Oliver Rakau

@oliverrakau

Chief Germany Economist and ECB commentator @OxfordEconomics. All views very much my own.

ID: 3381355079

18-07-2015 06:22:49

8,8K Tweet

9,9K Followers

584 Following

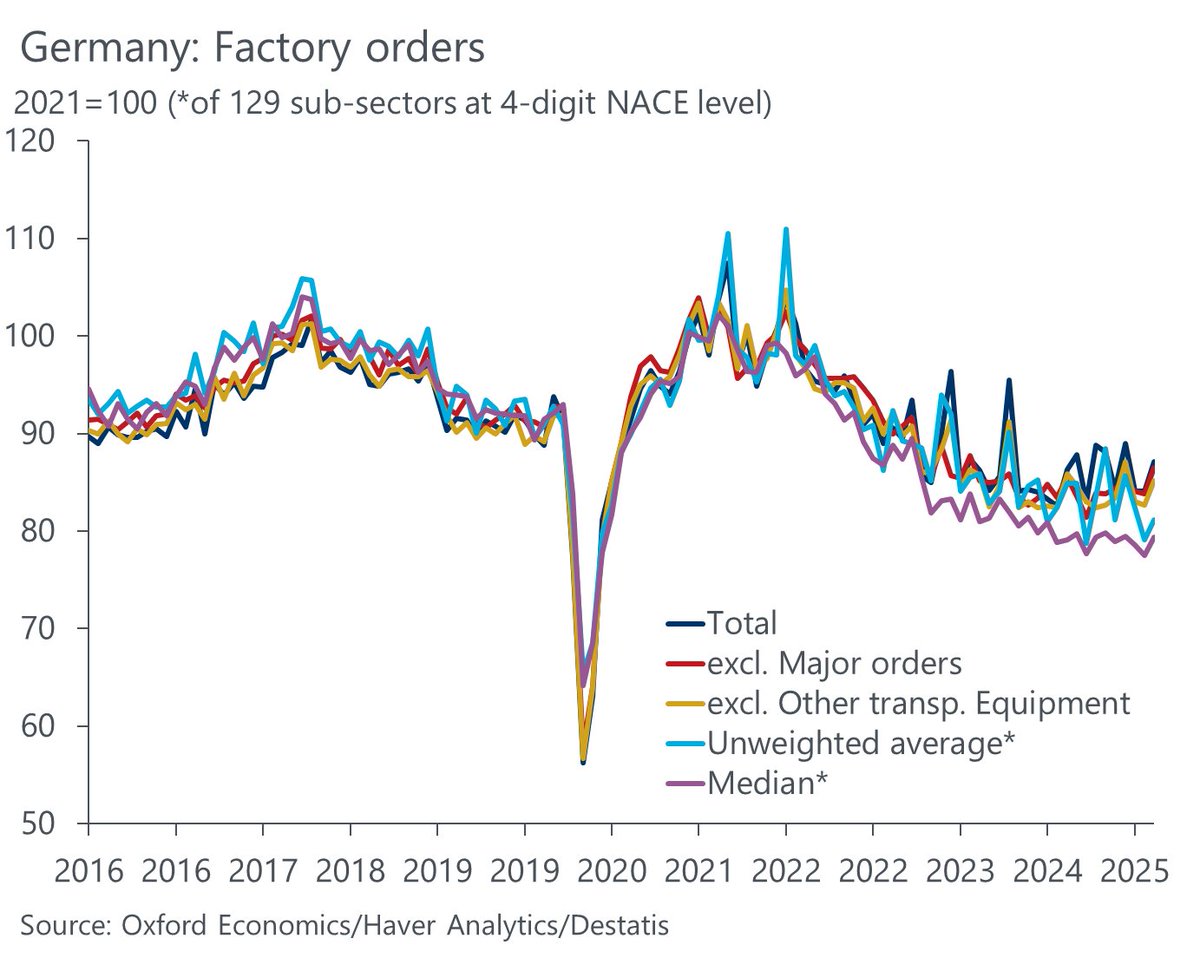

Back in 2013 when I was in grad school, Tim Kehoe 🇺🇸🇨🇦🇲🇽🇺🇦, Kim Ruhl, and I wrote a paper on what would happen if US trade deficits were halted by a "sudden stop" like those that plagued emerging economies in the 1970s. The world didn't find that question very interesting at the time, so