National Academy of Direct Taxes

@nadt_official

Apex Training Institute for IRS Officers

ID: 1641752675694833665

http://www.nadt.gov.in 31-03-2023 10:42:59

630 Tweet

1,1K Followers

8 Following

Data on Direct Tax (DT) collections and Advance Tax collections for FY 2025-26 as on 19.06.25 has been released. The data is available on the national website of Income Tax Department at the following link: incometaxindia.gov.in/Lists/Latest%2… Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance

Hon’ble Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman chaired a conclave with Pr. Chief Commissioners and Pr. Directors General Income Tax, emphasizing critical reforms & taxpayer-centric initiatives. The meeting focussed on the key areas of: 🔷Taxpayer

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting "Let’s Learn Tax" Chapter 09 Income from Salary Explore salary components, their taxability, and common mistakes to avoid while filing your ITR. Stay informed, stay compliant. Know What You Earn & What You Owe!

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting "Let’s Learn Tax" Chapter 9A Income from Salary(Cont.) Understand salary components like: ▶️Standard Deduction ▶️ HRA ▶️ TDS ▶️ Perquisites and Filing of ITR if Income is from Salary. Stay informed. Stay compliant. Know What You Earn & What You Owe!

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting "TAX ASSIST" Expressing scenarios- If 80GGC deduction is Claimed by Mistake then kindly- Revise your return or file ITR U Pay due taxes & interest Return excess refund Ignoring the communication may lead to scrutiny or penalty. Correct it before it costs you!

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting "TAX ASSIST" scenarios- Fraudulent 80GGC Claim? Think Again. ❌ Fake political donations ❌ Non genuine donations to political parties ❌ Claimed just for refunds? This is tax evasion. ✅ Revise your ITR or file ITR U ✅ Pay taxes + interest ✅ Avoid scrutiny & legal action

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting "TAX ASSIST" scenarios: Made a Genuine Donation under 80GGC. Donated to a legally registered political party? Keep valid receipts & bank transaction proof. They may be required for verification. Your compliance secures your claim.

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting KIND ATTENTION TAXPAYERS! Taxpayers who have received notice under Section 158BC can now submit Form ITR-B via the e-Proceeding tab on the Income Tax portal. link: incometax.gov.in/iec/foportal/ Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India

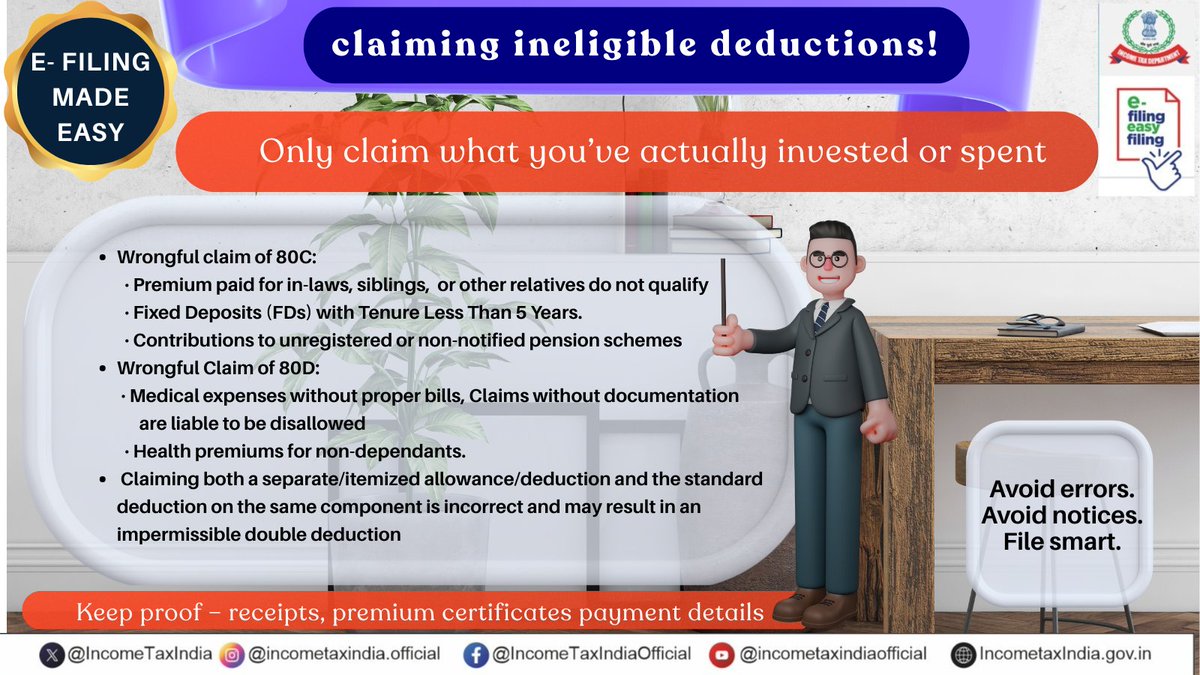

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting PMO India MyGovIndia "E- Filing Made Easy" Are you Claiming Deductions Without Eligibility ? Claim only if you're genuinely eligible. Example- 🔹 80C – Investments like PPF, ELSS, Life Insurance 🔹 80D – Health insurance premiums 🔹 80E – Education loan interest 🔹 80TTA/TTB – Savings & deposit

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting PMO India MyGovIndia "E- Filing Made Easy" Are you claiming ineligible deductions? Wrongful claim of deductions may invite penal provisions. Avoid errors, Avoid notices, File Smart.

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting "TAX ASSIST" Got an SMS/Email on VDA transactions? Please don’t ignore, it concerns to non filling of schedule VDA in ITR. ➡️Review your ITR carefully ➡️ Rectify via updated ITR u/s 139(8A) ➡️ Incorrect claims may lead to scrutiny or penalties. File Right. Stay Clear. Be Tax