NAR Research

@nar_research

Find out what NAR experts are saying about the housing market and economy. Contact us at [email protected] with questions.

ID: 36710827

https://www.nar.realtor/research-and-statistics 30-04-2009 16:55:21

26,26K Tweet

155,155K Followers

2,2K Following

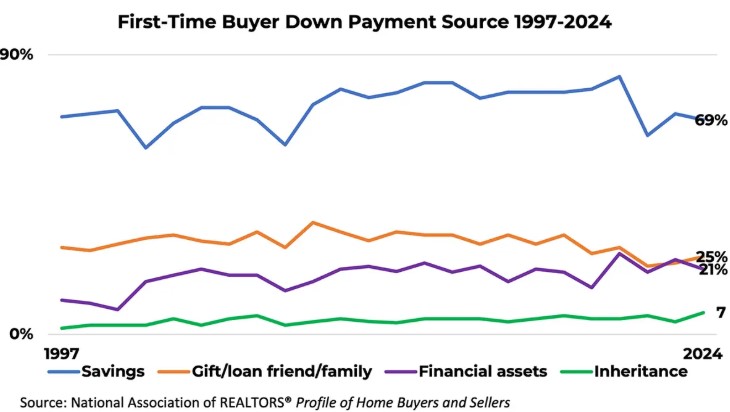

"Dating back to 2018, the typical down payment for rookies has ranged from just 6% to 9%, Dr. Jessica Lautz found. Going back to 1989, when NAR first started collecting this data, the average has only been as high as 10%." nationalmortgageprofessional.com/news/truth-abo…

NAR Deputy Chief Economist Dr. Jessica Lautz offers advice for first-time home buyers. WATCH: nar.realtor/blogs/economis…

NAR’s Deputy Chief Economist Dr. Jessica Lautz shares how first-time buyers can learn from others who made it happen in the past year. Get inspired and informed in the latest Ask the Economist. youtube.com/watch?v=vvSyIQ…