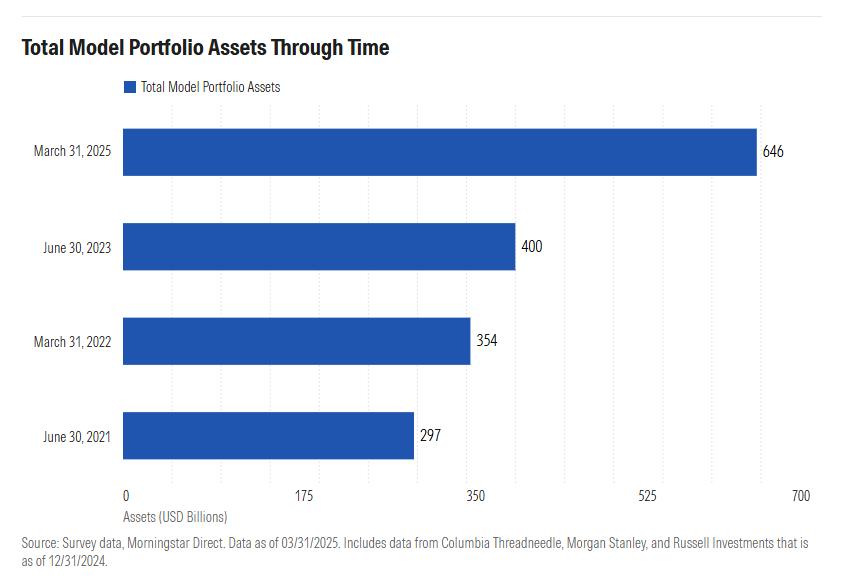

The Morningstar, Inc. manager research team has just published its latest look at the U.S. model portfolio landscape. Assets under advisement in model portfolios reported to Morningstar have more than doubled since 2021. These figures represent just an ice chip on the tip of the

Huge thanks to Joanna Gallegos and Dave Nadig for sharing their thoughts on private assets in ETFs. Top things I took away: 1. Invest with companies you trust 2. Pair the right strategy with the right wrapper 3. An ETF can add liquidity/price discovery to an asset class..to a point

Thematic ETFs haven't added value for investors in the past 5 years. Just 20% of US/EMEA thematic ETFs beat a broad market index, and the avg underperformed it by 8.5% annually. Thanks to Steve Johnson and the FT for highlighting this research! spr.ly/6014fkxuM

More fuel for the active/passive debate. Morningstar, Inc. out with its US Active/Passive Barometer, which measures the performance of active funds against passive peers. Only 31% of US stock-pickers beat their benchmarks through the one-year period ending in June, a significant