padugz

@nico_padugz

1% better than my yesterday's self

ID: 4184234661

14-11-2015 06:18:09

25,25K Tweet

1,1K Followers

2,2K Following

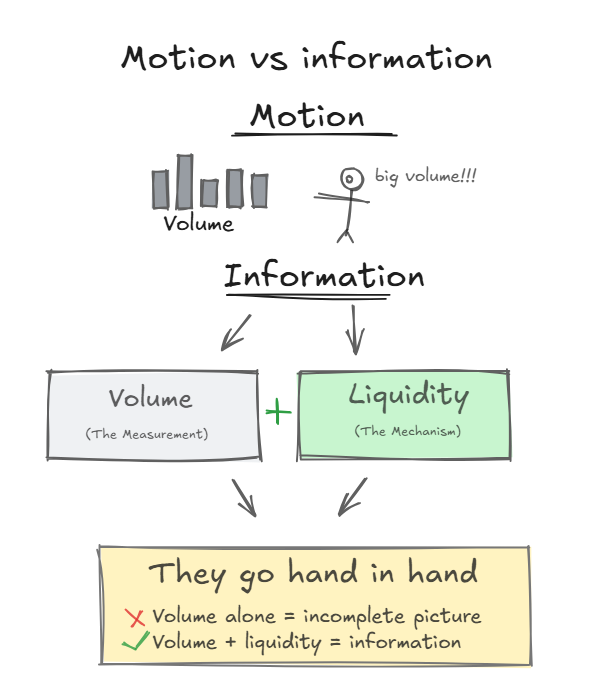

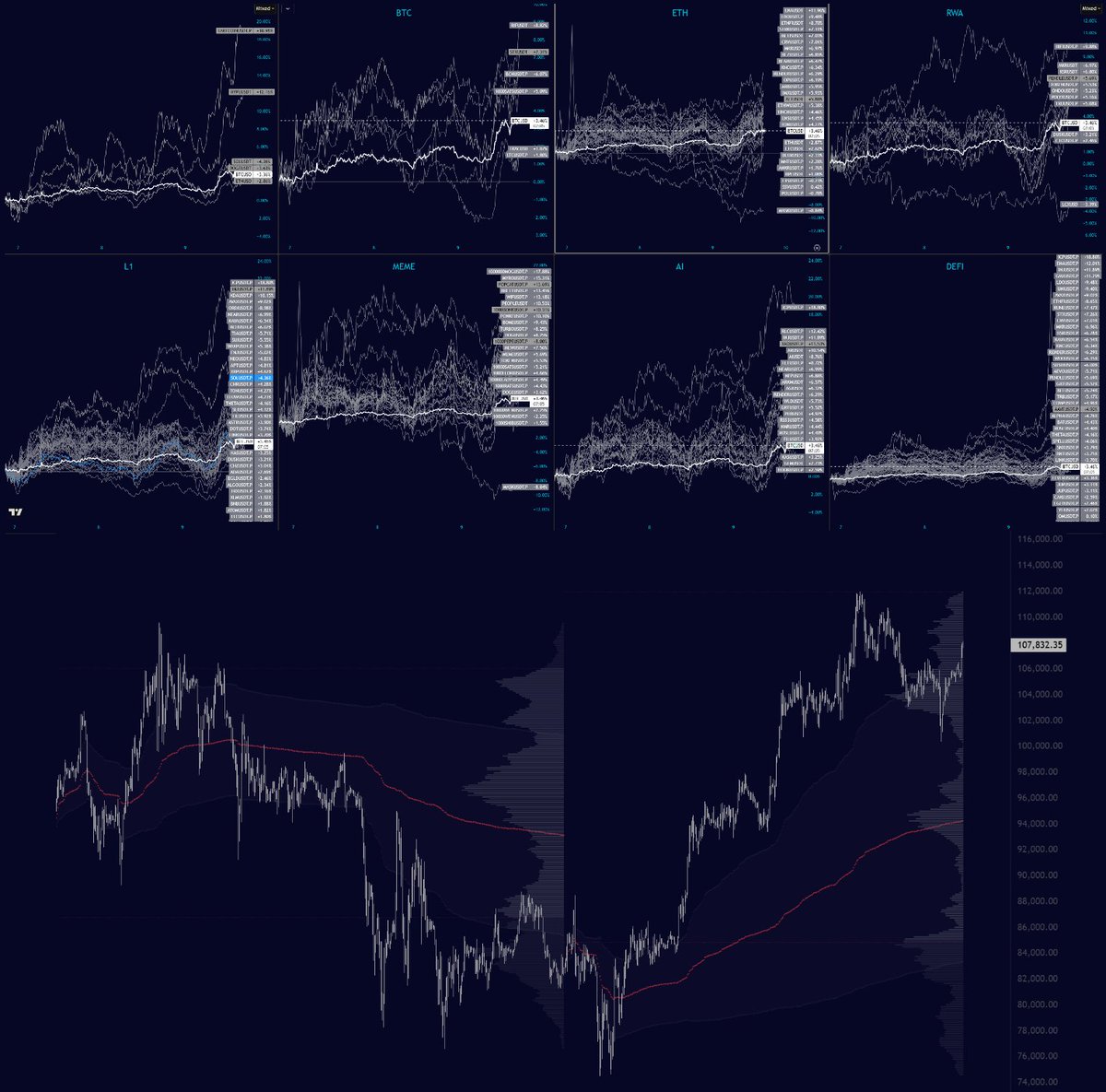

Essential Tools Value Bare minimum for my trading is Volume Profile & Vwap, this is how I determine "value" Volume Profile Use Case: Trade Locations Types: Fixed Range, Fixed time & Visible Range Application: TradingView Vwap Use Case: System selection, Directional bias &

DEGEN NEWS Iran has taken out key Israeli infrastructure